...about the "real" motivation with respect to Russia...

Macro-economics, Investments, Law, and Power, with special emphasis on high finance and low humor.

Friday, December 19, 2014

Thursday, December 18, 2014

What lower bound?

Rates during the Great Rate Compression can't go below zero...can they? Speaking of "risk free assets", gold has crept up, but U.S. equities continue their phase transformation from risk asset to "safe haven". What a transmogrification.

The Swiss National Bank on Thursday said it would introduce a negative exchange rate of -0.25 percent on sight deposit account balances at the central bank as it seeks to deter safe-haven buying.

The Swiss National Bank on Thursday said it would introduce a negative exchange rate of -0.25 percent on sight deposit account balances at the central bank as it seeks to deter safe-haven buying.

Google>Russia

The most important price for a sovereign nation is the price of its currency with respect to other competitor currencies. Some amazing cascades and spumescent reactions from volatile changes in that price.

Google is now more valuable than the entire Russian stock market. Russia’s stock market is now worth $325 billion while Google is valued at more than $340 billion, according to Bloomberg.

Google is now more valuable than the entire Russian stock market. Russia’s stock market is now worth $325 billion while Google is valued at more than $340 billion, according to Bloomberg.

Wednesday, December 10, 2014

The great rate compression continues

The entire world is gripped in a low or zero interest rate environment, and I have written about this on multiple instances here years ago. Quality collateral has also been purchased by CBs, creating a shortage of "risk free" financial assets.

This is untenable...and the first fissures in this arrangement will be seen in U.S. equities, which have incredibly transmogrified into the "risk free" asset for the world.

The winter months will be telling.

This is untenable...and the first fissures in this arrangement will be seen in U.S. equities, which have incredibly transmogrified into the "risk free" asset for the world.

The winter months will be telling.

Monday, December 08, 2014

Ding ding!

All aboard the express train!

Chinese brokerages’ valuations have surged to their highest level in more than four years as Shanghai’s surging stock market improves the prospects for trading revenue.

Chinese brokerages’ valuations have surged to their highest level in more than four years as Shanghai’s surging stock market improves the prospects for trading revenue.

Thursday, December 04, 2014

Oil.

The Saudis are the monopoly provider of oil. Every once in awhile we all need to be reminded of this simple fact. And while coordination is possible with the Saudis and the U.S. with respect to the Russian problem, it is more likley that the Saudis have finally decided to demonstrate to shale producers and other would be competitors who is boss. They lured out their competitors and are crushing them once they went all-in.

The junk world is shuddering with the prospect of $60 oil.

Tuesday, December 02, 2014

Inflation

Interesting article outlining the powerful emotional effect and "stickyness" that predictions have on experts. It is incredibly difficult to admit your prediction is false when your your entire ego balances upon the precipice of mediocrity.

On a more substantive note, Readers here are not surprised about the lack of inflation as most interpretations of how economies work amongst "experts" relied on hopelessly outdated economic models.

A snippet:

On a more substantive note, Readers here are not surprised about the lack of inflation as most interpretations of how economies work amongst "experts" relied on hopelessly outdated economic models.

A snippet:

Six years later, official consumer price index inflation sits at just 2 percent annually from July 2013 to July 2014, the latest period for which figures are available. This is identical to the rate for the previous year.

We asked four economists and market analysts to revisit what they originally predicted would happen after quantitative easing and assess whether (and why) they were right. Analyst Peter Schiff sticks to his guns, saying that any "claims of victory over inflation are premature and inaccurate. Inflation is easy to see in our current economy, if you make a genuine attempt to measure it." Economist Robert Murphy believes we are in a "calm before the storm" and is "confident that a day of price inflation reckoning looms." Contributing Editor David R. Henderson writes that the "financial crisis has brought such major changes in central banking that uncontrolled inflation from discretionary monetary policy is not as great a danger as it once was," though he remains critical of the Fed's growing powers. And economist Scott Sumner claims victory for the "market monetarists," noting that both Austrians and Keynesians have been proven wrong by events, and urging both sides to "take markets seriously."

Monday, December 01, 2014

Interesting timing...

...for China's announcement of a deposit protection scam...er..."scheme". Yes, the conditions ostensibly protect despositors from bank liquidation, but the exemption of foreign bank branches from the condition is telling. The effects here would shift Chinese deposits from smaller banks and foreign branches to larger Chinese banks. They also offer additional protection against runs on a bank in times of financial crisis.

Now why would the PBOC be concerned with that?

From the article:

Now why would the PBOC be concerned with that?

From the article:

The mainland had 49.9 trillion yuan of personal deposits and 53.7 trillion yuan of corporate time and demand deposits in October, according to the PBOC.

"To establish and regulate a deposit insurance scheme so that depositors are protected and financial risks can be reduced and financial stability maintained, the PBOC has drafted the rules for consultation," the official statement said.

Opinions can be submitted until December 30.

The establishment of a deposit insurance scheme is seen as a precursor to further financial reforms, including the scrapping of remaining controls on interest rates and increasing the role of market forces in the financial sector's operation so that lenders are allowed to fail if they are not well-run or if they take on too much risk.

Saturday, November 29, 2014

Crossfit!...a Challenger approaches!

As a follow up to my somewhat lengthy posting on the business prospects of Crossfit, it appears that yet another manifestation of that "brand" has appeared here in New Orleans.

Iron Tribe Fitness ("ITF") has opened with a "substantially similar" (read: identical) business model to Crossfit about 2 miles away from where I currently reside. To date, this makes 4 Crossfit or Crossfit related gyms within 2 miles of my location. This happened in 2 years. And with respect to my previous post, ITF is right on time: Imitating a successful (for now) business model with cosmetic changes and attempting to gain market share.

To be sure, there are differences between the two gyms (ITF: "we are cleaner but more expensive"), but those are very minor differentiating points between two businesses in a category that already appears saturated. Put another way, making minor differentiations will not drive in more customers to the general category of branded fitness. So its dog eat dog, and devil takes the hindmost.

Crossfit has to either innovate or die now. This will likely take the form of being a pre-eminant training facility for very serious athletes in all strength and endurance sports, which is a fine niche. Focusing energy on its competitors will guarantee disaster just as it has with every other business model The customer does not care about validity claims (which is the "real" crossfit?), he or she cares about the experience.

Iron Tribe Fitness ("ITF") has opened with a "substantially similar" (read: identical) business model to Crossfit about 2 miles away from where I currently reside. To date, this makes 4 Crossfit or Crossfit related gyms within 2 miles of my location. This happened in 2 years. And with respect to my previous post, ITF is right on time: Imitating a successful (for now) business model with cosmetic changes and attempting to gain market share.

