Italian spreads widening as I type this, the stop-gap measures propounded by the EU area are proving insufficient to a market innoculated against the cacophony of propaganda emitted from the ECB and official channels.

Put another way, the noise filter has been recalibrated, and a new standard of scrutiny and a more cynical view towards the EU's veracity is now THE theme going forward.

Thus, drastic measures such as QE and monetization follow. Recall these have vastly different effects where currency issuers are divorced from fiscal and taxation powers.

Tuesday, November 30, 2010

Sunday, November 28, 2010

Tomorrow's talking points...

...the EU area bailout, and Wikileaks.

The Germany Dispatches

Internal Source Kept US Informed of Merkel Coalition Negotiations

DPA

The US was kept abreast of German coalition negotiations as they took place. Here, Chancellor Merkel's Christian Democrats meet with Foreign Minister Westerwelle's Free Democrats in October 2009. Internal notes from the talks ended up in Washington not long later.

The 250,000 US State Department documents made public by WikiLeaks

reveal that the US has an extensive network of informants in Berlin

and was kept informed of coalition negotiations as Chancellor Merkel

was forming her current government. US officials, the cables show, are skeptical of several top German politicians.

The more than 250,000 secret documents from the US State Department

show just how critical the American diplomats were of the new German

government. In particular, the new Foreign Minister Guido Westerwelle, leader of the pro-business Free Democrats (FDP), is seen in a negative light. The secret reports describe him as incompetent, vain and critical of America. The US diplomats report that they face a challenge in dealing with a politician who is considered an "enigma," who has little foreign policy experience and "remains skeptical about the US." An embassy cable from Berlin from Sept. 22, 2009 describes Westerwelle as having an "exuberant personality." That is why he finds it difficult to take a backseat when it comes to any matters of dispute with Chancellor Angela Merkel," the cable says.

The Germany Dispatches

Internal Source Kept US Informed of Merkel Coalition Negotiations

DPA

The US was kept abreast of German coalition negotiations as they took place. Here, Chancellor Merkel's Christian Democrats meet with Foreign Minister Westerwelle's Free Democrats in October 2009. Internal notes from the talks ended up in Washington not long later.

The 250,000 US State Department documents made public by WikiLeaks

reveal that the US has an extensive network of informants in Berlin

and was kept informed of coalition negotiations as Chancellor Merkel

was forming her current government. US officials, the cables show, are skeptical of several top German politicians.

The more than 250,000 secret documents from the US State Department

show just how critical the American diplomats were of the new German

government. In particular, the new Foreign Minister Guido Westerwelle, leader of the pro-business Free Democrats (FDP), is seen in a negative light. The secret reports describe him as incompetent, vain and critical of America. The US diplomats report that they face a challenge in dealing with a politician who is considered an "enigma," who has little foreign policy experience and "remains skeptical about the US." An embassy cable from Berlin from Sept. 22, 2009 describes Westerwelle as having an "exuberant personality." That is why he finds it difficult to take a backseat when it comes to any matters of dispute with Chancellor Angela Merkel," the cable says.

A fine mess.

The EU area "encourages" bond holders to maintain their exposure to EU-area debt, and issues new bonds via an EU mechanism WITH SENIORITY over previous bonds? I see the strategy to devalue the Euro, but the ramifications for bonds and further issuance is very troubling. This is a terra incognito for the EU with multiple guarantees on debt (in several SOVEREIGN COUNTRIES) without a corresponding fiscal capacity tanatmount to providing a municipal fire department with millions of dollars of new fire-fighting equipment in the midst of a raging fire engulfing an lare section of the city.

The EU area is once again betting its existance on forward GDP, and more specifically, manufacturing output and exports.

This, coupled with the Spiegel articles out tomorrow, does not exactly burnish the ECB's credibility.

So its all a fine mess, and I just have to chuckle at these efforts to hold this creaking old rollercoaster together, and burst out laughing at the people who wish to ride it.

The EU area is once again betting its existance on forward GDP, and more specifically, manufacturing output and exports.

This, coupled with the Spiegel articles out tomorrow, does not exactly burnish the ECB's credibility.

