What a mess.

BEIJING: China's regulators plan to shift 2-3 trillion yuan ($308-463 billion) of debt off local governments, sources said, reducing the risk of a wave of defaults that would threaten the stability of the world's second-biggest economy.

As part of Beijing's overhaul of the finances of heavily-indebted local governments, the central government will pay off some of their loans and state banks including some of the "Big Four" will be forced to take some losses on the bad debt, said the sources, both of whom have direct knowledge of the plans.

Part of the debt will also be shifted to newly created companies, while private investors would be welcomed in projects previously off-limits to them, sources said.

Beijing will also lift a ban on provincial and municipal governments selling bonds, a step aimed at bolstering their finances with more transparent sources of funding.

Tuesday, May 31, 2011

The Economist...

...which in my experience is late to most macro developments, highlights the crony capitalism and agency risks I have been highlighting on this blog for years. The proverbial cat is out of the bag. I also love the "at least on paper" reference, as the entire world realizes they have been relying on economic and balance sheet figures that are at best "centrally managed" and at worst pure fabrications.

CHINA’S economy has, at least on paper, survived forces that have overwhelmed much of the rest of the world. But the recent round of bank tightening seems, at least indirectly, to be hitting with real force. Slowly, word has spread of Jin Libin, a resident of Inner Mongolia who ran a business empire encompassing supermarkets, mining and transport, who set himself on fire one day in April and burned to death. According to the Global Times, a government-run newspaper, he left private debts of $1.3 billion yuan ($191m) of private loans and another 150m yuan of loans from banks.

Still to be reflected is the impact of his collapse on his lenders, which, the Global Times says, included local banks, pawnshops and guaranty companies that had lent him money. No doubt there were also substantial loans from an impersonal network, a form of credit that is commonly used in China, though not legal. The consequences will not be trivial. Many other explosions driven by the same financial forces that brought down Mr Jin are sure to come.

CHINA’S economy has, at least on paper, survived forces that have overwhelmed much of the rest of the world. But the recent round of bank tightening seems, at least indirectly, to be hitting with real force. Slowly, word has spread of Jin Libin, a resident of Inner Mongolia who ran a business empire encompassing supermarkets, mining and transport, who set himself on fire one day in April and burned to death. According to the Global Times, a government-run newspaper, he left private debts of $1.3 billion yuan ($191m) of private loans and another 150m yuan of loans from banks.

Still to be reflected is the impact of his collapse on his lenders, which, the Global Times says, included local banks, pawnshops and guaranty companies that had lent him money. No doubt there were also substantial loans from an impersonal network, a form of credit that is commonly used in China, though not legal. The consequences will not be trivial. Many other explosions driven by the same financial forces that brought down Mr Jin are sure to come.

Sunday, May 29, 2011

False risks.

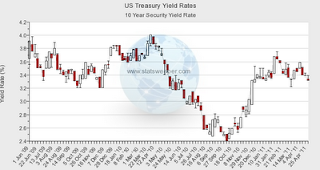

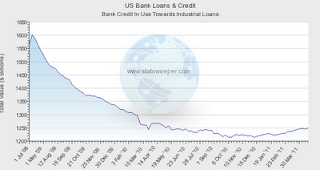

The below is yet another example of false beliefs regarding U.S. "debt", which is a sovereign currency issuer, and Greek obligations denominated in Euros which must be "obtained" by Greek authorities to pay these obligations. Its apples to oranges yet this simple error in assumptions colors a disproportionate portion of the debate regarding the U.S. debt ceiling. Furthermore, the risk of inflation is massively overstated with this type of analysis, as it ignores the demand side of the equation. Friedman famously said "inflation is always and everywhere a monetary phenomenon". He was incomplete. Inflation IN A FIAT CURRENCY REGIME comes from massive monetary creation by bank credit and associated wage demands.

Greece has a sovereign debt problem. The bonds of the Greek government have been downgraded by a major rating service. Their prices have fallen sharply in the market. This means that the risk is high that the government will default on its sovereign debt.

The interest rates that the Greek government must pay in order to borrow have risen sharply. This is worsening the government’s solvency and budget problems.

The government faces default. The government’s various spending cutbacks haven’t solved the problem.

They cannot solve the problem. It’s apparently too late. The government would have to restructure its debt by renegotiating with its multiple lenders. That’s a difficult and time-consuming process. It would have to work out repayment while simultaneously altering government policies so that the country’s private market economy could expand. This involves knotty political and economic issues that take years to resolve. The government doesn’t have this time.

The problem traces back to the earlier fact that for some years the government was able to borrow heavily at low interest rates. This means that it was able to sell its bonds at high prices. The problem arose because these market prices were too high.

Greece has a sovereign debt problem. The bonds of the Greek government have been downgraded by a major rating service. Their prices have fallen sharply in the market. This means that the risk is high that the government will default on its sovereign debt.

The interest rates that the Greek government must pay in order to borrow have risen sharply. This is worsening the government’s solvency and budget problems.

The government faces default. The government’s various spending cutbacks haven’t solved the problem.

They cannot solve the problem. It’s apparently too late. The government would have to restructure its debt by renegotiating with its multiple lenders. That’s a difficult and time-consuming process. It would have to work out repayment while simultaneously altering government policies so that the country’s private market economy could expand. This involves knotty political and economic issues that take years to resolve. The government doesn’t have this time.

The problem traces back to the earlier fact that for some years the government was able to borrow heavily at low interest rates. This means that it was able to sell its bonds at high prices. The problem arose because these market prices were too high.

Friday, May 27, 2011

Memorial Day

This will be an auspicious holiday, given the world is coming to grips with the fact that U.S. assets remain the only thing remotely close to "safe", even with the dismal housing numbers released today.

I expect some sort of announcement regarding the Euro situation this weekend given closed markets on Monday.

I expect some sort of announcement regarding the Euro situation this weekend given closed markets on Monday.

The Paper Dragon at home and abroad...

...the press continues the now popular assault on the business practices and "creative accounting" endemic to Chinese firms. I continued to be amazed that all of this was either ignored and how the investment world got caught up in this bubble.

First, the African problem (from The Economist)

Once feted as saviours in much of Africa, Chinese have come to be viewed with mixed feelings—especially in smaller countries where China’s weight is felt all the more. To blame, in part, are poor business practices imported alongside goods and services. Chinese construction work can be slapdash and buildings erected by mainland firms have on occasion fallen apart. A hospital in Luanda, the capital of Angola, was opened with great fanfare but cracks appeared in the walls within a few months and it soon closed. The Chinese-built road from Lusaka, Zambia’s capital, to Chirundu, 130km (81 miles) to the south-east, was quickly swept away by rains.

Business, Chinese style

Chinese expatriates in Africa come from a rough-and-tumble, anything-goes business culture that cares little about rules and regulations. Local sensitivities are routinely ignored at home, and so abroad.

Continuing on to creative accounting...

By FLOYD NORRIS

Published: May 26, 2011

To pull off a fraud that humiliates the cream of the global financial

elite, you need to have some friends. And where better to have them

than at the local bank?

The fraud at Longtop Financial Technologies, a Chinese financial

software company, was exposed this week in an amazing letter from its

auditors, Deloitte Touche Tohmatsu. It appears to be a tale of corrupt

bankers and their threats to auditors who had learned of the lies.

Deloitte, which had given clean audit opinions to Longtop for six

consecutive years, apparently was well on its way to providing a

seventh, for the fiscal year that ended March 31.

But for some reason — Deloitte did not say why —the auditor went back

to Longtop’s banks last week to again seek confirmation of cash

balances.

It appears Deloitte sought confirmations from bank headquarters,

rather than the local branches that had previously verified that

Longtop’s cash really was on deposit. And that set off panic at the

software firm.

“Within hours” of beginning the new round of confirmations on May 17,

the confirmation process was stopped, Deloitte stated in its letter of

resignation, the result of “intervention by the company’s officials

including the chief operating officer, the confirmation process was

stopped.”