To be sure, there are differences between the two gyms (ITF: "we are cleaner but more expensive"), but those are very minor differentiating points between two businesses in a category that already appears saturated. Put another way, making minor differentiations will not drive in more customers to the general category of branded fitness. So its dog eat dog, and devil takes the hindmost.

Crossfit has to either innovate or die now. This will likely take the form of being a pre-eminant training facility for very serious athletes in all strength and endurance sports, which is a fine niche. Focusing energy on its competitors will guarantee disaster just as it has with every other business model The customer does not care about validity claims (which is the "real" crossfit?), he or she cares about the experience.

Bitcoin

The wolves are circling now. I have written previously about Bitcoin and its terrible prospects as a true substitute to the unique monopoly enjoyed by the current cartel of fiat currency issuers.

Now we see all manner of assaults both from a variety of angles that will likely cause bitcoin to remain a fringe or curiosity item in the world's currency general store.

First off, the U.S. is auctioning several million bitcoins to the highest bidder. These bitcoins were "seized" from the raid on Silk Road, a provider of all things clandestine and/or contraband. Suffice to say that the Greeks were far more subtle at the gates of Troy.

As if this action was not imposing enough, the currency itself may be obviated by technology. If the below is true, the currency lacks any positive differentiator from the existing menue of global currencies and will be relegated to the dustbin of history straight away. This is a great lesson in risk analysis, and a wonderful demonstration of how quickly a Sovereign reacts to internal threats on its existing monopolies. From the following article:

Cryptology and Security of the University of Luxembourg have shown that Bitcoin does not protect user's IP address and that it can be linked to the user's transactions in real-time. To find this out, a hacker would need only a few computers and about €1500 per month for server and traffic costs. Moreover, the popular anonymization network "Tor" can do little to guarantee Bitcoin user's anonymity, since it can be blocked easily."

Friday, November 21, 2014

Even Standard & Poors...

...which is the financial rating agency equivalent to sounds of police sirens at the end of an action movie after everyone but the protagonist and his love interest has been killed...now thinks something may be amiss in the middle kingdom.

"A new report from credit-rating group Standard & Poor’s is causing a firestorm in China’s media, with reports citing the analysis as saying half of all government debt in the country may deserve a speculative or “junk” rating.

The recent S&P’s note said 15 of 31 provincial governments in China have issued debt instruments that have “speculative-grade credit features” under its criteria.

“A marked slowdown in economic growth and a sluggish property market” are weighing on the creditworthiness of Chinese provinces, the S&P report said."

"A new report from credit-rating group Standard & Poor’s is causing a firestorm in China’s media, with reports citing the analysis as saying half of all government debt in the country may deserve a speculative or “junk” rating.

The recent S&P’s note said 15 of 31 provincial governments in China have issued debt instruments that have “speculative-grade credit features” under its criteria.

“A marked slowdown in economic growth and a sluggish property market” are weighing on the creditworthiness of Chinese provinces, the S&P report said."

Fuel to the fire.

When the CB lowers rates in order to make refinancing conditions more attractive to political cronies (read: keep them in business until a putative recovery takes form in global demand for Chinese goods presumably still sitting in massive wharehouse complexes).

And of course this follows the news that Chinese students in America have hit an all-time high. This is more than exploring their options.

And of course this follows the news that Chinese students in America have hit an all-time high. This is more than exploring their options.

- 21-Nov-2014 10:36 - CHINA C.BANK SAYS CUTS BENCHMARK INTEREST RATE

Wednesday, November 19, 2014

Press Credentials.

In light of the recent comments regarding the legislative process by Mr. Gruber of MIT, I propose the entire American public be issued press credentials. Let officials be questioned by some of the more less fortunate Americans on issues...for hours...days perhaps.

I also propose that a case of whiskey (American bourbon or rye) be consumed in any governmental meeting (of non-defense personell) over 5 people. Less than 5 people will require only 1 bottle. This will cut down on unecessary personell padding consulting fees and will limit any serious discussion from said meetings.

The comments downplaying his involvement in crafting the bill are silly. An organization does not pay a man over 6 million dollars in exchange for nothing. Even our profligate administration would not do that...would they? And if they did, what would that say about such an organization?

When an organization can spend Trillions, but does not have to provide the same in value, and does not need to "get money" from anywhere but across the street at the Treasury, what kind of "opoly" is that?

Polite conversation...

There is a good reason politics and religion are not discussed in polite coversation. It is the tacit recognition that these sujbects illicit emotional responses rather than rational ones and the understanding that interlocutors in these discussions are basically mirroring their childhood conditioning.

It would be interesting to know if atheists are, on average, less politically inclined than true beleivers since the engine that drives both belief systems are generally the same - an understandable order based on some value set. Both religion and politics are palliatives for the grind of reality.

This is of course why economics is so useful in polite conversation. It can offer a somewhat "safe" proxy for more ingrained and cherished beliefs. Economic camps are bad costumes that barely disguise more emotional arguments with a few theories and perhaps some quantification. The foundation is the same - From Marx, to Adam Smith, to Keynes to Hayek, and to more modern economic theorists. It starts with a value system.

It would be interesting to know if atheists are, on average, less politically inclined than true beleivers since the engine that drives both belief systems are generally the same - an understandable order based on some value set. Both religion and politics are palliatives for the grind of reality.

This is of course why economics is so useful in polite conversation. It can offer a somewhat "safe" proxy for more ingrained and cherished beliefs. Economic camps are bad costumes that barely disguise more emotional arguments with a few theories and perhaps some quantification. The foundation is the same - From Marx, to Adam Smith, to Keynes to Hayek, and to more modern economic theorists. It starts with a value system.

Thursday, November 13, 2014

Quote of the day...

...The monopoly price setter claims they do not set the price.

As a student of opacity in language the below quote from Mr. Ali al-Naimi is a gem, and when someone states "talk" has "no basis in reality", that kind of excess is an excellent indicator for deception.

As a student of opacity in language the below quote from Mr. Ali al-Naimi is a gem, and when someone states "talk" has "no basis in reality", that kind of excess is an excellent indicator for deception.

Saudi Arabia's oil minister, Ali al-Naimi, yesterday broke months of silence to speak publicly about the Gulf nation's stance on the oil market. He dismissed claims that the country had triggered a "price war" to outcompete rival energy sources like US shale

"Talk of a price war is a sign of misunderstanding, deliberate or otherwise, and has no basis in reality," Mr Naimi said, according to Reuters. "We do not set the oil price. The market sets the prices."

Tuesday, November 11, 2014

Book review of the year...

...by the great Eric Falkenstein.

