...is a brittle, somewhat fictive thing when it concerns national interests.

The cycle of life continues...just as Cuba has been ruined by totalitarian rule via "freedome fighters", so to has China's idustrial output been appropriated by "communists".

Labels are useless when analyzing these societies. It is a simple matter of power and the means of production. It is a strange truth that China is much closer to the Bourgeoisie/proletariat dichotomy than the U.S., so I guess they follow their philsophical master in at least one respect...

from a Foreign Affairs article outlining some of the "challenges" the Paper Dragon faces:

Increased misappropriation of land, rising income inequality, and corruption are among the most contentious issues for Chinese society. China’s State Development Research Center estimates that from 1996 to 2006, officials and their business cronies illegally seized more than 4,000 square miles of land per year. In that time, 80 million peasants lost their homes. Yu Jianrong, a senior government researcher, has said that land issues represent one of the most serious political crises the CCP faces.

From 1996 to 2006, Chinese officials and their business cronies illegally seized more than 4,000 square miles of land per year. In that time, 80 million peasants lost their home.

China’s wealth gaps have also grown; according to Chinese media, the country’s GINI coefficient, a measure of income inequality, has risen to about 0.47. This level rivals those seen in Latin America, one of the most unequal regions in the world. The reality may be even worse than the data suggest. Wang Xiaolu, the deputy director of the National Economic Research Institute at the China Reform Foundation, estimates that every year about $1.3 trillion in income -- equivalent to 30 percent of China’s GDP -- goes unreported. More than 60 percent of the hidden income belongs to the wealthiest ten percent of China’s population, mostly CCP members and their families. The use of political power to secure inordinate wealth is a source of considerable resentment, and the wealthy are keenly aware of it. They now employ more than two million bodyguards, and the private security industry has grown into a $1.2 billion enterprise since it was established in 2002.

Wednesday, December 15, 2010

The Paper Dragon as beacon for the world

...infiltrating our "thought leaders". My comments in italics. This is a strange article that pines for a more "honest" approach to solving the U.S.'s internal problems. It then furnishes an example of a country that has experienced highly transitory success and suggests we follow suit. Hilarity ensues.

By Fareed Zakaria

Monday, December 13, 2010

This is the wrong time to raise taxes, say the politicians. The economy is fragile, say the economists. The recovery is halting, say the pundits. In a few years, they all affirm, we will need to get our fiscal house in order. Of course, just a few years ago, the economy was doing fine, and Washington decided it wasn't the moment to worry about the deficit. Instead, over the past decade, we cut taxes, added a massive entitlement program (prescription drugs for the elderly) and spent trillions on two wars. Somehow, no matter what the economic clock says, it's never time in Washington to cut spending or raise taxes. Call it mañana economics.

Hard to argue with this...

Procrastination economics

The best one can say about President Obama's compromise plan with Congress is that it will do some short-term good - at long-term cost. The only parts of the plan likely to have a significant effect in stimulating the economy are the extensions of unemployment insurance, cuts in payroll taxes and, perhaps, tax credits for businesses ("perhaps" because they are temporary and thus would only bring forward investments). To get these measures, worth about $250 billion, Obama agreed to an extension of the Bush tax cuts that will cost around $750 billion, and eventually much more since the tax cuts are now more likely to become permanent. It makes the original stimulus plan of 2009 look stunningly efficient.

The original stimulus plan was indeed inefficient. Tax cuts and organic growth via market forces allocate capital and investment much more efficiently than top-down governmental edict. Setting up the arithmetic here as a simple 750>250 is disengenuous.

The first act of the newly empowered Republican Party has been to add a trillion dollars to the deficit. Republicans have now fully embraced the Keynesian arguments that they routinely denounced. John Maynard Keynes argued that when private demand weakens, the government should pick up the slack. He advocated either of two paths: government spending or tax cuts. Republicans have simply chosen the latter course.

Spending cuts on the way?