First, the African problem (from The Economist)

Once feted as saviours in much of Africa, Chinese have come to be viewed with mixed feelings—especially in smaller countries where China’s weight is felt all the more. To blame, in part, are poor business practices imported alongside goods and services. Chinese construction work can be slapdash and buildings erected by mainland firms have on occasion fallen apart. A hospital in Luanda, the capital of Angola, was opened with great fanfare but cracks appeared in the walls within a few months and it soon closed. The Chinese-built road from Lusaka, Zambia’s capital, to Chirundu, 130km (81 miles) to the south-east, was quickly swept away by rains.

Business, Chinese style

Chinese expatriates in Africa come from a rough-and-tumble, anything-goes business culture that cares little about rules and regulations. Local sensitivities are routinely ignored at home, and so abroad.

Continuing on to creative accounting...

By FLOYD NORRIS

Published: May 26, 2011

To pull off a fraud that humiliates the cream of the global financial

elite, you need to have some friends. And where better to have them

than at the local bank?

The fraud at Longtop Financial Technologies, a Chinese financial

software company, was exposed this week in an amazing letter from its

auditors, Deloitte Touche Tohmatsu. It appears to be a tale of corrupt

bankers and their threats to auditors who had learned of the lies.

Deloitte, which had given clean audit opinions to Longtop for six

consecutive years, apparently was well on its way to providing a

seventh, for the fiscal year that ended March 31.

But for some reason — Deloitte did not say why —the auditor went back

to Longtop’s banks last week to again seek confirmation of cash

balances.

It appears Deloitte sought confirmations from bank headquarters,

rather than the local branches that had previously verified that

Longtop’s cash really was on deposit. And that set off panic at the

software firm.

“Within hours” of beginning the new round of confirmations on May 17,

the confirmation process was stopped, Deloitte stated in its letter of

resignation, the result of “intervention by the company’s officials

including the chief operating officer, the confirmation process was

stopped.”

Thursday, May 26, 2011

Market declines, inflation...

...lower (real) GDP forecasts, etc. And now, the world is focusing in on the demographic "challenges" the paper dragon faces.

This article is as good as any in levelling a healthy degree of skepticism regarding the Paper Dragon's prospects and global ambitions.

A snippet:

According to a United Nations forecast in 2008, the over-60 and over-65 age groups in China were expected to account for 12.3% and 8.2% of the population respectively in 2010, against 7.5% and 4.9% in India.

The new census demonstrates, however, that China’s population is aging even faster than expected. According to the survey, over-60 and over-65 make up 13.26% and 8.87% of the population.

The new Census also revealed that the imbalance between the ratio of boys to girls is also still increasing. The sex ratio in 2010 was 118.06, which is 1.2% more than 2000.

Based on the data of the 2000 census as well as the new census, China’s comprehensive national strength, from the viewpoint of its demographic structure, is currently at a historical peak. The working-age group of those 15-64 years, has reached almost 1 billion people, an all-time high, with the elderly dependency ratio less than 12%, and the general elderly dependency (ratio of the non-labor population to labor population) only 34%. In other words, China has never been less burdened by a non-labor population.

But again from the viewpoint of the demographical structure, China is set to repeat Japan’s economic recession experience of the 1990s. The difference is Japan became rich before growing old, while China is growing old before even getting rich. The average GDP of Japan today is above $40,000, while it is still just $4,000 in China.

This article is as good as any in levelling a healthy degree of skepticism regarding the Paper Dragon's prospects and global ambitions.

A snippet:

According to a United Nations forecast in 2008, the over-60 and over-65 age groups in China were expected to account for 12.3% and 8.2% of the population respectively in 2010, against 7.5% and 4.9% in India.

The new census demonstrates, however, that China’s population is aging even faster than expected. According to the survey, over-60 and over-65 make up 13.26% and 8.87% of the population.

The new Census also revealed that the imbalance between the ratio of boys to girls is also still increasing. The sex ratio in 2010 was 118.06, which is 1.2% more than 2000.

Based on the data of the 2000 census as well as the new census, China’s comprehensive national strength, from the viewpoint of its demographic structure, is currently at a historical peak. The working-age group of those 15-64 years, has reached almost 1 billion people, an all-time high, with the elderly dependency ratio less than 12%, and the general elderly dependency (ratio of the non-labor population to labor population) only 34%. In other words, China has never been less burdened by a non-labor population.

But again from the viewpoint of the demographical structure, China is set to repeat Japan’s economic recession experience of the 1990s. The difference is Japan became rich before growing old, while China is growing old before even getting rich. The average GDP of Japan today is above $40,000, while it is still just $4,000 in China.

Wednesday, May 25, 2011

Ratings agencies...

...near and far attempting to direct and hold attention.

05/25/11 Novato, California – Beijing-based Dagong Credit Rating Co. is China’s leading credit rating agency and, despite the limited international influence of its ratings, it keeps pumping out sovereign debt downgrades for the industrialized West.

The latest nation up… or down as the case may be… is the UK. It was already cut from its triple-A standing — as indicated by ratings from US agencies — to AA- in Dagong’s first headline-inducing ratings release. Recently, the UK has again been downgraded, this time to A+ with a negative outlook, due to its deteriorating solvency.

According to the BBC News:

“The agency blamed the UK’s sluggish growth, which it said would be stuck in the 1.3%-1.5% range for two more years, hurting government finances. The downgrade from AA- to A+ puts Britain on a par with Chile and heavily-indebted Belgium, and the US, which Dagong downgraded in November.

05/25/11 Novato, California – Beijing-based Dagong Credit Rating Co. is China’s leading credit rating agency and, despite the limited international influence of its ratings, it keeps pumping out sovereign debt downgrades for the industrialized West.

The latest nation up… or down as the case may be… is the UK. It was already cut from its triple-A standing — as indicated by ratings from US agencies — to AA- in Dagong’s first headline-inducing ratings release. Recently, the UK has again been downgraded, this time to A+ with a negative outlook, due to its deteriorating solvency.

According to the BBC News:

“The agency blamed the UK’s sluggish growth, which it said would be stuck in the 1.3%-1.5% range for two more years, hurting government finances. The downgrade from AA- to A+ puts Britain on a par with Chile and heavily-indebted Belgium, and the US, which Dagong downgraded in November.

Lehman, Bear, AIG, Merrill Lynch...

...Spain, Portugal, Italy, Greece.

Of these, Italy is the AIG. The largest of the four in terms of population and GDP. Greece would be akin to Lehman, since it appears its government debt is the catalyst.

If the EU does not, or cannot, guarantee a sizable portion of the liabilities of these countries, this will get very ugly very quickly.

As I have said, many strategists consider a return of Realpolitik (up to and including the point of armed conflict) such a remote possibility that contemplating risk scenarios of what a fractured Europe would look like is a colossal waste of time, and instead focus on Taiwan and the Asia arena.

I am of a different opinion on the subject and advise to refrain from entering into an entirely new point on the risk spectrum. The developed world, sans North America, is to be avoided.

Of these, Italy is the AIG. The largest of the four in terms of population and GDP. Greece would be akin to Lehman, since it appears its government debt is the catalyst.

If the EU does not, or cannot, guarantee a sizable portion of the liabilities of these countries, this will get very ugly very quickly.

As I have said, many strategists consider a return of Realpolitik (up to and including the point of armed conflict) such a remote possibility that contemplating risk scenarios of what a fractured Europe would look like is a colossal waste of time, and instead focus on Taiwan and the Asia arena.

I am of a different opinion on the subject and advise to refrain from entering into an entirely new point on the risk spectrum. The developed world, sans North America, is to be avoided.

Tuesday, May 24, 2011

Greece...

...the EU commissioner (basically a country's representative to the EU) from Greece is now openly floating the idea of an exit from the Euro and a return to the Drachma.