Snippet:

Piketty is a modern progressive, best defined as someone who thinks intellectuals should run everything as the vanguard of the people, which is why academics, journalists, and writers are predominantly progressive. Hayek noted that scribes have always been egalitarian, probably always lamenting the fact that the idiots in power don't write nearly as well as them, and thus, are objectively less qualified but via some tragic flaw in the universe, end up in power. It forms the common reverse dominance hierarchy so common today, where obsequious, hypocritical yet articulate and confident leaders pander to the masses and rule via democracy, focusing their envious eyes on those who aren't interested in that game, such as those concerned with business, religion, or their own family. As Piketty notes, "if we are to regain control of capitalism we must bet everything on democracy” (p. 573), he says from his inegalitarian and very undemocratic position at the Paris School of Economics.

Snippet:

Piketty is a modern progressive, best defined as someone who thinks intellectuals should run everything as the vanguard of the people, which is why academics, journalists, and writers are predominantly progressive. Hayek noted that scribes have always been egalitarian, probably always lamenting the fact that the idiots in power don't write nearly as well as them, and thus, are objectively less qualified but via some tragic flaw in the universe, end up in power. It forms the common reverse dominance hierarchy so common today, where obsequious, hypocritical yet articulate and confident leaders pander to the masses and rule via democracy, focusing their envious eyes on those who aren't interested in that game, such as those concerned with business, religion, or their own family. As Piketty notes, "if we are to regain control of capitalism we must bet everything on democracy” (p. 573), he says from his inegalitarian and very undemocratic position at the Paris School of Economics.

Thursday, November 06, 2014

Public speeches by leaders of State...

...are typically the repository of someone's polticial aspirations combined with empty promises and spiritual references to some amorphous cultural impetus that inevitably "wants" the speaker to continue his or her quest "for the people".

Vladimir Putin's speech at the recent Valdai conference was something else.

Once again he proves his bona fides as man who thinks history is watching him. (a luxury afforded to dicatorial states as there are no checks and/or balances to undermine his will)

He senses weakness in political will and continues to exploit this vacuum by providing a rational, open, caring, and eminently civilized voice of international cooperation. An interesting tact. But let us not avert our eyes from his goal, which is of course a neo Russian empire.

The speech itself and exerpts.

At the same time, the formation of a so-called polycentric world (I would also like to draw attention to this, colleagues) in and of itself does not improve stability; in fact, it is more likely to be the opposite. The goal of reaching global equilibrium is turning into a fairly difficult puzzle, an equation with many unknowns.

So, what is in store for us if we choose not to live by the rules – even if they may be strict and inconvenient – but rather live without any rules at all? And that scenario is entirely possible; we cannot rule it out, given the tensions in the global situation. Many predictions can already be made, taking into account current trends, and unfortunately, they are not optimistic. If we do not create a clear system of mutual commitments and agreements, if we do not build the mechanisms for managing and resolving crisis situations, the symptoms of global anarchy will inevitably grow.

Today, we already see a sharp increase in the likelihood of a whole set of violent conflicts with either direct or indirect participation by the world’s major powers. And the risk factors include not just traditional multinational conflicts, but also the internal instability in separate states, especially when we talk about nations located at the intersections of major states’ geopolitical interests, or on the border of cultural, historical, and economic civilizational continents.

Vladimir Putin's speech at the recent Valdai conference was something else.

Once again he proves his bona fides as man who thinks history is watching him. (a luxury afforded to dicatorial states as there are no checks and/or balances to undermine his will)

He senses weakness in political will and continues to exploit this vacuum by providing a rational, open, caring, and eminently civilized voice of international cooperation. An interesting tact. But let us not avert our eyes from his goal, which is of course a neo Russian empire.

The speech itself and exerpts.

At the same time, the formation of a so-called polycentric world (I would also like to draw attention to this, colleagues) in and of itself does not improve stability; in fact, it is more likely to be the opposite. The goal of reaching global equilibrium is turning into a fairly difficult puzzle, an equation with many unknowns.

So, what is in store for us if we choose not to live by the rules – even if they may be strict and inconvenient – but rather live without any rules at all? And that scenario is entirely possible; we cannot rule it out, given the tensions in the global situation. Many predictions can already be made, taking into account current trends, and unfortunately, they are not optimistic. If we do not create a clear system of mutual commitments and agreements, if we do not build the mechanisms for managing and resolving crisis situations, the symptoms of global anarchy will inevitably grow.

Today, we already see a sharp increase in the likelihood of a whole set of violent conflicts with either direct or indirect participation by the world’s major powers. And the risk factors include not just traditional multinational conflicts, but also the internal instability in separate states, especially when we talk about nations located at the intersections of major states’ geopolitical interests, or on the border of cultural, historical, and economic civilizational continents.

Thursday, October 23, 2014

Oil

Being the marginal monopoly producer of oil has its benefits, but also has its own masters. Saudi Arabia cut production not so much as a reaction to demand, but as placation for its Western masters and their massive investment in oil that is far more difficult to reach.

Thursday, October 16, 2014

Even the slower uptake websites have noticed...

...what readers here knew years ago.

Chinese banks are seeing the writing on the wall in terms of the debt they've accumulated, and they are taking measures to protect themselves.

The Bank of China is planning the biggest sale of shares ever — $6.5 billion to offshore investors,Bloomberg says. It's all in an effort to create a capital cushion.

China's banking system has piled up the most bad loans of any time since the financial crisis, and the banks are preparing for the moment those debts collapse.

Especially in corporate and property sectors, things are looking dire.

Let's tackle the corporate sector first. Last month, Morgan Stanley released a report saying China's corporates took on 5.4 times more leverage than ever before in the first half of 2014, bringing leverage up to levels unseen since 2006.

Sunday, September 28, 2014

That little itching feeling...

...so many weak links in the cellulose that comprises the Paper Dragon.

Good luck recycling this particular component.

Pro-democracy protests expanded in Hong Kong on Monday, a day after demonstrators upset over Beijing's decision to limit political reforms defied onslaughts of tear gas and appeals from Hong Kong's top leader to go home.

Good luck recycling this particular component.

Pro-democracy protests expanded in Hong Kong on Monday, a day after demonstrators upset over Beijing's decision to limit political reforms defied onslaughts of tear gas and appeals from Hong Kong's top leader to go home.

Thursday, September 18, 2014

Crimea...

...has always been the target, and with it, control of the Black Sea. The Great Game is upon us once again, with the usual players (Anglo-Saxons, Russians, Asians, Arabs, etc.) occupying the chess board.

Its only a couple moves for Russia to take Istanbul and full control of its previous central Asian empire. These are not outrageous goals for a newly competitive Russia, nor are they out of reach for a man who clearly believes history is on his side.

Recall that Moscow is the Third Rome. And I also note this article. It appears as though Putin has chosen his ideological lever. Constantinople (and its significance in the Orthodox church) is the glittering prize just south of Crimea in the Black Sea.