So when will we get serious about our fiscal mess? In 2020 or 2030, when the needed spending cuts and tax hikes get much larger? If we cannot inflict a little pain now, who will impose a lot of pain later? Does anyone believe that Washington will one day develop the political courage it now lacks? And what if, while we are getting around to doing something, countries get nervous about lending us money and interest rates rise?

Once again, the popular delusion of "funding" being the issue leads to inaccurate conclusions with respect to the yield curve. And even if these causalities (foreign governments lend us "money") were true, can export reliant emerging economies withstand the attendent currency movements from these yield fluctuations?

I understand the politics of compromise and the politics of reelection, and this deal makes sense on both grounds. It doesn't make much sense for the long-term growth of the American economy. What Washington is trying to do is reignite the consumption bubble - hoping to get Americans to spend money and take out loans. This plan, presidential adviser Lawrence Summers tells us, will get the economy to "escape velocity." It's an intriguing theory. If Americans keep spending money, using their credit cards, and buying houses, this will trigger the next technological and economic revolution.

Take Mr. Summers's (aka, "the smartest guy in the room") advice at your peril.

China has a different theory of how to get long-term, sustained growth. The Chinese have doubled their spending on education - with stunning results - and continue to build the world's best infrastructure. Reuters reports that Beijing is contemplating a plan to invest $1.5 trillion over the next five years in seven crucial industries. The targeted sectors are alternative energy, biotechnology, new-generation information technology, high-end equipment manufacturing, advanced materials, alternative-fuel cars, and energy-saving and environmentally friendly technologies. Somehow, housing and retail didn't make the list.

A model for sustained growth based on a corrupt totalitarian police state that has zero respect for international intellectual property "law"? Housing and retail don't make the list because the happiness of the plebs are an afterthought to the "Communists".

The basic problem in the U.S. economy is that for a generation now, we have been consuming more and saving and investing less. Consumption ranged from 60 to 65 percent of gross domestic product for decades; then it started moving up in the early 1980s, reaching 70 percent of GDP in 2001, where it has stayed ever since. More spending has not been triggered by rising incomes but entirely by an expansion of credit - the underlying cause of the crash of 2008. And yet our solution to our problems is to expand credit and consumption.

Since Savings equals investment, but does not equal spending, the phenomenae of consumption growing as a % of GDP is partially attributable to the importance of a knowledge, service intensive economy.

Of course, we don't have the money to pay for our new tax plan, so we will borrow it, in part from foreign central banks. While China spends its money to invest in long-term growth, it lends us cash so that we can give ourselves one more big tax break. Someone in Beijing must be smiling.

Here we go, we do not need to fund the deficit via foreign "money". Someone in Beijing must be very nervous...becuase if the export driven gravy train is halted or even slowed slightly, the entire edifice of economic driven "progress" in china goes the way of that emperor who wore no clothes.

By Fareed Zakaria

Monday, December 13, 2010

This is the wrong time to raise taxes, say the politicians. The economy is fragile, say the economists. The recovery is halting, say the pundits. In a few years, they all affirm, we will need to get our fiscal house in order. Of course, just a few years ago, the economy was doing fine, and Washington decided it wasn't the moment to worry about the deficit. Instead, over the past decade, we cut taxes, added a massive entitlement program (prescription drugs for the elderly) and spent trillions on two wars. Somehow, no matter what the economic clock says, it's never time in Washington to cut spending or raise taxes. Call it mañana economics.

Hard to argue with this...

Procrastination economics

The best one can say about President Obama's compromise plan with Congress is that it will do some short-term good - at long-term cost. The only parts of the plan likely to have a significant effect in stimulating the economy are the extensions of unemployment insurance, cuts in payroll taxes and, perhaps, tax credits for businesses ("perhaps" because they are temporary and thus would only bring forward investments). To get these measures, worth about $250 billion, Obama agreed to an extension of the Bush tax cuts that will cost around $750 billion, and eventually much more since the tax cuts are now more likely to become permanent. It makes the original stimulus plan of 2009 look stunningly efficient.