So its all a fine mess, and I just have to chuckle at these efforts to hold this creaking old rollercoaster together, and burst out laughing at the people who wish to ride it.

Wednesday, November 24, 2010

Seeking the blameworthy...

Blame, blame, blame. It is a pity commentators don't take a more serious tac and investigate the incentive structures that FULLY explain this licentious, avaricious behavior.

Still, this article does relate some very useful nuggets:

One is the role of financial intermediaries, such as banks. Rather than seeking the most productive outlet for the money that depositors and investors entrust to them, they may follow trends and surf bubbles. These activities shift capital into projects that have little or no long-term value, such as speculative real-estate developments in the swamps of Florida. Rather than acting in their customers’ best interests, financial institutions may peddle opaque investment products, like collateralized debt obligations. Privy to superior information, banks can charge hefty fees and drive up their own profits at the expense of clients who are induced to take on risks they don’t fully understand—a form of rent seeking. “Mispricing gives incorrect signals for resource allocation, and, at worst, causes stock market booms and busts,” Woolley wrote in a recent paper. “Rent capture causes the misallocation of labor and capital, transfers substantial wealth to bankers and financiers, and, at worst, induces systemic failure. Both impose social costs on their own, but in combination they create a perfect storm of wealth destruction.”

Still, this article does relate some very useful nuggets:

One is the role of financial intermediaries, such as banks. Rather than seeking the most productive outlet for the money that depositors and investors entrust to them, they may follow trends and surf bubbles. These activities shift capital into projects that have little or no long-term value, such as speculative real-estate developments in the swamps of Florida. Rather than acting in their customers’ best interests, financial institutions may peddle opaque investment products, like collateralized debt obligations. Privy to superior information, banks can charge hefty fees and drive up their own profits at the expense of clients who are induced to take on risks they don’t fully understand—a form of rent seeking. “Mispricing gives incorrect signals for resource allocation, and, at worst, causes stock market booms and busts,” Woolley wrote in a recent paper. “Rent capture causes the misallocation of labor and capital, transfers substantial wealth to bankers and financiers, and, at worst, induces systemic failure. Both impose social costs on their own, but in combination they create a perfect storm of wealth destruction.”

Tuesday, November 23, 2010

Cross-Holdings...

...that would make a Keiretsu blush. United Europe has chained themselves to the Jolly Rodger.

Recursive Fed reaction functions...

...in the latest Fed Minutes, the Fed mentions that it has revised its forecast of economic growth in ligth of "asset market developments...reflecting heightened expectations".

This is curious considering the Fed has willfully altered the asset mix with QE2 (which, once again, has no net effect and even if it did had an effect, this would be deflationary and diametrically opposed to the Fed's desired outcomes.). Put another way, moved the target to the place they shot the arrow, and now claim success

This is curious considering the Fed has willfully altered the asset mix with QE2 (which, once again, has no net effect and even if it did had an effect, this would be deflationary and diametrically opposed to the Fed's desired outcomes.). Put another way, moved the target to the place they shot the arrow, and now claim success

Monday, November 22, 2010

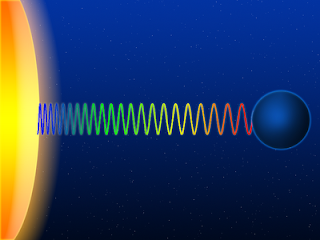

QE2 Red Shifting

The Dollar Index measuring the currency’s performance against those of six major trading partners has climbed as much as 5.1 percent from its low this year on Nov. 4. Futures traders have slashed bets for a decline in the dollar against the euro, yen, Australian dollar and Swiss franc, data from the Commodities Futures Trading Association in Washington show.

Leaders from Chinese Premier Wen Jiabao to John Boehner, the nominee to be the next speaker of the House of Representatives, have said Fed Chairman Bernanke’s plan to print money and buy $600 billion of U.S. government debt will cause instability and faster inflation. The $4 trillion-a-day currency market is signaling the Fed’s strategy is unlikely to debase the dollar as long as the economy continues to strengthen.

No net effect. Furthermore, the risk is tilted to the deflationary side (given the context of the current environment of banking malaise, etc.) since swapping interest bearing assets (bonds) with non-interest bearing assets (cash) removes current and future income streams from the economy.