We can assume increased instability in Turkey, backed by Russia. Putin and Russia are in an excellent position. All that is required for Western concession are promises to assist in the organized Fundamentalist Muslim threat...which, conveniently, also exists in Turkey.

The U.S. has sent Destroyers to the region of a class that has little to no capacity to strike ground targets. This speaks volumes to the priority targets amongst the players. Its not Ukraine, but the Black Sea that is in play.

Its only a couple moves for Russia to take Istanbul and full control of its previous central Asian empire. These are not outrageous goals for a newly competitive Russia, nor are they out of reach for a man who clearly believes history is on his side.

Recall that Moscow is the Third Rome. And I also note this article. It appears as though Putin has chosen his ideological lever. Constantinople (and its significance in the Orthodox church) is the glittering prize just south of Crimea in the Black Sea.

We can assume increased instability in Turkey, backed by Russia. Putin and Russia are in an excellent position. All that is required for Western concession are promises to assist in the organized Fundamentalist Muslim threat...which, conveniently, also exists in Turkey.

The U.S. has sent Destroyers to the region of a class that has little to no capacity to strike ground targets. This speaks volumes to the priority targets amongst the players. Its not Ukraine, but the Black Sea that is in play.

Scotland

Wether or not 4 million people decide to collectively re-program their "nationality" is not so interesting as the current global trend towards increased autonomy and the return of "sovereignity", which has been under siege for the last 40 years.

Globalization has been wonderful for commerce, but unfortunately, when you scale power to global levels the opportunity for corruption and control becomes too intoxicating. What we are witnessing is the concept of subsidiarity writ large. It is beneficial to have globally connected commerce, but the power structures that follow this phenomenon have proven to be less useful.

This is a simple re-pricing of information. Modern goverments would have you believe that smaller countries will not enjoy the benefits of large-scale information matrixes (like currencies, regulation, courts, etc.). This is of course nonsense as most of these matrixes have become increasingly cheap due to technological advances. What real disadvantages would Scotland suffer if they vote for independence? Would they somehow be untethered from the entire world and set adrift at the mercy of the elements like the Pequod? Or will they be able to chart their own course and bestride the world on their own power like the Nautilus? Predictably, the owners of this current global system are concerned.

The desire to de-scale governmental power is entirely logical, and in this blogger's opinion, necessary in order to prevent more violent means of re-pricing information.

Globalization has been wonderful for commerce, but unfortunately, when you scale power to global levels the opportunity for corruption and control becomes too intoxicating. What we are witnessing is the concept of subsidiarity writ large. It is beneficial to have globally connected commerce, but the power structures that follow this phenomenon have proven to be less useful.

This is a simple re-pricing of information. Modern goverments would have you believe that smaller countries will not enjoy the benefits of large-scale information matrixes (like currencies, regulation, courts, etc.). This is of course nonsense as most of these matrixes have become increasingly cheap due to technological advances. What real disadvantages would Scotland suffer if they vote for independence? Would they somehow be untethered from the entire world and set adrift at the mercy of the elements like the Pequod? Or will they be able to chart their own course and bestride the world on their own power like the Nautilus? Predictably, the owners of this current global system are concerned.

The desire to de-scale governmental power is entirely logical, and in this blogger's opinion, necessary in order to prevent more violent means of re-pricing information.

Wednesday, September 17, 2014

With power so concentrated...

...access to policy makers is priceless.

As I have stated previously, most philosophers (or to use the modern appelation "intellectuals") are apologists in one form or another.

As I have stated previously, most philosophers (or to use the modern appelation "intellectuals") are apologists in one form or another.

Wednesday, July 09, 2014

Headline of the day...

...Gold could go up, or down. Fascinating.

"Charts hinting at a big move for gold"

Friday, June 27, 2014

Theme collision...

This is a wonderful collision of major themes on this blog, namely:

1. Gold is not a "safe" investment or necessarily negatively correlated to recessions, currency weakness, etc.

2. China has little to no control over its internal credit procedures, which are largely politically directed, thus resulting in one of the biggest economic bubbles in history.

And so now we "discover" that an amount equal to the GDP of Iceland (15 Billion dollars or so) is the result of falsified transactions...and with "owners" of gold having to deal with multiple collateral claims in various jurisidctions, it again begs the question of "what do you, precisely, own when you have claims on precious metals in storage somewhere".

And what do the correspoding banks in China "own" when they list these loans as assets?

1. Gold is not a "safe" investment or necessarily negatively correlated to recessions, currency weakness, etc.

2. China has little to no control over its internal credit procedures, which are largely politically directed, thus resulting in one of the biggest economic bubbles in history.

And so now we "discover" that an amount equal to the GDP of Iceland (15 Billion dollars or so) is the result of falsified transactions...and with "owners" of gold having to deal with multiple collateral claims in various jurisidctions, it again begs the question of "what do you, precisely, own when you have claims on precious metals in storage somewhere".

And what do the correspoding banks in China "own" when they list these loans as assets?

China’s chief auditor discovered 94.4 billion yuan ($15.2 billion) of loans backed by falsified gold transactions, adding to signs of possible fraud in commodities financing deals.

Twenty-five bullion processors in China, the biggest producer and consumer of gold, made a combined profit of more than 900 million yuan from the loans, according to a report on the National Audit Office’swebsite.

Public security authorities are also probing alleged fraud at Qingdao Port, where copper and aluminum stockpiles may have been pledged multiple times as collateral for loans. Steps by the Chinese government to rein in credit by raising borrowing costs in recent years created a surge in commodities financing deals that Goldman Sachs Group Inc. estimates to be worth as much as $160 billion.

Tuesday, June 10, 2014

There are two Iraqs...

The one with people, and the one with oil. Which one remains a vital U.S. interest?

Militants seized the airport, TV stations and governor's

offices in Mosul, Iraq's second-largest city, as police and soldiers

ran from their posts -- a stunning collapse of the security forces

that has raised questions about Prime Minister Nuri al-Maliki's

ability to hold the country together.

In perhaps a sign of just how serious the threat is to Iraq's

stability, al-Maliki took to the airwaves to call on all men to

volunteer to fight, promising to provide weapons and equipment.

"We will not allow for the remainder of the ... province and the city

to fall," he said in a live speech broadcast on Iraqi state TV.

Militants seized the airport, TV stations and governor's

offices in Mosul, Iraq's second-largest city, as police and soldiers

ran from their posts -- a stunning collapse of the security forces

that has raised questions about Prime Minister Nuri al-Maliki's

ability to hold the country together.

In perhaps a sign of just how serious the threat is to Iraq's

stability, al-Maliki took to the airwaves to call on all men to

volunteer to fight, promising to provide weapons and equipment.