The original stimulus plan was indeed inefficient. Tax cuts and organic growth via market forces allocate capital and investment much more efficiently than top-down governmental edict. Setting up the arithmetic here as a simple 750>250 is disengenuous.

The first act of the newly empowered Republican Party has been to add a trillion dollars to the deficit. Republicans have now fully embraced the Keynesian arguments that they routinely denounced. John Maynard Keynes argued that when private demand weakens, the government should pick up the slack. He advocated either of two paths: government spending or tax cuts. Republicans have simply chosen the latter course.

Spending cuts on the way?

So when will we get serious about our fiscal mess? In 2020 or 2030, when the needed spending cuts and tax hikes get much larger? If we cannot inflict a little pain now, who will impose a lot of pain later? Does anyone believe that Washington will one day develop the political courage it now lacks? And what if, while we are getting around to doing something, countries get nervous about lending us money and interest rates rise?

Once again, the popular delusion of "funding" being the issue leads to inaccurate conclusions with respect to the yield curve. And even if these causalities (foreign governments lend us "money") were true, can export reliant emerging economies withstand the attendent currency movements from these yield fluctuations?

I understand the politics of compromise and the politics of reelection, and this deal makes sense on both grounds. It doesn't make much sense for the long-term growth of the American economy. What Washington is trying to do is reignite the consumption bubble - hoping to get Americans to spend money and take out loans. This plan, presidential adviser Lawrence Summers tells us, will get the economy to "escape velocity." It's an intriguing theory. If Americans keep spending money, using their credit cards, and buying houses, this will trigger the next technological and economic revolution.

Take Mr. Summers's (aka, "the smartest guy in the room") advice at your peril.

China has a different theory of how to get long-term, sustained growth. The Chinese have doubled their spending on education - with stunning results - and continue to build the world's best infrastructure. Reuters reports that Beijing is contemplating a plan to invest $1.5 trillion over the next five years in seven crucial industries. The targeted sectors are alternative energy, biotechnology, new-generation information technology, high-end equipment manufacturing, advanced materials, alternative-fuel cars, and energy-saving and environmentally friendly technologies. Somehow, housing and retail didn't make the list.

A model for sustained growth based on a corrupt totalitarian police state that has zero respect for international intellectual property "law"? Housing and retail don't make the list because the happiness of the plebs are an afterthought to the "Communists".

The basic problem in the U.S. economy is that for a generation now, we have been consuming more and saving and investing less. Consumption ranged from 60 to 65 percent of gross domestic product for decades; then it started moving up in the early 1980s, reaching 70 percent of GDP in 2001, where it has stayed ever since. More spending has not been triggered by rising incomes but entirely by an expansion of credit - the underlying cause of the crash of 2008. And yet our solution to our problems is to expand credit and consumption.

Since Savings equals investment, but does not equal spending, the phenomenae of consumption growing as a % of GDP is partially attributable to the importance of a knowledge, service intensive economy.

Of course, we don't have the money to pay for our new tax plan, so we will borrow it, in part from foreign central banks. While China spends its money to invest in long-term growth, it lends us cash so that we can give ourselves one more big tax break. Someone in Beijing must be smiling.

Here we go, we do not need to fund the deficit via foreign "money". Someone in Beijing must be very nervous...becuase if the export driven gravy train is halted or even slowed slightly, the entire edifice of economic driven "progress" in china goes the way of that emperor who wore no clothes.

Tuesday, December 14, 2010

A recurring theme...

...on this blog. This should not surprise readers here.

MEXICO CITY (Dow Jones)--The International Monetary Fund said Tuesday it plans to expand a precautionary credit line to Mexico to around $73 billion from $48 billion and extend the facility for another two years, at the request of Mexican authorities.

The IMF implemented the existing flexible credit line during the economic crisis in 2009, essentially raising Mexico's international reserves and offering a vote of confidence in the country's economic and fiscal situation.