A completely rational response given the threat to Greek sovereignty (coupled with its proud anarchist traditions...a descent into austerity threatens the physical well-being of Greek politicians. Thus, this is no time for subtlety.

A completely rational response given the threat to Greek sovereignty (coupled with its proud anarchist traditions...a descent into austerity threatens the physical well-being of Greek politicians. Thus, this is no time for subtlety.

LatAm

It won't be long before a carrier group anchors in the Carribean above Aruba and the Antilles...perhaps my formulation of the Obama Doctrine will come to fruition after all.

The U.S. State Department announced sanctions against Venezuelan state-owned oil company Petroleos de Venezuela (PDVSA) May 24 in retaliation for Venezuela's shipments of gasoline to Iran. The sanctions bar PDVSA from any U.S. government contracts, as well as any U.S.-sourced export/import financing.

According to the State Department, the sanctions will not impact PDVSA's ability to ship oil into the United States, or the operations of its subsidiaries. While it is too early to know the precise impact the sanctions on PDVSA will have, on its face the move appears more symbolic than actually intended to harm PDVSA's business interests.

Venezuelan President Hugo Chavez announced in September 2009 a deal worth $800 million under which Venezuela would ship Iran 20,000 barrels of gasoline per day to supply its domestic consumption needs. Venezuela has admitted to occasional shipments of gasoline between 2009 and 2010, but has also made several statements indicating that it had halted shipments because Iran no longer needed Venezuelan gasoline. Closer to the truth is that the Venezuelan refining sector struggles to meet soaring domestic demand, suffers from a serious lack of maintenance and can barely keep up with its own production needs. Venezuela simply lacks both the excess capacity to supply Iran, and the financial stability to absorb opportunity costs of shipping gasoline halfway around the world.

Another pressing concern for Venezuela is the possibility that it might actually provoke a serious response out of the United States by violating U.N. sanctions against Iran. While relations between the United States and Venezuela appeared to ameliorate briefly in the wake of U.S. President Barack Obama taking office, the two quickly returned to tense relations. The most recent source of tension between the two states was the extradition to Venezuela by Colombia of accused drug kingpin Walid Makled. That U.S. sanctions against PDVSA follow what some interest groups in Washington view as a missed opportunity to gain leverage over Chavez is no coincidence. Pressure has been building in Washington to enact sanctions against Chavez and his regime, including efforts to link the Venezuelan government to international militant organization Hezbollah.

The U.S. State Department announced sanctions against Venezuelan state-owned oil company Petroleos de Venezuela (PDVSA) May 24 in retaliation for Venezuela's shipments of gasoline to Iran. The sanctions bar PDVSA from any U.S. government contracts, as well as any U.S.-sourced export/import financing.

According to the State Department, the sanctions will not impact PDVSA's ability to ship oil into the United States, or the operations of its subsidiaries. While it is too early to know the precise impact the sanctions on PDVSA will have, on its face the move appears more symbolic than actually intended to harm PDVSA's business interests.

Venezuelan President Hugo Chavez announced in September 2009 a deal worth $800 million under which Venezuela would ship Iran 20,000 barrels of gasoline per day to supply its domestic consumption needs. Venezuela has admitted to occasional shipments of gasoline between 2009 and 2010, but has also made several statements indicating that it had halted shipments because Iran no longer needed Venezuelan gasoline. Closer to the truth is that the Venezuelan refining sector struggles to meet soaring domestic demand, suffers from a serious lack of maintenance and can barely keep up with its own production needs. Venezuela simply lacks both the excess capacity to supply Iran, and the financial stability to absorb opportunity costs of shipping gasoline halfway around the world.

Another pressing concern for Venezuela is the possibility that it might actually provoke a serious response out of the United States by violating U.N. sanctions against Iran. While relations between the United States and Venezuela appeared to ameliorate briefly in the wake of U.S. President Barack Obama taking office, the two quickly returned to tense relations. The most recent source of tension between the two states was the extradition to Venezuela by Colombia of accused drug kingpin Walid Makled. That U.S. sanctions against PDVSA follow what some interest groups in Washington view as a missed opportunity to gain leverage over Chavez is no coincidence. Pressure has been building in Washington to enact sanctions against Chavez and his regime, including efforts to link the Venezuelan government to international militant organization Hezbollah.

A summation...

...of how to think about serious matters like macroeconomics.

From Fitzhugh's "In Defense of Slavery" (yes, good passages can come from bad premises)

The reader will excuse us for so often introducing the thoughts and words of others. We do so not only for the sake of their authority, but because they express our own thoughts better than we can express them ourselves. In truth, we deal out our thoughts, facts and arguments in that irregular and desultory way in which we acquired them. We are no regular built scholar--have pursued no "royal road to mathematics," nor to anything else. We have, by observation and desultory reading, picked up our information by the wayside, and endeavored to arrange, generalize and digest it for ourselves. To learn "to forget," is almost the only thing we have labored to learn. We have been so bored through life by friends... who retain on their intellectual stomachs in gross, crude, undigested, and unassimilated form, every thing that they read, and retail and repeat it in that undigested form.... We thought once this thing was original with us, but find that Say pursued this plan in writing his Political Economy. He first read all the books he could get hold of on this subject, and then took time to forget them, before he began to write.

From Fitzhugh's "In Defense of Slavery" (yes, good passages can come from bad premises)

The reader will excuse us for so often introducing the thoughts and words of others. We do so not only for the sake of their authority, but because they express our own thoughts better than we can express them ourselves. In truth, we deal out our thoughts, facts and arguments in that irregular and desultory way in which we acquired them. We are no regular built scholar--have pursued no "royal road to mathematics," nor to anything else. We have, by observation and desultory reading, picked up our information by the wayside, and endeavored to arrange, generalize and digest it for ourselves. To learn "to forget," is almost the only thing we have labored to learn. We have been so bored through life by friends... who retain on their intellectual stomachs in gross, crude, undigested, and unassimilated form, every thing that they read, and retail and repeat it in that undigested form.... We thought once this thing was original with us, but find that Say pursued this plan in writing his Political Economy. He first read all the books he could get hold of on this subject, and then took time to forget them, before he began to write.

Improvement.

The Ratings Agencies have played their part, and now its time for a more empirical view of credit ratings. This of course assumes that accurate spreads can be garnered for all the relevant securities, but it is a positive step in the right direction.

LONDON, May 1 (Reuters) - Goldman Sachs's (GS.N) fund arm is developing a new global credit strategy for institutions that will rely on market prices rather than heavily-criticised credit rating agencies.

"Clients often give investment guidelines determined by credit ratings, but we don't think that's the way to think about risk," said Andrew Wilson, global co-head of fixed income and currency at Goldman Sachs Asset Management (GSAM).

Instead, GSAM's approach is to segment credit spreads into five groups, to assess how issuers are trading in relation to their peers, Wilson told Reuters in an interview.

"So the widest 20 percent are the most risky, regardless of the rating," he said.

"That has helped us identify risky names and react in a timely fashion, as the market is a much better guide. Credit spreads widen immediately on bad news, whereas it might take a while for the ratings agencies to reflect that."

LONDON, May 1 (Reuters) - Goldman Sachs's (GS.N) fund arm is developing a new global credit strategy for institutions that will rely on market prices rather than heavily-criticised credit rating agencies.

"Clients often give investment guidelines determined by credit ratings, but we don't think that's the way to think about risk," said Andrew Wilson, global co-head of fixed income and currency at Goldman Sachs Asset Management (GSAM).

Instead, GSAM's approach is to segment credit spreads into five groups, to assess how issuers are trading in relation to their peers, Wilson told Reuters in an interview.

"So the widest 20 percent are the most risky, regardless of the rating," he said.

"That has helped us identify risky names and react in a timely fashion, as the market is a much better guide. Credit spreads widen immediately on bad news, whereas it might take a while for the ratings agencies to reflect that."