"We will not allow for the remainder of the ... province and the city

to fall," he said in a live speech broadcast on Iraqi state TV.

Wednesday, May 21, 2014

The facepalm is strong...

...concerning a recent interview statement given by "Maestro" Greenspan.

"I've made lots of mistakes in the 18½ years that I was at the Fed. I don't think that that (read: lowering rates) one was one and I don't think that we were as an organization significantly involved in what was happening in the global markets."

"I've made lots of mistakes in the 18½ years that I was at the Fed. I don't think that that (read: lowering rates) one was one and I don't think that we were as an organization significantly involved in what was happening in the global markets."

A new age...

...of corporate espionage. Of course in this case, public and private interests are a bit comingled.

Full article here.

Full article here.

In 2010, as Westinghouse and China began talking about building more plants, the hackers intercepted internal discussions between Westinghouse's former CEO Aris Candris and about a half dozen other top-level decision makers, the indictment claimed. The correspondence dealt with strategy for negotiating a deal and concerns that the Chinese might one day become a competitor to Westinghouse in nuclear technology.

Over the next two years, the indictment said, Westinghouse had at least 1.4 gigabytes of information stolen from its computers. That's roughly equivalent to 700,000 pages of e-mails and attachments.

Monday, May 05, 2014

More on collateral shortages...

The engine is stalling...but what will the reversal bring?

Excluding those held by the Federal Reserve, Treasuries due in 10 years or more account for just 5 percent of the $12.1 trillion market for U.S. debt. New rules designed to plug shortfalls at pension funds may now triple their purchases of longer-dated Treasuries, creating $300 billion in extra demand over the next two years that would equal almost half the $642 billion outstanding, Bank ofNova Scotia estimates.

Fewer available bonds, along with a lack of inflation and increased foreign buying, help to explain why longer-term Treasuries are surging this year even as the Fed pares its own bond purchases. The demand has pushed down yields on 30-year government debt by more than a half-percentage point to 3.37 percent, the most since 2000, data compiled by Bloomberg show.

Thursday, April 24, 2014

The supply of collateral

The Fed must taper at this point, given the lack of available collateral (and the decline in issuance of Treasury and "safe" Agency securities). We are indeed in strange times, as if the black hole of QE and associated bond purchases is beginning to eject matter via the quasar of Fed tapering. The consumption, storage, and ejection of all this financial matter is one of my major interests at the moment.

The interesting part is defining what the "matter" is...a zero interest note (dollars) or some "debt instrument" that accrues dollars via some future rate schedule?

Once of the themes of this blog is "what ramifications are produced when a world is run by a fiat currencies". This is an unpredecented experiment in geo-political cooperation, and can be generally thought of as a treaty between the G20 nations.

Of course, treaties are always broken.

Billions and Billions...indeed.

Tuesday, April 22, 2014

The Crossfit Bubble

As a student of financial bubbles, I also seem pre-programmed to study the causes and effects of cultural, technological, political, intellectual, and environmental bubbles as well. A "bubble" can be loosely defined as any function where outputs suffer marginally decreasing returns from inputs. Put another way, a model cannot be sustained from increased effort and becomes inherently unstable. Examples in unsustainability are all around us, and while the inputs and outputs may vary wildly through the spectrum of life, the causes and effects are quite consistent.

One example of an unsustainable growth model has to be the branded commodity called "Crossfit". This is an exercise program which emphasizes semi-random, extremely intense workout sessions. I have tried Crossfit. It is certainly challenging, but the emphasis here is not to argue about the merits of Crossfit as a training regimen, but rather investigate how sustainable it will be as a cultural and business phenomenon. I have also attended the Crossfit Games ("The Games") in an effort to further understand the cultural sustainability aspect of Crossfit.

For the sake of Brevity, let me state that Crossfit is most certainly an unsustainable cultural and economic bubble.

By emphasizing "elite fitness", and marketing the accomplishments of highly trained and physically gifted individuals, it naturally creates a division between patrons who are competing for the Crossfit Games and those who are "merely" there to exercise. This was demonstrated in the cultural response to "registration" for the The Games whereby anyone with $20.00 to spend could post their results for several "open workouts" that would qualify them for competition. Many elite competitors found it silly that novice athletes would attempt to qualify for one of the most strenuous contests of human work output on the planet. But of course, this is the result of Crossfit attempting to grow by exploiting more revenue streams from its members. A registration fee of $20.00 for, say, 300,00 members equates to $6 Million in profits with a cost basis of a spreadsheet program and associated webpage maintenance. Not a bad take.

Also, the sheer number of Crossfit gyms (I live in New Orleans and there are now 3 within walking distance) has all the classic signs of a bubble. Rapid expansion to capture the primary revenue stream of Crossfit (the sale of certification classes to teach Crossfit) has resulted in a glut of Crossfit gyms whose marketing materials state they "forge elite fitness". If Crossfit wishes to continue this marketing image, and it must be understood that the marketing component creates much of the worth of the Crossfit brand, then diluting this image by catering to a mass audience will only serve to alienate Crossfit's core community. Becoming the McDonald's of fitness does not enhance their brand. It is a marketing tightrope walk that is unsustainable. The core membership will fracture into several different types of branded fitness outlets, and the Crossfit brand will be hollowed out.

Speaking of competition, there is already exogenous competition in the form of athletic clubs and the like as well and endogenous competition in the form of Crossfitesque gyms Again, this is branded exercise and there are no barriers to entry. The Games themselves have a new competitor in the National Pro Fitness League. This is reminiscent of the many "Texas Hold'em Poker" T.V. shows that proliferated in the early and mid 2000s before disappearing en mass. All of this activity further erodes the branded fitness sector that Crossfit has come to dominate, and this dilution will cause crossfit gyms to compete on pricing alone (the fate of a commodity) and the bubble will burst.

The above analysis does not even take into account the possibility of even further brand erosion once Crossfit enthusiasts understand that competitors in The Games follow wildly different training programs than the rank and file members of individual Crossfit gyms. But again, I don't want to get into efficacy arguments about the Crossfit regimen. It is intense physical training.

I give this particular bubble 3-4 more years before the stresses due to an unsustainable model begin to challenge the brand and the entire business model. I am not saying it will disappear completely. People still watch Texas Hold'em poker shows...but viewship, prize money, and registration to major events are all down 30-50% from their peaks. The inputs and outputs are different, but the causes and effects are the same.

One example of an unsustainable growth model has to be the branded commodity called "Crossfit". This is an exercise program which emphasizes semi-random, extremely intense workout sessions. I have tried Crossfit. It is certainly challenging, but the emphasis here is not to argue about the merits of Crossfit as a training regimen, but rather investigate how sustainable it will be as a cultural and business phenomenon. I have also attended the Crossfit Games ("The Games") in an effort to further understand the cultural sustainability aspect of Crossfit.