Tuesday, IMF Managing Director Dominique Strauss-Kahn welcomed a request by Mexico's Foreign Exchange Commission, made up of Finance Ministry and Bank of Mexico officials, to expand and extend the credit line.

"We're not imposing conditionality, we're just recognizing that the government has the right policies in place," Strauss-Kahn said at an event. "Because you're doing well, we'll be happy to provide you--without asking anything else--this financial support that you may use, or not. I hope not."

MEXICO CITY (Dow Jones)--The International Monetary Fund said Tuesday it plans to expand a precautionary credit line to Mexico to around $73 billion from $48 billion and extend the facility for another two years, at the request of Mexican authorities.

The IMF implemented the existing flexible credit line during the economic crisis in 2009, essentially raising Mexico's international reserves and offering a vote of confidence in the country's economic and fiscal situation.

Tuesday, IMF Managing Director Dominique Strauss-Kahn welcomed a request by Mexico's Foreign Exchange Commission, made up of Finance Ministry and Bank of Mexico officials, to expand and extend the credit line.

"We're not imposing conditionality, we're just recognizing that the government has the right policies in place," Strauss-Kahn said at an event. "Because you're doing well, we'll be happy to provide you--without asking anything else--this financial support that you may use, or not. I hope not."

The Protocol of change...

After observable events prove a theory or a process to be wholly incorrect and imprudent, at what point does a rational thinker change his/her protocol for understanding a given issue?

On a theoretical level, Moody's insistance that "ability to pay" comes from "ability to raise funds via taxes" is wrong. A sovereign issuer of currency does not need to collect its own currency in order to pay in that currency. Furthermore, external "funding" from other currencies that grant creditworthiness is a misnomer. We live in a fiat floating currency world and Moody's continues to think constrained by the manacles of gold.

On an experimental level, one need only look to Japan to note the inadequacies of Moody's approach to sovereign creditworthiness.

NEW YORK (Reuters) – Moody's warned on Monday that it could move a step closer to cutting the U.S. Aaa rating if President Barack Obama's tax and unemployment benefit package becomes law.

The plan agreed to by President Barack Obama and Republican leaders last week could push up debt levels, increasing the likelihood of a negative outlook on the United States rating in the coming two years, the ratings agency said.

A negative outlook, if adopted, would make a rating cut more likely over the following 12-to-18 months.

For the United States, a loss of the top Aaa rating, reduce the appeal of U.S. Treasuries, which currently rank as among the world's safest investments.

"From a credit perspective, the negative effects on government finance are likely to outweigh the positive effects of higher economic growth," Moody's analyst Steven Hess said in a report sent late on Sunday.

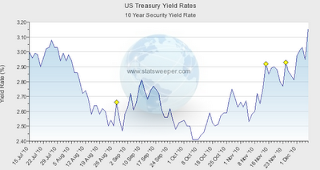

After Obama announced his plan, Treasury prices fell sharply in volatile trade last week and yields have hit a six-month high, in part due to concerns over the effect the package will have on government debt levels.

If the bill becomes law, it will "adversely affect the federal government budget deficit and debt level," Moody's said.

On a theoretical level, Moody's insistance that "ability to pay" comes from "ability to raise funds via taxes" is wrong. A sovereign issuer of currency does not need to collect its own currency in order to pay in that currency. Furthermore, external "funding" from other currencies that grant creditworthiness is a misnomer. We live in a fiat floating currency world and Moody's continues to think constrained by the manacles of gold.

On an experimental level, one need only look to Japan to note the inadequacies of Moody's approach to sovereign creditworthiness.

NEW YORK (Reuters) – Moody's warned on Monday that it could move a step closer to cutting the U.S. Aaa rating if President Barack Obama's tax and unemployment benefit package becomes law.

The plan agreed to by President Barack Obama and Republican leaders last week could push up debt levels, increasing the likelihood of a negative outlook on the United States rating in the coming two years, the ratings agency said.