Good article...

...in The Economist regarding public relations firms and their roles in media. It is useful to be reminded that virtually everything you read, see, and hear from "popular" news media derives its material from someone or something attempting to manipulate opinion to either drive votes or sales.

A snippet:

FOR journalists, public-relations agents are like urban foxes: there seem to be more of them about these days, and they are more brazen than ever. Reporters were shocked, shocked to hear on May 12th that Burson-Marsteller (BM), a big PR agency, had tried to persuade newspaper writers and a blogger to scribble nasty things about Google’s record on privacy, while concealing that its growing rival, Facebook, was paying for this lobbying. To make things worse, BM then erased criticism of its shady spinning that had been posted on the agency’s own Facebook page. It thereby committed three cardinal sins of PR: becoming the story; getting caught; and appearing to attempt a cover-up.

The PR flacks who did Facebook’s dirty work were two ex-journalists who had only recently gone over to the dark side. Their error was to put their indecent proposal in writing, in an e-mail pitch. When the blogger, Christopher Soghoian, sensibly asked who was paying them to do so, they refused—again in writing—to say, whereupon Mr Soghoian published their exchange of messages. This prompted USA Today to reveal that it had been on the receiving end of a similar PR pitch, and the Daily Beast, an online newspaper, to reveal that Facebook was the paymaster.

More seasoned PR flacks might have done it differently. First, lunch the journalists concerned, ostensibly to discuss some other story. Then, over dessert, casually slip into the conversation the poison that their secret client wanted them to spread. With luck the reporters would follow up on the scuttlebutt without mentioning its source, assuring themselves that they had got the story through their “contacts”.

A snippet:

FOR journalists, public-relations agents are like urban foxes: there seem to be more of them about these days, and they are more brazen than ever. Reporters were shocked, shocked to hear on May 12th that Burson-Marsteller (BM), a big PR agency, had tried to persuade newspaper writers and a blogger to scribble nasty things about Google’s record on privacy, while concealing that its growing rival, Facebook, was paying for this lobbying. To make things worse, BM then erased criticism of its shady spinning that had been posted on the agency’s own Facebook page. It thereby committed three cardinal sins of PR: becoming the story; getting caught; and appearing to attempt a cover-up.

The PR flacks who did Facebook’s dirty work were two ex-journalists who had only recently gone over to the dark side. Their error was to put their indecent proposal in writing, in an e-mail pitch. When the blogger, Christopher Soghoian, sensibly asked who was paying them to do so, they refused—again in writing—to say, whereupon Mr Soghoian published their exchange of messages. This prompted USA Today to reveal that it had been on the receiving end of a similar PR pitch, and the Daily Beast, an online newspaper, to reveal that Facebook was the paymaster.

More seasoned PR flacks might have done it differently. First, lunch the journalists concerned, ostensibly to discuss some other story. Then, over dessert, casually slip into the conversation the poison that their secret client wanted them to spread. With luck the reporters would follow up on the scuttlebutt without mentioning its source, assuring themselves that they had got the story through their “contacts”.

Monday, May 23, 2011

Trajectories...

As the world moves to more competitive austerity measures and trade policies (themselves largely a badge of honor displayed by politicians to succor their constituents...and also as a distraction from previous profligacy) history has taught us several lessons.

Current events likely presage a new era of Real Politik and active competition between nations especially in the developed world. Two decades of relative cooperation will in my view yield to some harsh economic realities ahead. We note that recent and increasing attacks on all manner of civil liberties in the name of expediency and arbitrary standards of conduct by Central Governments to pick winners without regard to process as extremely dangerous precursors to putative events.

This is certainly not to say the world will end, mayan calander style, but it does require a re-thinking of global markets and what assets likely appreciate in these (transitory, it must be said...tough times do not last and life goes on) times.

As I have intimated several times on this blog, new standards of order will not be held by positive economic conditions augmenting all living standards, but by more coercive methods. History has shown us that when austerity measures are put in place, populations reject the FAITH of PROGRESS that was so vigorously sold to them by their leaders.

Nothing Changes.

Current events likely presage a new era of Real Politik and active competition between nations especially in the developed world. Two decades of relative cooperation will in my view yield to some harsh economic realities ahead. We note that recent and increasing attacks on all manner of civil liberties in the name of expediency and arbitrary standards of conduct by Central Governments to pick winners without regard to process as extremely dangerous precursors to putative events.

This is certainly not to say the world will end, mayan calander style, but it does require a re-thinking of global markets and what assets likely appreciate in these (transitory, it must be said...tough times do not last and life goes on) times.

As I have intimated several times on this blog, new standards of order will not be held by positive economic conditions augmenting all living standards, but by more coercive methods. History has shown us that when austerity measures are put in place, populations reject the FAITH of PROGRESS that was so vigorously sold to them by their leaders.

Nothing Changes.

U.S. drug policy fail

This article sums up the massive public waste U.S. drug policy generates.

She was sentenced to 12 years behind bars for selling two baggies of marijuana worth about $30.

Patricia says, "I've never been arrested. I've never had to spend any time in jail. I knew I was in trouble. I knew what I did. I didn't try to deny it or hide it. But I never thought it would be this."

She was sentenced to 12 years behind bars for selling two baggies of marijuana worth about $30.

Patricia says, "I've never been arrested. I've never had to spend any time in jail. I knew I was in trouble. I knew what I did. I didn't try to deny it or hide it. But I never thought it would be this."

Greek Fire(sale)

One of the wonderful things about general sovereign debt obligations is that they are simply obligations on tax receipts, and not secured (as are other bonds) by physical assets. This leaves some national property unencumbered for sale.

The Greek government has said it will begin to sell stakes in a number of domestic corporations "immediately" in order to raise cash to help reduce its massive debts.

These include stakes in the telecoms firm OTE, state-owned Postbank and the ports of Athens and Thessaloniki.

Earlier, European stock markets fell, partly due to continuing fears about a possible debt restructuring in Greece.

Weak eurozone economic data also hit investor sentiment.

"The cabinet decided to proceed immediately with the sale of stakes in OTE, the Postbank, the Athens and Thessaloniki ports and the Thessaloniki water company in order to front-load its ambitious privatisation programme," said Greek Finance Minister George Papaconstantinou.

The Greek government has said it will begin to sell stakes in a number of domestic corporations "immediately" in order to raise cash to help reduce its massive debts.

These include stakes in the telecoms firm OTE, state-owned Postbank and the ports of Athens and Thessaloniki.

Earlier, European stock markets fell, partly due to continuing fears about a possible debt restructuring in Greece.

Weak eurozone economic data also hit investor sentiment.

"The cabinet decided to proceed immediately with the sale of stakes in OTE, the Postbank, the Athens and Thessaloniki ports and the Thessaloniki water company in order to front-load its ambitious privatisation programme," said Greek Finance Minister George Papaconstantinou.

Friday, May 20, 2011

Relative value

Recall the excessive (read: tulip-mania levels of reality bending) prices Japanese investors were willing to pay for U.S. real estate during its boom years. Note how the story for gold demand is revolving around several narratives, whilst never seriously discussing the possibility of a collapse like every other commodity market whose values have appreciated by 100% or more. Name ONE, dear reader, that has achieved this type of price sustainability since 1972, in real or nominal currency.

There is none.

(From the WSJ)

Chinese investors are snapping up gold bars and coins, buying more than ever before in the first quarter of 2011 and overtaking Indian buyers as the world's biggest purchasers of the metal.

China's investment demand for gold more than doubled to 90.9 metric tons in the first three months of the year, outpacing India's modest rise to 85.6 tons, the World Gold Council said in its quarterly report on Thursday. China now accounts for 25% of gold investment demand, compared with India's 23%.

The report underscores the rising appetite for gold among the growing middle-class in China. Fears of the country's soaring inflation, as well as a search for new investments, is luring investors to gold, and marketing of the precious metal has also increased in recent months.