For the sake of Brevity, let me state that Crossfit is most certainly an unsustainable cultural and economic bubble.

By emphasizing "elite fitness", and marketing the accomplishments of highly trained and physically gifted individuals, it naturally creates a division between patrons who are competing for the Crossfit Games and those who are "merely" there to exercise. This was demonstrated in the cultural response to "registration" for the The Games whereby anyone with $20.00 to spend could post their results for several "open workouts" that would qualify them for competition. Many elite competitors found it silly that novice athletes would attempt to qualify for one of the most strenuous contests of human work output on the planet. But of course, this is the result of Crossfit attempting to grow by exploiting more revenue streams from its members. A registration fee of $20.00 for, say, 300,00 members equates to $6 Million in profits with a cost basis of a spreadsheet program and associated webpage maintenance. Not a bad take.

Also, the sheer number of Crossfit gyms (I live in New Orleans and there are now 3 within walking distance) has all the classic signs of a bubble. Rapid expansion to capture the primary revenue stream of Crossfit (the sale of certification classes to teach Crossfit) has resulted in a glut of Crossfit gyms whose marketing materials state they "forge elite fitness". If Crossfit wishes to continue this marketing image, and it must be understood that the marketing component creates much of the worth of the Crossfit brand, then diluting this image by catering to a mass audience will only serve to alienate Crossfit's core community. Becoming the McDonald's of fitness does not enhance their brand. It is a marketing tightrope walk that is unsustainable. The core membership will fracture into several different types of branded fitness outlets, and the Crossfit brand will be hollowed out.

Speaking of competition, there is already exogenous competition in the form of athletic clubs and the like as well and endogenous competition in the form of Crossfitesque gyms Again, this is branded exercise and there are no barriers to entry. The Games themselves have a new competitor in the National Pro Fitness League. This is reminiscent of the many "Texas Hold'em Poker" T.V. shows that proliferated in the early and mid 2000s before disappearing en mass. All of this activity further erodes the branded fitness sector that Crossfit has come to dominate, and this dilution will cause crossfit gyms to compete on pricing alone (the fate of a commodity) and the bubble will burst.

The above analysis does not even take into account the possibility of even further brand erosion once Crossfit enthusiasts understand that competitors in The Games follow wildly different training programs than the rank and file members of individual Crossfit gyms. But again, I don't want to get into efficacy arguments about the Crossfit regimen. It is intense physical training.

I give this particular bubble 3-4 more years before the stresses due to an unsustainable model begin to challenge the brand and the entire business model. I am not saying it will disappear completely. People still watch Texas Hold'em poker shows...but viewship, prize money, and registration to major events are all down 30-50% from their peaks. The inputs and outputs are different, but the causes and effects are the same.

The most interesting slow-motion bubble popping...

...continues. We note many sources (in an informationally "centralized" country) "leaking" bad economic figures, in a deliberate attempt to manage the inevitable. However, this is not a case of legitimate numbers being reported...but rather an effort to buy time in the hopes global demand picks up.

It also buys time for the elite party members to move assets and family members to safer locales, or at least have a plan to do so at a moments notice.

From Bloomberg:

China’s bad-loan ratio rose “significantly” in the first quarter, increasing risks for the nation’s banking industry, according to the nation’s largest manager of soured debt.

The business environment this year has been “grim and complicated” as lenders face pressures on asset quality, liquidity and lending margins, China Huarong Asset Management Co. Chairman Lai Xiaomin said during an internal meeting on April 15, according to a statement today on the website of the Beijing-based company.

China’s slowing economy has made it tougher for borrowers to repay debt, driving up banks’ sour loans for a ninth straight quarter as of December to the highest level since 2008, data from the banking regulator show. New nonperforming loans amounted to more than 60 billion yuan ($9.6 billion) in the first two months of this year, compared with 100 billion yuan for all of 2013, China Business News reported on April 9, citing people it didn’t identify.

“The economic indicators we’ve seen so far are quite disappointing and repayment risks are rising across sectors from property to small businesses due to weak demand,” Rainy Yuan, a Shanghai-based analyst at Masterlink Securities Corp., said by phone. “Banks will be hit in such an operating environment but managers of bad assets like Huarong and China Cinda Asset Management Co. stand to benefit” because they can accumulate more sour loans, she said.

Wednesday, April 16, 2014

Pulled Pork

Being a resident of the great city of New Orleans (the only city in the U.S. that feels to an American as though you are treaveling abroad), I am exposed to more than my fair share of great cuisine. And I must say the roast beef and pulled pork here is also delicious just about anywhere you go...any meat that becomes so juicy than you can "pull" it apart is bound to be wonderful.

So speaking of meat that can be pulled apart, the U.S. is faced with a myriad number of challenges. It is as though the pack of wolves that is the rest of the world collectively smells the blood trail of the a mighty wounded bear.

The Ukraininan/Russian situation is providing all sorts of cover (several reports indicate an Al-Quieda backed attack on Baghdad itself) for operatives around the world to probe, test, and evaluate if they can break from cover and seize interests.

An interesting time, and I half expect a missile test from North Korea right...about...

Wednesday, April 09, 2014

The levers of Power.

As sure as justification follows action, apologists follow the levers of power. The neo-classical model of economics sprung Athena-like out of the head of industrialization in the same fashion as scholasticism forming the bedrock for feudal-monarchy relationship of past centruries.

But systems change, and the neo-classical model is not quite as relevent anymore, is it?

The Recapitulator is actively seeking what alternatives are out there, and which is likely to be the winner, thus forming a new set of apologists who will declare "system x, and only system x" to be the most efficient way extant of governing humans, gathering their collective talents, and providing "fairness" and "justice" to all.

Like a wise economist said with respect to opportunism in the market of ideas:

“Only a crisis - actual or perceived - produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around. That, I believe, is our basic function: to develop alternatives to existing policies, to keep them alive and available until the politically impossible becomes the politically inevitable.”

Was this quote by Saul Alinky or some similar "radical"? No. It was by Milton Friedman.

Tuesday, March 18, 2014

May we live...

...in interesting times indeed.

With Crimea's referendum passing, it would appear that Russia has indeed regained some satellites of its former empire...without firing a shot. They rightly see the U.S. as weakened in this situation considering its adventures of the past decade and certainly cannot appear to passive as an area of high national interest is absorbed.

This epsisode should (both in real and normative terms) end quietly...I hope...