In astronomical terms, whatever effect QE2 was supposed to have is Red-shifting at a large and increasing rate.

Cross-Subsidization

The blamestorming continues. There are elements of hypocracy on both sides (Ireland, for example, benefited massively from the Euro as their very business friendly tax structures meant FDI flooded into their banking system), but the root problem is, once again, that there is no such thing as a currency union without fiscal union. You simply must have monopoly currency issuing powers to make the system work.

The main elements of the story are that the banks’ problems are so

deep that they exceed the fiscal capacity of the State. We cannot

borrow enough money from the bond markets to sort them out and also

fund the exchequer deficit, so we have no choice but to turn to the

European Financial Stability Facility and the IMF.

While the later point is unfortunately true, the role of the ECB in

how we came to this sorry pass is worthy of some scrutiny. A more

critical analysis might conclude that its policies over the last two

years added greatly to our problems and ultimately its own. And it is the ECB’s problems as much as ours that brought things to a head last week.

One of the main differences between how the two-year-old crisis has

played out in Europe and America has been the refusal of the ECB to

allow any significant bank fail.

It is worth noting in this regard that Jean Claude Trichet rang Brian Lenihan over that fateful weekend in September 2008 to impress on him the importance of not letting any Irish bank fail. The obvious

inference was that the ECB would play its part.

Trichet was, of course, pushing at an open door given the other

factors at play in Ireland: profound regulatory failure combined with the inability of the administration or the banks to comprehend the scope of the problem.

But the fact remains that the Government could not have gone down the road it did without the support of the ECB. Frankfurt has provided the liquidity needed to make the National Asset Management Agency function and was committed to a similar facility for the winding up of Anglo.

The main elements of the story are that the banks’ problems are so

deep that they exceed the fiscal capacity of the State. We cannot

borrow enough money from the bond markets to sort them out and also

fund the exchequer deficit, so we have no choice but to turn to the

European Financial Stability Facility and the IMF.

While the later point is unfortunately true, the role of the ECB in

how we came to this sorry pass is worthy of some scrutiny. A more

critical analysis might conclude that its policies over the last two

years added greatly to our problems and ultimately its own. And it is the ECB’s problems as much as ours that brought things to a head last week.

One of the main differences between how the two-year-old crisis has

played out in Europe and America has been the refusal of the ECB to

allow any significant bank fail.

It is worth noting in this regard that Jean Claude Trichet rang Brian Lenihan over that fateful weekend in September 2008 to impress on him the importance of not letting any Irish bank fail. The obvious

inference was that the ECB would play its part.

Trichet was, of course, pushing at an open door given the other

factors at play in Ireland: profound regulatory failure combined with the inability of the administration or the banks to comprehend the scope of the problem.

But the fact remains that the Government could not have gone down the road it did without the support of the ECB. Frankfurt has provided the liquidity needed to make the National Asset Management Agency function and was committed to a similar facility for the winding up of Anglo.

Friday, November 19, 2010

Bernanke's gambit

The Full Statement Can Be Found Here.

My comments in italics where appropriate, this is an abridged version of the full statement.

The Federal Reserve's policy target for the federal funds rate has been near zero since December 2008, so another means of providing monetary accommodation has been necessary since that time. Accordingly, the FOMC purchased Treasury and agency-backed securities on a large scale from December 2008 through March 2010, a policy that appears to have been quite successful in helping to stabilize the economy and support the recovery during that period. Following up on this earlier success, the Committee announced this month that it would purchase additional Treasury securities. In taking that action, the Committee seeks to support the economic recovery, promote a faster pace of job creation, and reduce the risk of a further decline in inflation that would prove damaging to the recovery.

We will not be disuaded from QE2, regardless of the risks, to reneg on the policy measure now would be an admission of impotence for Fed policy, which is a categorical impossibility.