"I think people will be surprised by the strength in the Chinese demand, but we think this is a trend that is set to continue," said Eily Ong, an investment research manager at the gold council.

[More from WSJ.com: LinkedIn IPO Soars, Feeding Web Boom]

Historically, India has been the largest investment market for gold. In 2007, just before investing in gold began to take off globally, India's physical gold demand accounted for 61% of the world's total. China's was 9%. In terms of total consumer demand, which also included jewelry, India is still a bigger consumer of gold than China, taking in 291.8 tons in the first quarter, compared with China's 233.8 tons.

Still, the voracious appetite shown by Chinese buyers prompted the gold council to increase its forecast for the nation's demand.

"In March 2010, we predicted that gold demand in China would double by 2020; however, we believe that this doubling may in fact be achieved sooner," said Albert Cheng, the World Gold Council 's managing director for the Far East. "Increasing prosperity in the world's most populous country coupled with their high affinity for gold will serve to drive demand in the long term."

There is none.

(From the WSJ)

Chinese investors are snapping up gold bars and coins, buying more than ever before in the first quarter of 2011 and overtaking Indian buyers as the world's biggest purchasers of the metal.

China's investment demand for gold more than doubled to 90.9 metric tons in the first three months of the year, outpacing India's modest rise to 85.6 tons, the World Gold Council said in its quarterly report on Thursday. China now accounts for 25% of gold investment demand, compared with India's 23%.

The report underscores the rising appetite for gold among the growing middle-class in China. Fears of the country's soaring inflation, as well as a search for new investments, is luring investors to gold, and marketing of the precious metal has also increased in recent months.

"I think people will be surprised by the strength in the Chinese demand, but we think this is a trend that is set to continue," said Eily Ong, an investment research manager at the gold council.

[More from WSJ.com: LinkedIn IPO Soars, Feeding Web Boom]

Historically, India has been the largest investment market for gold. In 2007, just before investing in gold began to take off globally, India's physical gold demand accounted for 61% of the world's total. China's was 9%. In terms of total consumer demand, which also included jewelry, India is still a bigger consumer of gold than China, taking in 291.8 tons in the first quarter, compared with China's 233.8 tons.

Still, the voracious appetite shown by Chinese buyers prompted the gold council to increase its forecast for the nation's demand.

"In March 2010, we predicted that gold demand in China would double by 2020; however, we believe that this doubling may in fact be achieved sooner," said Albert Cheng, the World Gold Council 's managing director for the Far East. "Increasing prosperity in the world's most populous country coupled with their high affinity for gold will serve to drive demand in the long term."

Thursday, May 19, 2011

Dangerous rhetoric...

...emanating from just about every political head on the planet. Multiple references to a "world as it should be" and other utopian nonense is, and always has been, one of the worst states for the vast majority of people on the planet.

The Euro predicament in a story...

...From Martin Wolf of the FT. As I have said, the Euro actions are long options for Euro area nominal GDP to rise in order to "lift all ships".

A story is told of a man sentenced by his king to death. The latter tells him that he can keep his life if he teaches the monarch’s horse to talk within a year. The condemned man agrees. Asked why he did so, he answers that anything might happen: the king might die; he might die; and the horse might learn to talk.

This has been the eurozone’s approach

A story is told of a man sentenced by his king to death. The latter tells him that he can keep his life if he teaches the monarch’s horse to talk within a year. The condemned man agrees. Asked why he did so, he answers that anything might happen: the king might die; he might die; and the horse might learn to talk.

This has been the eurozone’s approach

Tuesday, May 17, 2011

Instant Classic...

...a near-perfect example of a pseudo event. Nothing substantive whatsoever in this communique.

Guests to the 44th Annual Meeting of the Board of Governors of the Asian Development Bank (ADB) have praised Vietnam’s solutions to curb inflation and stabilise the macro-economy.

IMF Deputy General Director Naoyuki Shiohara and World Bank Vice President James Adams were among the guests who were received by Prime Minister Nguyen Tan Dung on separate occasions in Hanoi on May 5.

At a reception for IMF Deputy General Director Shiohara, PM Dung hailed the practical results of the cooperation between Vietnam and the International Monetary Fund (IMF) in policy consultation and official training.

He told Shiohara that Vietnam would continue with inflation control, macro economic stabilisation and ensuring social welfare for sustainable economic development.

The PM said he hoped the IMF will continue working with Vietnam in policy consultation.

Shiohara congratulated Vietnam on its successful organisation of ADB’s 44 th annual meeting, saying that effective cooperation between the IMF and Vietnam has contributed to assisting Vietnam’s micro-economic management and policy consultation.

He hailed the Vietnamese Government’s solutions to stabilise the macroeconomy but suggested the nation continue implementing its policy in a medium and long-term to control inflation.

While receiving WB Vice President Adams, PM Dung highlighted the important contributions of the Vietnam-WB relationship to the country’s socio-economic development.

Guests to the 44th Annual Meeting of the Board of Governors of the Asian Development Bank (ADB) have praised Vietnam’s solutions to curb inflation and stabilise the macro-economy.

IMF Deputy General Director Naoyuki Shiohara and World Bank Vice President James Adams were among the guests who were received by Prime Minister Nguyen Tan Dung on separate occasions in Hanoi on May 5.

At a reception for IMF Deputy General Director Shiohara, PM Dung hailed the practical results of the cooperation between Vietnam and the International Monetary Fund (IMF) in policy consultation and official training.

He told Shiohara that Vietnam would continue with inflation control, macro economic stabilisation and ensuring social welfare for sustainable economic development.

The PM said he hoped the IMF will continue working with Vietnam in policy consultation.

Shiohara congratulated Vietnam on its successful organisation of ADB’s 44 th annual meeting, saying that effective cooperation between the IMF and Vietnam has contributed to assisting Vietnam’s micro-economic management and policy consultation.

He hailed the Vietnamese Government’s solutions to stabilise the macroeconomy but suggested the nation continue implementing its policy in a medium and long-term to control inflation.

While receiving WB Vice President Adams, PM Dung highlighted the important contributions of the Vietnam-WB relationship to the country’s socio-economic development.

The Duke of Newport Beach

Communicates his position. I agree with his prognosis but strongly disagree with his diagnosis.

The co-CEO of the world’s largest bond fund has warned America that it faces a combination of higher inflation, austerity and financial repression over the coming years as policy makers grapple with the impact of the financial crisis and the subsequent policy response.

“Think of the debt overhangs in advanced economies where projected rates of economic growth are not sufficient to avoid mounting debt and deficit problems,” said Mohamed A. El-Erian in speech at a PIMCO forum on growth.

“Some are already flashing red, and they will force even more difficult decisions between restructuring and the massive socialization of losses, like Greece,” he added.

“Others are flashing orange, like the US, and already require future sacrifices, most likely through a combination of higher inflation, austerity and, importantly, financial repression,” said El-Erian, who classifies financial repression as seeking to impose negative real rates of returns on savers.

This policy will undermine the real return contract offered to savers and, in El-Erian’s view, come instead of any bold moves to address structural problems and imbalances.

“Secular baseline portfolio positioning should minimize exposure to the negative impact of financial repression, hedge against higher inflation and currency depreciation and exploit the heightened differentiation in balance sheets and growth potentials,” El-Erian added.

The co-CEO of the world’s largest bond fund has warned America that it faces a combination of higher inflation, austerity and financial repression over the coming years as policy makers grapple with the impact of the financial crisis and the subsequent policy response.

“Think of the debt overhangs in advanced economies where projected rates of economic growth are not sufficient to avoid mounting debt and deficit problems,” said Mohamed A. El-Erian in speech at a PIMCO forum on growth.

“Some are already flashing red, and they will force even more difficult decisions between restructuring and the massive socialization of losses, like Greece,” he added.