A negative outlook, if adopted, would make a rating cut more likely over the following 12-to-18 months.

For the United States, a loss of the top Aaa rating, reduce the appeal of U.S. Treasuries, which currently rank as among the world's safest investments.

"From a credit perspective, the negative effects on government finance are likely to outweigh the positive effects of higher economic growth," Moody's analyst Steven Hess said in a report sent late on Sunday.

After Obama announced his plan, Treasury prices fell sharply in volatile trade last week and yields have hit a six-month high, in part due to concerns over the effect the package will have on government debt levels.

If the bill becomes law, it will "adversely affect the federal government budget deficit and debt level," Moody's said.

Friday, December 10, 2010

Quote of the day

plus ca change...

"There will no longer be need for spheres of influence, for alliances, for balance of power, or any other of the special arrangements, through which, in the unhappy past, the nations strove to safeguard their security in order to promote their national interests"

Secretary of State Cordell Hull, 1943

War is not the only form of combat, and we are observing the mobilizations to effect the terms of trade for export depedent regimes versus developed consumer based society.

"Wealth" is not denominated in terra firma, and agrarian monopoly no longer guarantees power. No, the wars of today and the future are fought over terms of trade and the transport routes that lubricate them.

"There will no longer be need for spheres of influence, for alliances, for balance of power, or any other of the special arrangements, through which, in the unhappy past, the nations strove to safeguard their security in order to promote their national interests"

Secretary of State Cordell Hull, 1943

War is not the only form of combat, and we are observing the mobilizations to effect the terms of trade for export depedent regimes versus developed consumer based society.

"Wealth" is not denominated in terra firma, and agrarian monopoly no longer guarantees power. No, the wars of today and the future are fought over terms of trade and the transport routes that lubricate them.

Wednesday, December 08, 2010

What will they say?

What will historians say of the EU experiment 50 years from now, especially given their handling of the current funding and credit crisis?

The below quote demonstrates the level of deception their leaders are willing to engage in...the remarks are even more astounding given the Fed's recent disclosure regarding its lending activities to Euro area banks during the worst of the crisis.

“The U.S. will lose its status as the superpower of the global financial system" Steinbrueck told the lower house of parliament in Berlin. "The long term consequences of the crisis are not yet clear. But one thing seems likely to me: the USA will lose its superpower status in the global financial system. The world financial system is becoming multipolar."

He went on to say, "Wall Street will never be the same again. A few days ago there were two Mohicans left remaining out of the investment banks. Now they no longer exist." The finance minister was referring to the sudden transformation of Goldman Sachs (nyse: GS - news - people ) and Morgan Stanley (nyse: MS - news - people ) into bank holding companies. "The world will never be the same as it was before the crisis. The whole world over we must adjust ourselves to lower rates of growth and--with a time lag--unfavorable developments on labor markets."

The center-left politician also said he felt there was no need for Germany or Europe as a whole to imitate the U.S. Treasury's way of dealing with the financial crisis because it is largely an "American problem."

The below quote demonstrates the level of deception their leaders are willing to engage in...the remarks are even more astounding given the Fed's recent disclosure regarding its lending activities to Euro area banks during the worst of the crisis.

“The U.S. will lose its status as the superpower of the global financial system" Steinbrueck told the lower house of parliament in Berlin. "The long term consequences of the crisis are not yet clear. But one thing seems likely to me: the USA will lose its superpower status in the global financial system. The world financial system is becoming multipolar."

He went on to say, "Wall Street will never be the same again. A few days ago there were two Mohicans left remaining out of the investment banks. Now they no longer exist." The finance minister was referring to the sudden transformation of Goldman Sachs (nyse: GS - news - people ) and Morgan Stanley (nyse: MS - news - people ) into bank holding companies. "The world will never be the same as it was before the crisis. The whole world over we must adjust ourselves to lower rates of growth and--with a time lag--unfavorable developments on labor markets."