Although securities purchases are a different tool for conducting monetary policy than the more familiar approach of managing the overnight interest rate, the goals and transmission mechanisms are very similar. In particular, securities purchases by the central bank affect the economy primarily by lowering interest rates on securities of longer maturities, just as conventional monetary policy, by affecting the expected path of short-term rates, also influences longer-term rates. Lower longer-term rates in turn lead to more accommodative financial conditions, which support household and business spending. As I noted, the evidence suggests that asset purchases can be an effective tool; indeed, financial conditions eased notably in anticipation of the Federal Reserve's policy announcement.

We have altered the supply of relevent securities and their maturities, pray we don't alter it any further.

Incidentally, in my view, the use of the term "quantitative easing" to refer to the Federal Reserve's policies is inappropriate. Quantitative easing typically refers to policies that seek to have effects by changing the quantity of bank reserves, a channel which seems relatively weak, at least in the U.S. context. In contrast, securities purchases work by affecting the yields on the acquired securities and, via substitution effects in investors' portfolios, on a wider range of assets.

Substitution effects...yes...stocks anyone?

This policy tool will be used in a manner that is measured and responsive to economic conditions. In particular, the Committee stated that it would review its asset-purchase program regularly in light of incoming information and would adjust the program as needed to meet its objectives. Importantly, the Committee remains unwaveringly committed to price stability and does not seek inflation above the level of 2 percent or a bit less that most FOMC participants see as consistent with the Federal Reserve's mandate. In that regard, it bears emphasizing that the Federal Reserve has worked hard to ensure that it will not have any problems exiting from this program at the appropriate time. The Fed's power to pay interest on banks' reserves held at the Federal Reserve will allow it to manage short-term interest rates effectively and thus to tighten policy when needed, even if bank reserves remain high. Moreover, the Fed has invested considerable effort in developing tools that will allow it to drain or immobilize bank reserves as needed to facilitate the smooth withdrawal of policy accommodation when conditions warrant. If necessary, the Committee could also tighten policy by redeeming or selling securities.

Its all under control.

Third, countries that maintain undervalued currencies may themselves face important costs at the national level, including a reduced ability to use independent monetary policies to stabilize their economies and the risks associated with excessive or volatile capital inflows. The latter can be managed to some extent with a variety of tools, including various forms of capital controls, but such approaches can be difficult to implement or lead to microeconomic distortions. The high levels of reserves associated with currency undervaluation may also imply significant fiscal costs if the liabilities issued to sterilize reserves bear interest rates that exceed those on the reserve assets themselves. Perhaps most important, the ultimate purpose of economic growth is to deliver higher living standards at home; thus, eventually, the benefits of shifting productive resources to satisfying domestic needs must outweigh the development benefits of continued reliance on export-led growth.

China, we control the vertical. We control the horizontal. Do. Not. Defy. Us.

My comments in italics where appropriate, this is an abridged version of the full statement.

The Federal Reserve's policy target for the federal funds rate has been near zero since December 2008, so another means of providing monetary accommodation has been necessary since that time. Accordingly, the FOMC purchased Treasury and agency-backed securities on a large scale from December 2008 through March 2010, a policy that appears to have been quite successful in helping to stabilize the economy and support the recovery during that period. Following up on this earlier success, the Committee announced this month that it would purchase additional Treasury securities. In taking that action, the Committee seeks to support the economic recovery, promote a faster pace of job creation, and reduce the risk of a further decline in inflation that would prove damaging to the recovery.

We will not be disuaded from QE2, regardless of the risks, to reneg on the policy measure now would be an admission of impotence for Fed policy, which is a categorical impossibility.

Although securities purchases are a different tool for conducting monetary policy than the more familiar approach of managing the overnight interest rate, the goals and transmission mechanisms are very similar. In particular, securities purchases by the central bank affect the economy primarily by lowering interest rates on securities of longer maturities, just as conventional monetary policy, by affecting the expected path of short-term rates, also influences longer-term rates. Lower longer-term rates in turn lead to more accommodative financial conditions, which support household and business spending. As I noted, the evidence suggests that asset purchases can be an effective tool; indeed, financial conditions eased notably in anticipation of the Federal Reserve's policy announcement.

We have altered the supply of relevent securities and their maturities, pray we don't alter it any further.