UPDATE:

I also hope our "diplomats" stop with this sort of rhetoric:

US Vice-President Joe Biden, speaking in Poland, said Russia's involvement in Crimea was "a brazen military incursion" and its annexation of the territory was "nothing more than a land grab" by Moscow.

With Crimea's referendum passing, it would appear that Russia has indeed regained some satellites of its former empire...without firing a shot. They rightly see the U.S. as weakened in this situation considering its adventures of the past decade and certainly cannot appear to passive as an area of high national interest is absorbed.

This epsisode should (both in real and normative terms) end quietly...I hope...

UPDATE:

Breaking reports from Crimea on Tuesday indicate that Russian forces are storming Ukrainian military bases following Moscow’s annexation of the Ukrainian peninsula.

Ukraine’s defense ministry reports that shots were fired by Russian soldiers at Ukrainian troops and at least one Ukrainian soldier was wounded.

I also hope our "diplomats" stop with this sort of rhetoric:

US Vice-President Joe Biden, speaking in Poland, said Russia's involvement in Crimea was "a brazen military incursion" and its annexation of the territory was "nothing more than a land grab" by Moscow.

Friday, March 07, 2014

The Paper Dragon...

The illusion can no longer be supported. Please raise your seats to the upright crash position and buckly your seatbealts. We thank you for flying Credit Bubble Airlines...

A Chinese solar-cell maker failed to pay full interest on its bonds, leading to the country’s first onshore default and signaling the government will back off its practice of bailing out companies with bad debt.

Shanghai Chaori Solar Energy Science & Technology Co. (002506) is trying to sell some of its overseas plants to raise money to repay the debt

Wednesday, March 05, 2014

Weapons...

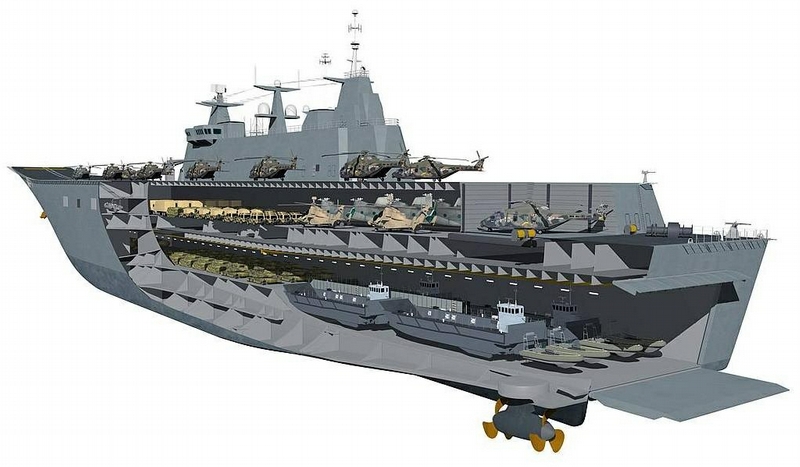

So the French built helicopter carrier deal with Russia is still on. Shocking. With the possibilities and spectrum of action being discussed constantly, my mind is on other players.

This incursion provides nice cover to accomplish some politically unpalatable goals for countries unaffected by the conflict.

Thursday, February 13, 2014

The Bitcoin saga...

...a continuing farce...

After taking an observational interest in this newfound coin, it appears as though the problems discussed here will be too much for the fledeling "currency".

Powerful enemies cause powerful problems...particularly when you question their legitimacy and threaten to de-scale their influence.

And now some bitcoins have been "stolen". When the list of suspects includes some of the world's most powerful countries, good luck.

Dear MtGox Customers and Bitcoiners,

As you are aware, the MtGox team has been working hard to address an issue with the way that bitcoin withdrawals are processed. By "bitcoin withdrawal" we are referring to transactions from a MtGox bitcoin wallet to an external bitcoin address. Bitcoin transactions to any MtGox bitcoin address, and currency withdrawals (Yen, Euro, etc) are not affected by this issue.

The problem we have identified is not limited to MtGox, and affects all transactions where Bitcoins are being sent to a third party. We believe that the changes required for addressing this issue will be positive over the long term for the whole community. As a result we took the necessary action of suspending bitcoin withdrawals until this technical issue has been resolved.

Addressing Transaction Malleability

MtGox has detected unusual activity on its Bitcoin wallets and performed investigations during the past weeks. This confirmed the presence of transactions which need to be examined more closely.

After taking an observational interest in this newfound coin, it appears as though the problems discussed here will be too much for the fledeling "currency".

Powerful enemies cause powerful problems...particularly when you question their legitimacy and threaten to de-scale their influence.

And now some bitcoins have been "stolen". When the list of suspects includes some of the world's most powerful countries, good luck.

Dear MtGox Customers and Bitcoiners,

As you are aware, the MtGox team has been working hard to address an issue with the way that bitcoin withdrawals are processed. By "bitcoin withdrawal" we are referring to transactions from a MtGox bitcoin wallet to an external bitcoin address. Bitcoin transactions to any MtGox bitcoin address, and currency withdrawals (Yen, Euro, etc) are not affected by this issue.

The problem we have identified is not limited to MtGox, and affects all transactions where Bitcoins are being sent to a third party. We believe that the changes required for addressing this issue will be positive over the long term for the whole community. As a result we took the necessary action of suspending bitcoin withdrawals until this technical issue has been resolved.

Addressing Transaction Malleability

MtGox has detected unusual activity on its Bitcoin wallets and performed investigations during the past weeks. This confirmed the presence of transactions which need to be examined more closely.

Trade balance wars...

...a continuing saga...

Insularity goes both ways. With Europe contiuing along the (well treaded) path of mercantilistic policy, the rest of the world has already gotten the joke. Pre-emptive depreciation strikes in a global financial war, indeed. I have written about this in a slightly different context before, but its instructive to note the tone of policy makers.

(Arnaud Montebourg, French Minister of Industry)

What is your view on the level of the euro?

As Minister of Industry, I believe that the euro is out of his nails

(french phrase: "sorti de ses clous", meaning way outside the norm) in

an overstatement that has become problematic in the eyes of all our

businesses. Between 2012 and 2013, it has appreciated over 10% against

the dollar and more than 40% against the yen. All while between the

third quarter of 2012 and the third quarter of 2013, the growth

rate was 3.4% accumulated in the United States, 2.3% in Japan and -

0.2% in the euro area! We have the most depressed area in the world and

the currency appreciates most in the world. This is grotesque.

...

Do not you afraid to start a currency war?

But it already exists this war! We are the victims and we are the only

ones not to react!

Insularity goes both ways. With Europe contiuing along the (well treaded) path of mercantilistic policy, the rest of the world has already gotten the joke. Pre-emptive depreciation strikes in a global financial war, indeed. I have written about this in a slightly different context before, but its instructive to note the tone of policy makers.