“Others are flashing orange, like the US, and already require future sacrifices, most likely through a combination of higher inflation, austerity and, importantly, financial repression,” said El-Erian, who classifies financial repression as seeking to impose negative real rates of returns on savers.

This policy will undermine the real return contract offered to savers and, in El-Erian’s view, come instead of any bold moves to address structural problems and imbalances.

“Secular baseline portfolio positioning should minimize exposure to the negative impact of financial repression, hedge against higher inflation and currency depreciation and exploit the heightened differentiation in balance sheets and growth potentials,” El-Erian added.

Sunday, May 15, 2011

Leadership Transition

I don't rule out foul play, but that appears to be irrelevant at this point. This man has long had a "reputation", but this is remarkable given his intent to run for the French presidency.

Dominique Strauss-Kahn, head of the International Monetary Fund and a presidential hopeful in France, has been arrested and charged with attempted rape, criminal sexual act and unlawful imprisonment, New York City police and the IMF said on Sunday.

His personal attorney, William Taylor, confirmed that Mr. Strauss-Kahn would plead not guilty to the charges today, suggesting he will be arraigned on Sunday.

The arrest is set to change the course of France's presidential elections next year, likely depriving the Socialist Part of its most promising candidate and boosting the chances of reelection for French President Nicolas Sarkozy.

"Whatever the outcome of the procedure is, [Mr. Strauss-Kahn] will not be able to run for president," said Jacques Attali, a former advisor to France's late Socialist president Francois Mitterrand.

The arrest of Mr. Strauss-Kahn, 62 years old, who was apprehended by police in the first-class section of an Air France plane minutes before it left New York for Paris on Saturday night, also throws into disarray the leadership of the IMF, whose intervention has played a key role helping European leaders manage the continent's debt crisis.

Dominique Strauss-Kahn, head of the International Monetary Fund and a presidential hopeful in France, has been arrested and charged with attempted rape, criminal sexual act and unlawful imprisonment, New York City police and the IMF said on Sunday.

His personal attorney, William Taylor, confirmed that Mr. Strauss-Kahn would plead not guilty to the charges today, suggesting he will be arraigned on Sunday.

The arrest is set to change the course of France's presidential elections next year, likely depriving the Socialist Part of its most promising candidate and boosting the chances of reelection for French President Nicolas Sarkozy.

"Whatever the outcome of the procedure is, [Mr. Strauss-Kahn] will not be able to run for president," said Jacques Attali, a former advisor to France's late Socialist president Francois Mitterrand.

The arrest of Mr. Strauss-Kahn, 62 years old, who was apprehended by police in the first-class section of an Air France plane minutes before it left New York for Paris on Saturday night, also throws into disarray the leadership of the IMF, whose intervention has played a key role helping European leaders manage the continent's debt crisis.

Saturday, May 14, 2011

Advantage: G.

This should be challenged and ruled Unconstitutional by the SCOTUS. Government should enjoy broad powers, but also be tempered because of the massive Ex-Post (and in Indiana for now, Ex-Ante) powers of the state apparatus it can levy upon citizens.

INDIANAPOLIS | Overturning a common law dating back to the English Magna Carta of 1215, the Indiana Supreme Court ruled Thursday that Hoosiers have no right to resist unlawful police entry into their homes.

In a 3-2 decision, Justice Steven David writing for the court said if a police officer wants to enter a home for any reason or no reason at all, a homeowner cannot do anything to block the officer's entry.

"We believe ... a right to resist an unlawful police entry into a home is against public policy and is incompatible with modern Fourth Amendment jurisprudence," David said. "We also find that allowing resistance unnecessarily escalates the level of violence and therefore the risk of injuries to all parties involved without preventing the arrest."

David said a person arrested following an unlawful entry by police still can be released on bail and has plenty of opportunities to protest the illegal entry through the court system.

INDIANAPOLIS | Overturning a common law dating back to the English Magna Carta of 1215, the Indiana Supreme Court ruled Thursday that Hoosiers have no right to resist unlawful police entry into their homes.

In a 3-2 decision, Justice Steven David writing for the court said if a police officer wants to enter a home for any reason or no reason at all, a homeowner cannot do anything to block the officer's entry.

"We believe ... a right to resist an unlawful police entry into a home is against public policy and is incompatible with modern Fourth Amendment jurisprudence," David said. "We also find that allowing resistance unnecessarily escalates the level of violence and therefore the risk of injuries to all parties involved without preventing the arrest."

David said a person arrested following an unlawful entry by police still can be released on bail and has plenty of opportunities to protest the illegal entry through the court system.

Is Mr. Stiglitz...

...one of my readers?

I have been at odds with him over many things, but on this issue he appears to be on the right side of history.

(From "Advisor One" blog)

Nobel Prize-winning economist Joseph Stiglitz said that countries adopting an austerity-based economic policy were sure to fail. Speaking in Copenhagen on Friday, he accused European leaders of what he called “deficit fetishism,” arguing that budget cutting in lean times retards rather than encourages economic growth.

Bloomberg News quotes the Stiglitz, a Columbia University professor, paraphrasing the famous Einstein quote about insanity. Said Stiglitz: “Austerity is an experiment that has been tried before with the same results.”

The Stiglitz criticism comes on the heels of first-quarter economic results that proved stronger than expected for Europe’s leading economies, Germany and France. Even Greece, whose solvency issues triggered Europe’s economic crisis, eked out its first economic expansion in three years, with growth of 0.8% for the quarter, which matched the EU average.

I have been at odds with him over many things, but on this issue he appears to be on the right side of history.

(From "Advisor One" blog)

Nobel Prize-winning economist Joseph Stiglitz said that countries adopting an austerity-based economic policy were sure to fail. Speaking in Copenhagen on Friday, he accused European leaders of what he called “deficit fetishism,” arguing that budget cutting in lean times retards rather than encourages economic growth.

Bloomberg News quotes the Stiglitz, a Columbia University professor, paraphrasing the famous Einstein quote about insanity. Said Stiglitz: “Austerity is an experiment that has been tried before with the same results.”

The Stiglitz criticism comes on the heels of first-quarter economic results that proved stronger than expected for Europe’s leading economies, Germany and France. Even Greece, whose solvency issues triggered Europe’s economic crisis, eked out its first economic expansion in three years, with growth of 0.8% for the quarter, which matched the EU average.

Friday, May 13, 2011

The Scepter and the Sword

As I have stated previously, the tenor and location of our fleets allow us to oberve foreign policy priority and objectives.

(no specific locations for obvious reasons are provided by the Navy)

U.S.S. Enterprise: 23Mar-10May2011, Arabian Sea

U.S.S. Carl Vinson - 06May-10May2011, Indian Ocean

U.S.S. Ronald Reagan - 10May2011, North Arabian Sea

(the rest are close to/at port)

Addendum: Added link entitled "U.S. Carrier Group Locations" to useful links sections on this blog for future reference.

(no specific locations for obvious reasons are provided by the Navy)

U.S.S. Enterprise: 23Mar-10May2011, Arabian Sea

U.S.S. Carl Vinson - 06May-10May2011, Indian Ocean

U.S.S. Ronald Reagan - 10May2011, North Arabian Sea

(the rest are close to/at port)

Addendum: Added link entitled "U.S. Carrier Group Locations" to useful links sections on this blog for future reference.

Shareholder Rights...

...Paper Dragon style.

When you "own" a security, on any segment of the capital stack of a company, what precisely do you "own" if actions like these can take place without explicit shareholder approval? The proffered explanation of "we had to divest 40%+ of the company due to regulatory reasons" is amusing and its outlandishness is only in proportion to its real purpose: to ridicule and humuliate its American partners.

So again, what do you have if you invest in these companies?

(snippet from New York Times)

The latest and most significant dust-up became public this week when Yahoo said that the Alibaba Group had transferred ownership of Alipay, an online payment service, to a group led by Jack Ma, Alibaba’s chief executive. The move was particularly worrisome to Yahoo because it would seem to erode the value of its 43 percent stake in Alibaba, which also operates separate eBay-style sites for businesses and consumers.