Incidentally, in my view, the use of the term "quantitative easing" to refer to the Federal Reserve's policies is inappropriate. Quantitative easing typically refers to policies that seek to have effects by changing the quantity of bank reserves, a channel which seems relatively weak, at least in the U.S. context. In contrast, securities purchases work by affecting the yields on the acquired securities and, via substitution effects in investors' portfolios, on a wider range of assets.

Substitution effects...yes...stocks anyone?

This policy tool will be used in a manner that is measured and responsive to economic conditions. In particular, the Committee stated that it would review its asset-purchase program regularly in light of incoming information and would adjust the program as needed to meet its objectives. Importantly, the Committee remains unwaveringly committed to price stability and does not seek inflation above the level of 2 percent or a bit less that most FOMC participants see as consistent with the Federal Reserve's mandate. In that regard, it bears emphasizing that the Federal Reserve has worked hard to ensure that it will not have any problems exiting from this program at the appropriate time. The Fed's power to pay interest on banks' reserves held at the Federal Reserve will allow it to manage short-term interest rates effectively and thus to tighten policy when needed, even if bank reserves remain high. Moreover, the Fed has invested considerable effort in developing tools that will allow it to drain or immobilize bank reserves as needed to facilitate the smooth withdrawal of policy accommodation when conditions warrant. If necessary, the Committee could also tighten policy by redeeming or selling securities.

Its all under control.

Third, countries that maintain undervalued currencies may themselves face important costs at the national level, including a reduced ability to use independent monetary policies to stabilize their economies and the risks associated with excessive or volatile capital inflows. The latter can be managed to some extent with a variety of tools, including various forms of capital controls, but such approaches can be difficult to implement or lead to microeconomic distortions. The high levels of reserves associated with currency undervaluation may also imply significant fiscal costs if the liabilities issued to sterilize reserves bear interest rates that exceed those on the reserve assets themselves. Perhaps most important, the ultimate purpose of economic growth is to deliver higher living standards at home; thus, eventually, the benefits of shifting productive resources to satisfying domestic needs must outweigh the development benefits of continued reliance on export-led growth.

China, we control the vertical. We control the horizontal. Do. Not. Defy. Us.

Thursday, November 18, 2010

Bernanke's speech...

...That will be featured all over tomorrow is a classic case of its kind in political diversion. I will comment more in time.

One source of these

tensions has been the bifurcated nature of the global economic

recovery: Some economies have fully recouped their losses while

others have lagged behind. But at a deeper level, the tensions

arise from the lack of an agreed-upon framework to ensure that

national policies take appropriate account of interdependencies

across countries and the interests of the international system

as a whole. Accordingly, the essential challenge for

policymakers around the world is to work together to achieve a

mutually beneficial outcome--namely, a robust global economic

expansion that is balanced, sustainable, and less prone to

crises.

One source of these

tensions has been the bifurcated nature of the global economic

recovery: Some economies have fully recouped their losses while

others have lagged behind. But at a deeper level, the tensions

arise from the lack of an agreed-upon framework to ensure that

national policies take appropriate account of interdependencies

across countries and the interests of the international system

as a whole. Accordingly, the essential challenge for

policymakers around the world is to work together to achieve a

mutually beneficial outcome--namely, a robust global economic

expansion that is balanced, sustainable, and less prone to

crises.

Opening salvo...

...for the failed state south of the U.S.

Texas Gov. Rick Perry said the United States should consider deploying military forces into Mexico to stem the drug-related violence afflicting the border region.

Perry, the incoming chairman of the Republican Governors Association, told MSNBC on Thursday morning that while Mexico would “obviously” have to approve any American assistance, military might is needed to defeat the drug cartels that have stymied Mexican authorities. And he pegged decreased border violence as a prerequisite for any successful immigration reform push in Washington.

Texas Gov. Rick Perry said the United States should consider deploying military forces into Mexico to stem the drug-related violence afflicting the border region.

Perry, the incoming chairman of the Republican Governors Association, told MSNBC on Thursday morning that while Mexico would “obviously” have to approve any American assistance, military might is needed to defeat the drug cartels that have stymied Mexican authorities. And he pegged decreased border violence as a prerequisite for any successful immigration reform push in Washington.