(Arnaud Montebourg, French Minister of Industry)

What is your view on the level of the euro?

As Minister of Industry, I believe that the euro is out of his nails

(french phrase: "sorti de ses clous", meaning way outside the norm) in

an overstatement that has become problematic in the eyes of all our

businesses. Between 2012 and 2013, it has appreciated over 10% against

the dollar and more than 40% against the yen. All while between the

third quarter of 2012 and the third quarter of 2013, the growth

rate was 3.4% accumulated in the United States, 2.3% in Japan and -

0.2% in the euro area! We have the most depressed area in the world and

the currency appreciates most in the world. This is grotesque.

...

Do not you afraid to start a currency war?

But it already exists this war! We are the victims and we are the only

ones not to react!

Wednesday, January 29, 2014

To laugh or cry...

A well-known University increases its profits by providing an "education" that serves no other purpose but to keep the revenue wheels greased. I have written about the NCAA previously on this blog. The Universities of the U.S.A. should be banned from providing athletic talent for professional sports. The lack of a well-developed market here is causing these absurd distortions. What a farce. And, of course, the fact that this University practiced these methods guarantees that its competitors employ similar tactics.

Also note that the University if dealing with these issues during a massive and uncharacteristic snow-storm in the area...literally snowing over this news to some degree.

As the great Lily Tomlin said "No matter how cynical you become, its never enough to keep up"

That painful history consists of the transformation of UNC's former

African and Afro-American Studies Department into a factory churning

out fake grades from phony classes disproportionately attended by

varsity athletes. No one is disputing that anymore. What's still

unclear is the degree to which Chapel Hill's powerful Athletic

Department initiated and/or exploited the fraudulent Afro-Am

department. (It has since been reformed and "rebranded," Dean pointed

out, as African, African-American, and Diaspora Studies.)

In the most important piece of actual news he delivered during his

visit to New York--news that as far as I can tell has not been reported

anywhere else--Dean said he had commissioned an internal study on the

entire history of African and African-American studies at UNC. He said

he's determined to get to the bottom of what forces and personalities

caused the program's ugly corruption. He also vowed to "look at"

whether athletes were "clustering" in other departments and classes

reputed to be the source of easy grades. If these inquiries are

thorough and followed by changes, UNC could go from outlaw to leader

in cleaning up the relationship between Division 1 "revenue sports,"

as they're known, and the provision of real undergraduate education.

Also note that the University if dealing with these issues during a massive and uncharacteristic snow-storm in the area...literally snowing over this news to some degree.

As the great Lily Tomlin said "No matter how cynical you become, its never enough to keep up"

That painful history consists of the transformation of UNC's former

African and Afro-American Studies Department into a factory churning

out fake grades from phony classes disproportionately attended by

varsity athletes. No one is disputing that anymore. What's still

unclear is the degree to which Chapel Hill's powerful Athletic

Department initiated and/or exploited the fraudulent Afro-Am

department. (It has since been reformed and "rebranded," Dean pointed

out, as African, African-American, and Diaspora Studies.)

In the most important piece of actual news he delivered during his

visit to New York--news that as far as I can tell has not been reported

anywhere else--Dean said he had commissioned an internal study on the

entire history of African and African-American studies at UNC. He said

he's determined to get to the bottom of what forces and personalities

caused the program's ugly corruption. He also vowed to "look at"

whether athletes were "clustering" in other departments and classes

reputed to be the source of easy grades. If these inquiries are

thorough and followed by changes, UNC could go from outlaw to leader

in cleaning up the relationship between Division 1 "revenue sports,"

as they're known, and the provision of real undergraduate education.

Unfortunately...

...all laws are not created equal. In countries with a strong history of accountability and oversight (which include, at least nominally, countries of anglo saxon tradition) such laws can increase transparency and competition. In other countries that have history steeped less in rule-sets, such laws increase arbitrary enforcement and generally lead to further concentrations of power within the ruling class (in this case, the Communist Party)

From The Economist:

China’s government has always made life difficult for firms in some sectors—it has restricted market access for foreign banks and brokerage houses and blocked internet firms, including Facebook and Twitter—but the tough treatment seems to be spreading. Hardware firms such as Cisco, IBM and Qualcomm are facing a post-Snowden backlash; GlaxoSmithKline, a drugmaker, is ensnared in a corruption probe; Apple was forced into a humiliating apology last year for offering inadequate warranties; and Starbucks has been accused by state media of price-gouging. A sweeping consumer-protection law will come into force in March, possibly providing a fresh line of attack on multinationals. And the government’s crackdown on extravagant spending by officials is hitting the foreign firms that peddle luxuries

Tuesday, January 28, 2014

Bitcoin.

Who has the capital, both financial and political, to withstand this pressure? Nobody. If you are going to challenge, even tangentially, the primacy of the prevailing currency of the country in which you reside, expect retaliation by any and all available means with "extreme prejudice". Challenging the local Lord has been a guaranteed way to lose life and/or property for centuries.

Charlie Shrem, the CEO of Bitcoin exchange company BitInstant and a well-known voice in the virtual currency community, has been charged with scheming to sell and launder $1 million worth of Bitcoin to users of the illegal drug website Silk Road.

The criminal complaint, unsealed today in Manhattan federal court, says that the 24-year-old Shrem conspired with Robert Faiella, a 52-year-old who used the handle "BTCKing." Faiella allegedly obtained Bitcoins from Shrem, then sold them anonymously to Silk Road users at a markup through the site.

The prosecutors say Shrem was aware of the illegal activity and even bought drugs on Silk Road himself. "Truly innovative business models don’t need to resort to old-fashioned law-breaking, and when Bitcoins, like any traditional currency, are laundered and used to fuel criminal activity, law enforcement has no choice but to act," US Attorney Preet Bharara said in a statement.

The Paper Dragon solves the problem...

...so we have visual confirmation of what were previously merely optical backstops. This of course "solves" nothing and the massive imbalances continue to weigh on internal stability. It is one thing to have a few million people living in poverty, as in the United States...but inequality scales heavily with population.

1.2 Billion angry Chinese await the eventualities here.

1.2 Billion angry Chinese await the eventualities here.

The cost of insuring China’s bonds against non-payment fell the most since September and debt linked to municipalities gained after the bailout of a troubled trust product averted a default that may have spooked markets.

Credit-default swaps protecting Chinese sovereign bonds for five years slid nine basis points, or 0.09 percentage points, to 96 yesterday in New York, according to data provider CMA. The average yield on five-year notes rated AA, the most common grade for so-called local-government financing vehicles, dropped two basis points to 7.58 percent, the biggest decline in more than two weeks, ChinaBond figures show.

Subscribe to:

Posts (Atom)