The center-left politician also said he felt there was no need for Germany or Europe as a whole to imitate the U.S. Treasury's way of dealing with the financial crisis because it is largely an "American problem."

Unintended?

As the great Martin Wolf said "its really, really, really difficult for public institutions to create intelligent policy".

So the main, primary, only focus for QE2 was the value of lowering yields thereby increasing economic acitivity and credit via the interest rate channel. I have long argued that this is not the case with QE, but nevermind that...just look at the effects.

Bond yields rising with each successive wave of QE announcement. And even more "curious", where is the broad based dollar strength that typically (that is, according to accepted economic doctrine) follows increases in yields?

Monday, December 06, 2010

Expanding the program...

...follow up to last post. He went on Television to sell the Fed to the public, nothing more. It had admittedly been a very rough few months for the Fed.

Federal Reserve Chairman Ben S. Bernanke said the economy is barely expanding at a sustainable pace and that it’s possible the Fed may expand bond purchases beyond the $600 billion announced last month to spur growth.

“We’re not very far from the level where the economy is not self-sustaining,” Bernanke said in an interview broadcast yesterday by CBS Corp.’s “60 Minutes” program. “It’s very close to the border. It takes about 2.5 percent growth just to keep unemployment stable and that’s about what we’re getting.”

Bernanke, in a rare appearance on a nationally broadcast news program, defended the Fed’s efforts to prop up a recovery so weak that only 39,000 jobs were created in November. The unemployment rate last month rose to 9.8 percent, the highest level since April, the Labor Department said on Dec. 3, three days after the Bernanke interview was taped. Republican lawmakers have said the Fed’s policy of “quantitative easing” may do little to help unemployment and may fuel inflation

Federal Reserve Chairman Ben S. Bernanke said the economy is barely expanding at a sustainable pace and that it’s possible the Fed may expand bond purchases beyond the $600 billion announced last month to spur growth.

“We’re not very far from the level where the economy is not self-sustaining,” Bernanke said in an interview broadcast yesterday by CBS Corp.’s “60 Minutes” program. “It’s very close to the border. It takes about 2.5 percent growth just to keep unemployment stable and that’s about what we’re getting.”

Bernanke, in a rare appearance on a nationally broadcast news program, defended the Fed’s efforts to prop up a recovery so weak that only 39,000 jobs were created in November. The unemployment rate last month rose to 9.8 percent, the highest level since April, the Labor Department said on Dec. 3, three days after the Bernanke interview was taped. Republican lawmakers have said the Fed’s policy of “quantitative easing” may do little to help unemployment and may fuel inflation

Beyond the valley of QE

As expected, the Fed is unable to jettison economic canon. Thus, QE is still a method that it deems both effective and appropriate given current employment and inflation data. The market has thusly happily priced in further rounds of QE in the ardent hope that increasing financial asset prices rises all ships.

This is all fine and good until the markets fully understand that QE is simply an accounting exercise and causes no real economic growth in an of itself.

And so this parasitic relationship will go on a bit further, until either the host realizes the prognosis, or the parasite ceases to receive nourishment.

This is all fine and good until the markets fully understand that QE is simply an accounting exercise and causes no real economic growth in an of itself.

And so this parasitic relationship will go on a bit further, until either the host realizes the prognosis, or the parasite ceases to receive nourishment.

Wednesday, December 01, 2010

A good run...

...for more than half a century, Europe has experienced a uncharacteristically low incident of conflict, opting instead for a belief in "progress" via good governance.

Mean reversion is a terrible thing, especially when there is so far to fall.

Mean reversion is a terrible thing, especially when there is so far to fall.

Quote(s) of the day...