Wednesday, November 17, 2010

Newport Beach men...

...ponder coordination among G20 economies.

This rather downcast analysis of what possibly comes next should ring alarm bells in Washington and in other capitals. It is a call for intensifying international economic diplomacy with a view, first and foremost, to reaching rapid convergence on a common analysis of what ails the global economy. Without that, any other step can’t be productive.

Global economic cooperation has been weakened by a disappointing G-20 summit. But coordination is still the only way to secure the collaborative outcome that is so critical for the wellbeing of so many around the world.

“Uneven growth and widening imbalances are fueling the temptation to diverge from global solutions into uncoordinated actions,” the G-20 statement said, adding that “uncoordinated policy actions will only lead to worse outcomes for all.”

Without common analysis and purpose, we will all find that a rather bland G-20 statement will, unfortunately, become very prescient.

This rather downcast analysis of what possibly comes next should ring alarm bells in Washington and in other capitals. It is a call for intensifying international economic diplomacy with a view, first and foremost, to reaching rapid convergence on a common analysis of what ails the global economy. Without that, any other step can’t be productive.

Global economic cooperation has been weakened by a disappointing G-20 summit. But coordination is still the only way to secure the collaborative outcome that is so critical for the wellbeing of so many around the world.

“Uneven growth and widening imbalances are fueling the temptation to diverge from global solutions into uncoordinated actions,” the G-20 statement said, adding that “uncoordinated policy actions will only lead to worse outcomes for all.”

Without common analysis and purpose, we will all find that a rather bland G-20 statement will, unfortunately, become very prescient.

Tuesday, November 16, 2010

Disengenuous outrage...

...the real reason for Democratic outrage at the recent SCOTUS decision in Citizens United v. Federal Election Commission, No. 08-205, is not for due to any theory of Justice. Rather, it tilts the balance of power among institutions, and among parties by putting corporations on equal footing with Unions.

Its beneficial to review this list of top donors.

Its beneficial to review this list of top donors.

Analogy of the day

The EU is currently experiencing late stages of "multiple organ failure". It is fascinating to see the similarities and more study is needed to bear fruit, if indeed any is to be had.

Inevitability's rubicon

The entire world now sees what was warned about here and in many other places. It is more destabilizing than any previous currency system, and holds as its lynchpin the collective guilt of Germany, which is quickly evaporating.

Nov. 16 (Bloomberg) -- Who's next? First Greece went bust.

Now Ireland is on the brink of a bailout from the European Union

and the International Monetary Fund.

When it happens, we'll hear plenty of soothing words about

how contagion has been stopped, the euro area has been put on a

firmer footing, and the single currency saved. There will be a

lot of grand rhetoric about the importance of the European

project. Stern condemnations of the speculators will ring out

across the continent.

Don't listen to a word of it. The euro has turned into a

bankruptcy machine. Once the markets have finished with Ireland,

they will simply move on to Portugal and Spain, and after that

to Italy and France.

There is a domino effect at work, and, with each rescue,

the fault lines within the euro grow wider and wider. This

process isn't going to stop until the euro is taken apart.

The Irish crisis is far more serious for the euro than the

Greek one. The only thing that can rescue the former Celtic

Tiger now is a clear and straightforward commitment from the

rest of the euro-area nations to salvage the country's economy.

No doubt that will be forthcoming. Tens of billions of euros

will be thrown at shoring up confidence in Ireland's finances.

But it is very hard for the single currency's remaining

supporters to explain why it has come to this. The Greeks

fiddled their way into the euro. They should never have been

allowed on board. And once inside, they should have been told to

reform fast or get out again.

Nov. 16 (Bloomberg) -- Who's next? First Greece went bust.

Now Ireland is on the brink of a bailout from the European Union

and the International Monetary Fund.

When it happens, we'll hear plenty of soothing words about

how contagion has been stopped, the euro area has been put on a

firmer footing, and the single currency saved. There will be a

lot of grand rhetoric about the importance of the European

project. Stern condemnations of the speculators will ring out

across the continent.

Don't listen to a word of it. The euro has turned into a

bankruptcy machine. Once the markets have finished with Ireland,

they will simply move on to Portugal and Spain, and after that

to Italy and France.