Yahoo recently said that stake’s value had more than doubled to $2.3 billion, making it one of its most valuable assets.

The intrigue grew on Thursday when Yahoo said in another regulatory filing that it had learned of the transfer only after it was completed on March 31. Furthermore, Yahoo said that Alibaba’s management had transferred Alipay without getting approval from Alibaba’s board.

Not surprisingly, Yahoo said that it and another investor, SoftBank, “are engaged in ongoing discussions” with Alibaba. Granted, those discussions, Wall Street analysts pointed out, are taking place after the fact, not before, as would normally be the case for such major financial decisions.

Alibaba’s explanation was that it had to transfer ownership to get Alipay for a regulatory license that requires domestic ownership of certain nonfinancial institutions.

When you "own" a security, on any segment of the capital stack of a company, what precisely do you "own" if actions like these can take place without explicit shareholder approval? The proffered explanation of "we had to divest 40%+ of the company due to regulatory reasons" is amusing and its outlandishness is only in proportion to its real purpose: to ridicule and humuliate its American partners.

So again, what do you have if you invest in these companies?

(snippet from New York Times)

The latest and most significant dust-up became public this week when Yahoo said that the Alibaba Group had transferred ownership of Alipay, an online payment service, to a group led by Jack Ma, Alibaba’s chief executive. The move was particularly worrisome to Yahoo because it would seem to erode the value of its 43 percent stake in Alibaba, which also operates separate eBay-style sites for businesses and consumers.

Yahoo recently said that stake’s value had more than doubled to $2.3 billion, making it one of its most valuable assets.

The intrigue grew on Thursday when Yahoo said in another regulatory filing that it had learned of the transfer only after it was completed on March 31. Furthermore, Yahoo said that Alibaba’s management had transferred Alipay without getting approval from Alibaba’s board.

Not surprisingly, Yahoo said that it and another investor, SoftBank, “are engaged in ongoing discussions” with Alibaba. Granted, those discussions, Wall Street analysts pointed out, are taking place after the fact, not before, as would normally be the case for such major financial decisions.

Alibaba’s explanation was that it had to transfer ownership to get Alipay for a regulatory license that requires domestic ownership of certain nonfinancial institutions.

Thursday, May 12, 2011

Causation

The world is an incredibly complex place. Extricating causation from events is a very perilous, but necessary intellectual activity. The subject of causation is an inherently confounding arena of thought because of the different perspectives of those who seek to find it.

For example, in the law, causation typically focuses on "proximate cause" and "cause in fact" ("but for A happening, B would not have happened"). But these tests carry with them the luxury of an arbitrary truncation of time for the benefit of establishing blame on the parties by use of specific statutory (or common law) infractions.

In the markets and in forecasting, it would be foolish to apply such tests. Simply looking at the proximate source of market movements or civil unrest leads to profound misunderstanings and an incomplete notion of global events. However, this is why financial "news" networks are so powerful. They produce "proximate" causes for geo-political and economic events that have taken years, not days, to come to fruition. Human beings are hard-wired (likely a remnant of our own evolutionary biology) to simply stop once the proximate cause is satisfied. Striking marcasite with flint causes sparks. The sparks cause fire. Fire has many uses.

Let's take a straightforward example. The Revolutionary War in America circa 1776 was faught over tax laws, unfair limits on representation, and the desire for a sovereign state among the oppressed people in the colonies.

Perhaps. But for people like myself, these are necessary, but not sufficient events that "caused" the war. The desire for "freedom" and such are such incomplete notions, what were the catalysts behind such calls for action?

The Bengal Famine of 1770 caused the war. The Famine itself was "caused" by the ineptitude and incompetance of the British East India Company ("BEIC") officers, who clearly did not understand the macro-economic risks of their short-term profit maximizing decisions. BEIC suffered huge financial losses, and, being the world's most powerful company in a well-developed Military Industrial Complex (where government is De Facto controlled by business interests), simply compelled The Crown to enable the Tea Act of 1773 on the other side of the world in a jurisdiction that was thought to be docile and loyal.

The Tea Act levied a tax on all tea in the colonies...save those supplied by the British East India Company. These events "caused" the Boston Tea Party, an important catalyst for the Revolutionary War. They also "caused" Parliament to effectively nationalize the British East India company later that year.

Thus, it is important to note all potential economic causes for large geo-political events. There are several occurring at this very moment. As I have said before, nothing changes.

For example, in the law, causation typically focuses on "proximate cause" and "cause in fact" ("but for A happening, B would not have happened"). But these tests carry with them the luxury of an arbitrary truncation of time for the benefit of establishing blame on the parties by use of specific statutory (or common law) infractions.

In the markets and in forecasting, it would be foolish to apply such tests. Simply looking at the proximate source of market movements or civil unrest leads to profound misunderstanings and an incomplete notion of global events. However, this is why financial "news" networks are so powerful. They produce "proximate" causes for geo-political and economic events that have taken years, not days, to come to fruition. Human beings are hard-wired (likely a remnant of our own evolutionary biology) to simply stop once the proximate cause is satisfied. Striking marcasite with flint causes sparks. The sparks cause fire. Fire has many uses.

Let's take a straightforward example. The Revolutionary War in America circa 1776 was faught over tax laws, unfair limits on representation, and the desire for a sovereign state among the oppressed people in the colonies.

Perhaps. But for people like myself, these are necessary, but not sufficient events that "caused" the war. The desire for "freedom" and such are such incomplete notions, what were the catalysts behind such calls for action?

The Bengal Famine of 1770 caused the war. The Famine itself was "caused" by the ineptitude and incompetance of the British East India Company ("BEIC") officers, who clearly did not understand the macro-economic risks of their short-term profit maximizing decisions. BEIC suffered huge financial losses, and, being the world's most powerful company in a well-developed Military Industrial Complex (where government is De Facto controlled by business interests), simply compelled The Crown to enable the Tea Act of 1773 on the other side of the world in a jurisdiction that was thought to be docile and loyal.

The Tea Act levied a tax on all tea in the colonies...save those supplied by the British East India Company. These events "caused" the Boston Tea Party, an important catalyst for the Revolutionary War. They also "caused" Parliament to effectively nationalize the British East India company later that year.

Thus, it is important to note all potential economic causes for large geo-political events. There are several occurring at this very moment. As I have said before, nothing changes.

Paradigm Lost...

...a continuing series. The funding assumptions that I have discussed on this blog on numerous occasions remain an intellectual null zone for "mainstream" economists. The below article from today's FT demonstrates this once again. Sovereign issuers do not need "loans" to get "money" to pay interest or principle on debt. The desire for the world to NET SAVE U.S. financial assets is completely rational given the geopolitical and institutional framework existing at this epoch in history.

This assymetrical fetish emphasizing net exports and "debt" levels is counterproductive to understanding what the world instructs anyone willing to look. The more officials in the Euro area in particular misapply these assumptions, the more they are forced into History's classic re-booting mechansim for governments, currencies, bonds, and sovereign nations: War.

By Axel Merk

Published: May 11 2011 13:31 | Last updated: May 11 2011 13:31

Imagine a country that spends and prints trillions to patch up any problem.

Now imagine another country where there is no central Treasury, meaning that bail-outs are less easy, and which has a central bank that has mopped up liquidity over the past year, rather than engage in quantitative easing.

Why does it surprise anyone that the latter, the eurozone, has a stronger currency than the former, the US? Because of peripheral countries’ debt refinancing issues? And the potential for contagion? These are real and serious issues, but in our assessment, they should be primarily priced into the spreads of eurozone bonds, not the euro itself.