...in light of the latest search for the economic holy grail:

"What happens at bottom is that a prejudice, a notion, an "inspiration", generally a desire of the heart sifted and made abstract, is defended by them with reasons sought after the event - they are one and all advocates who do not want to be regarded as such, and for the most part no better than cunning pleaders for their prejucies which they baptize as "truths"...this spectacle makes us smile, we who are fastidious and find no little amusement iin observing the subtle tricks of old moralists and moral preachers, not to speak of that hocus-pocus of mathematical form which, as if in iron, Spinoza encased and masked his philosophy - the love of his wisdom, to render that world fairly and squarlely, so as to strike terror into the heart of any assailant who should dare to glance at that invincible maiden and Pallas Athene - how much timidity and vulnerability this masquerade of a sick recluse betrays!- Nietzsche, Beyond Good and Evil

There are many discliplines that produce linear gains in knowledge. The obvious one is Physics, where theory is tested by events that ALWAYS and EVERYWHERE confirm the theory. The humanities obey categorically different generators. Simply dressing them up in math in order to legitimize and make them subject of serious study does not dilute the central fact that the humanities deals with humans, and humans do not always and everywhere obey ANY set rules save base survival.

So the attempt to penetrate the fog of human behavior, particularly in aggregate over cultures, regions, states, and continents, is doomed to fail. Throwing another 1000 economists at the "problem" misinterprets the question. I am reminded again of the sage words of Robert L. Bacon in his book "Secrets of Professional Turf Betting", a book about the sport of Horse Racing and betting:

"There is no danger of the public ever finding any key to the secret of winning. The crazy gambling urges and speculative hysteria that overcomes most players at the track makes that fact a certainty, but, if the public play ever did get wise to the facts of life, the principle of ever-changing cycles would move the form away from the public immediately"

We will always be assailed with attempts to transmogrify humans into bits that answer "yes" or "no" (the picture to this post is "Bit" from the movie "Tron") to attacks upon their consumption baskets and intertemporal budget constraints and savings desires, but what has all this "reserach" produced?

By Mark Whitehouse

Physicist Doyne Farmer thinks we should analyze the economy the way we do epidemics and traffic.

Psychoanalyst David Tuckett believes the key to markets' gyrations can be found in the works of Sigmund Freud.

Economist Roman Frydman thinks we can never forecast the economy with any accuracy.

Disparate as their ideas may seem, all three are grappling with a riddle that they hope will catalyze a revolution in economics: How can we understand a world that has proven far more complex than the most advanced economic models assumed?

The question is far from academic. For decades, most economists, including the world's most powerful central bankers, have supposed that people are rational enough, and the working of markets smooth enough, that the whole economy can be reduced to a handful of equations. They assemble the equations into mathematical models that attempt to mimic the behavior of the economy.

From Washington to Frankfurt to Tokyo, the models inform crucial decisions about everything from the right level of interest rates to how to regulate banks.

In the wake of a financial crisis and punishing recession that the models failed to capture, a growing number of economists are beginning to question the intellectual foundations on which the models are built. Researchers, some of whom spent years on the academic margins, are offering up a barrage of ideas

that they hope could form the building blocks of a new paradigm.

"We're in the 'let a thousand flowers bloom' stage," says Robert Johnson, president of the Institute for New Economic Thinking, launched last year with $50 million from financier George Soros, a big donor to liberal causes who has long been a vocal critic of mainstream economics. The institute so far has approved funding for more than 27 projects, including efforts by Messrs. Farmer

and Tuckett aimed at developing new ways to model the economy.

Some of academia's most authoritative figures say the new ideas are out of the mainstream for a good reason: They're still very far from producing a model that demonstrably improves on the status quo.

"I guess I'll wait until I see these models and what they can and cannot do," says Robert Lucas, an economist at the University of Chicago who won the Nobel Prize for his work on "rational expectations," the concept at the very heart of modern orthodoxy.

New York University's Mark Gertler, who with now-Federal Reserve Chairman Ben Bernanke did ground-breaking work in the 1980s on how financial troubles can trip up the economy, says economists already have many of the tools they need to fix the current models.

Subscribe to:

Posts (Atom)