Think of it this way: in the US, Federal Reserve chairman Ben Bernanke has testified that going off the gold standard during the Great Depression helped the US recover faster than other countries. Fast-forward to today: we believe Bernanke embraces a weaker currency as a monetary policy tool to help address the current state of the US economy. What many overlook is that someone must be on the other side of that trade: today it is the eurozone, which is experiencing a strong currency, despite the many challenges in the 17-nation bloc.

A year ago, the euro appeared to be the only asset traded as a hedge against, or to profit from, all things wrong in the eurozone. This was partly driven by liquidity, because it is easier to sell the euro than to short debt of peripheral eurozone countries; and as the trade worked, others piled in. As the euro approached lows of $1.18 against the dollar, the trade was no longer a “safe” one-way bet and traders had to look elsewhere. As a result, the euro is now substantially stronger, yet peripheral bond debt is much weaker.

The one language policymakers understand is that of the bond market. A “wonderful dialogue” has been playing out, encouraging policymakers to engage in real reform. Often minority governments have made extremely tough decisions. Ultimately, it us up to each country to implement their respective reforms; political realities will cause many to fall short of promises, resulting in more bond market “encouragement”. Policymakers hate this dialogue, of course, but must respect it.

Any country may default on its debt. The problem is that it may be impossible to receive another loan, at least at palatable financing costs. Any country considering a default must be willing and able to absorb the consequences, which is an overnight eradication of the primary deficit.

This assymetrical fetish emphasizing net exports and "debt" levels is counterproductive to understanding what the world instructs anyone willing to look. The more officials in the Euro area in particular misapply these assumptions, the more they are forced into History's classic re-booting mechansim for governments, currencies, bonds, and sovereign nations: War.

By Axel Merk

Published: May 11 2011 13:31 | Last updated: May 11 2011 13:31

Imagine a country that spends and prints trillions to patch up any problem.

Now imagine another country where there is no central Treasury, meaning that bail-outs are less easy, and which has a central bank that has mopped up liquidity over the past year, rather than engage in quantitative easing.

Why does it surprise anyone that the latter, the eurozone, has a stronger currency than the former, the US? Because of peripheral countries’ debt refinancing issues? And the potential for contagion? These are real and serious issues, but in our assessment, they should be primarily priced into the spreads of eurozone bonds, not the euro itself.

Think of it this way: in the US, Federal Reserve chairman Ben Bernanke has testified that going off the gold standard during the Great Depression helped the US recover faster than other countries. Fast-forward to today: we believe Bernanke embraces a weaker currency as a monetary policy tool to help address the current state of the US economy. What many overlook is that someone must be on the other side of that trade: today it is the eurozone, which is experiencing a strong currency, despite the many challenges in the 17-nation bloc.

A year ago, the euro appeared to be the only asset traded as a hedge against, or to profit from, all things wrong in the eurozone. This was partly driven by liquidity, because it is easier to sell the euro than to short debt of peripheral eurozone countries; and as the trade worked, others piled in. As the euro approached lows of $1.18 against the dollar, the trade was no longer a “safe” one-way bet and traders had to look elsewhere. As a result, the euro is now substantially stronger, yet peripheral bond debt is much weaker.

The one language policymakers understand is that of the bond market. A “wonderful dialogue” has been playing out, encouraging policymakers to engage in real reform. Often minority governments have made extremely tough decisions. Ultimately, it us up to each country to implement their respective reforms; political realities will cause many to fall short of promises, resulting in more bond market “encouragement”. Policymakers hate this dialogue, of course, but must respect it.

Any country may default on its debt. The problem is that it may be impossible to receive another loan, at least at palatable financing costs. Any country considering a default must be willing and able to absorb the consequences, which is an overnight eradication of the primary deficit.

Tuesday, May 10, 2011

Who cares...and a bit late.

Once again...they have to say these things to appease certain constituents. Abbottabad is next to Kashmir...

So my comments in italics bespeak to the title of this post.

The relationship between Pakistan and the US is under intense scrutiny, with the Pakistani army saying that it will review co-operation with the US if there is another violation of its sovereignity.

The warning follows the special operation by US commandos on Monday inside Pakistani territory that led to the death of Osama bin Laden, the leader of al-Qaeda.

The Pakistan army threatened on Thursday to reconsider its anti-terrorism co-operation with the US if the Americans carried out another unilateral attack like the killing of bin Laden.

"COAS made it clear that any similar action violating the sovereignty of Pakistan will warrant a review on the level of military/intelligence co-operation with the United States," the army said in a statement, referring to the chief of army staff, General Ashfaq Kayani.

It said Kayani told his colleagues that a decision had been made to reduce the number of US military personnel to the "minimum essential" levels.

Although both the US and Pakistani governments have also attempted to highlight co-operation between the two, comments coming from senior officials suggest the opposite.

Earlier on Thursday, the Pakistani foreign secretary, Salman Bashir, gave warning that regional neighbours should not think they can follow America's lead.

He cautioned the US and other countries on Thursday against future raids in the country on suspected fighters, saying that such actions would have "disastrous consequences". "We feel that that sort of misadventure or miscalculation would result in a terrible catastrophe," he said.

"There should be no doubt Pakistan has adequate capacity to ensure its own defence."

So my comments in italics bespeak to the title of this post.

The relationship between Pakistan and the US is under intense scrutiny, with the Pakistani army saying that it will review co-operation with the US if there is another violation of its sovereignity.

The warning follows the special operation by US commandos on Monday inside Pakistani territory that led to the death of Osama bin Laden, the leader of al-Qaeda.

The Pakistan army threatened on Thursday to reconsider its anti-terrorism co-operation with the US if the Americans carried out another unilateral attack like the killing of bin Laden.

"COAS made it clear that any similar action violating the sovereignty of Pakistan will warrant a review on the level of military/intelligence co-operation with the United States," the army said in a statement, referring to the chief of army staff, General Ashfaq Kayani.

It said Kayani told his colleagues that a decision had been made to reduce the number of US military personnel to the "minimum essential" levels.

Although both the US and Pakistani governments have also attempted to highlight co-operation between the two, comments coming from senior officials suggest the opposite.

Earlier on Thursday, the Pakistani foreign secretary, Salman Bashir, gave warning that regional neighbours should not think they can follow America's lead.

He cautioned the US and other countries on Thursday against future raids in the country on suspected fighters, saying that such actions would have "disastrous consequences". "We feel that that sort of misadventure or miscalculation would result in a terrible catastrophe," he said.

"There should be no doubt Pakistan has adequate capacity to ensure its own defence."

Paradigm Lost

The calls never cease for the U.S. to bolster its fiscal position to avoid default. Once again, I remind the world that the U.S., as sovereign currency issuer, cannot "default" due to a result of simply crediting Treasury Security accounts at the Fed. We must all be reminded that the reason the U.S. current account deficit is large is because other countries wish to net save (hence the positive Capital Account) U.S. financial assets. AND FOR VERY GOOD REASONS. So first I present to you a snippet from a well-respected financial website that misstates the problem. Next I present you one of those VERY GOOD REASONS.

And what is a "technical default" anyway??

Allowing the U.S. Treasury to default on its obligations because of a failure to increase the sovereign debt subject to limit would be a colossal blunder. Fortunately, that’s not what those advocating tough conditions in exchange for a debt limit increase are saying. The issue presented by many in the news media is whether Congress would elect to willingly torpedo the U.S. Treasury market – and, by extension, the global financial markets that rely on Treasuries as risk-free collateral – by refusing to increase the debt ceiling. Paul Krugman has advanced another popular narrative, namely that the “constant lectures about the need to reduce the budget deficit…represent distorted priorities, since our immediate concern should be job creation.”

Achieving growth is certainly vital to securing the future, but policymakers need to stay focused on the real default issue: whether the terms of the debt limit increase this summer will be sufficiently tough to ensure that the nation’s debt-to-GDP ratio is stabilized and eventually sharply reduced. Ironically, the greater risk of default comes from an increase in the debt limit that fails to enact tough budget rules and substantial reductions in federal outlays.