There is a domino effect at work, and, with each rescue,

the fault lines within the euro grow wider and wider. This

process isn't going to stop until the euro is taken apart.

The Irish crisis is far more serious for the euro than the

Greek one. The only thing that can rescue the former Celtic

Tiger now is a clear and straightforward commitment from the

rest of the euro-area nations to salvage the country's economy.

No doubt that will be forthcoming. Tens of billions of euros

will be thrown at shoring up confidence in Ireland's finances.

But it is very hard for the single currency's remaining

supporters to explain why it has come to this. The Greeks

fiddled their way into the euro. They should never have been

allowed on board. And once inside, they should have been told to

reform fast or get out again.

Monday, November 15, 2010

QE2 Aftermath...

...indicates (according to Treasury yields) nothing has happened. The market appears resigned to admit that this asset swap has minimal impact on the economy, and there remains the danger that this damages the Fed's credibility as THE one stop shop for economic policy.

Friday, November 12, 2010

G20

Its everyman for himself and devil take the hindmost.

As we observe the tectonic shift from global concerns to more locally-driven pressures (in good economic times, politicians have the luxury of leisure time and can afford diversion into realms that are not their expertise or responsibility...it is a great strength of this country that in bad economic times, the very same politicians are compelled to focus their attention on their immediate constituents), tensions in trade predominate.

Bailouts are met with counter-bailouts, de-valuations (in whatever form is selected as most palatable) are met with counter-devaluations.

The real question is, as always, real economic assets.

This is why the U.S. will feel more pain, but will emerge from the current fog as sole hyper-power of the world.

As we observe the tectonic shift from global concerns to more locally-driven pressures (in good economic times, politicians have the luxury of leisure time and can afford diversion into realms that are not their expertise or responsibility...it is a great strength of this country that in bad economic times, the very same politicians are compelled to focus their attention on their immediate constituents), tensions in trade predominate.

Bailouts are met with counter-bailouts, de-valuations (in whatever form is selected as most palatable) are met with counter-devaluations.

The real question is, as always, real economic assets.

This is why the U.S. will feel more pain, but will emerge from the current fog as sole hyper-power of the world.

Thursday, November 11, 2010

For comedic effect...

Dagong Global Credit Rating Co. Ltd., the only wholly Chinese-owed rating agency, cut its rating on U.S. debt to A from AA, citing the Federal Reserve’s move last week to initiate another round of asset buying, worth $600 billion. It also placed the U.S. sovereign credit rating on negative watch.

G-20 set to gather amid controversyAhead of Thursday's G-20 meeting, controversy has grown over the Fed's recent stimulus moves, which China and other nations have protested.

“The new round of quantitative easing monetary policy adopted by the Federal Reserve has brought about an obvious trend of depreciation of the U.S. dollar and the continuation and deepening of credit crisis in the U.S.,” Dagong said.

“Such a move entirely encroaches on the interests of the creditors, indicating the decline of the U.S. government’s intention of debt repayment,” the agency said.

G-20 set to gather amid controversyAhead of Thursday's G-20 meeting, controversy has grown over the Fed's recent stimulus moves, which China and other nations have protested.

“The new round of quantitative easing monetary policy adopted by the Federal Reserve has brought about an obvious trend of depreciation of the U.S. dollar and the continuation and deepening of credit crisis in the U.S.,” Dagong said.

“Such a move entirely encroaches on the interests of the creditors, indicating the decline of the U.S. government’s intention of debt repayment,” the agency said.

Dangerous precedent

Even with the austerity measures in place. Hopefully this precipitates the fall of the Euro area sooner than I expected.

Fears that Ireland could be forced into a Greek-style bailout by the

European Union or the International Monetary Fund swept through

financial markets today after the beleaguered country's borrowing

costs soared to levels seen as unsustainable by investors.

Long-term Irish interest rates surged to their highest levels since

the launch of the single currency amid growing evidence that repeated bouts of budget austerity have failed to convince international investors that the former Celtic Tiger economy can cope with the banking crisis caused by a boom-and-bust in its housing market.

Attempts by Patrick Honohan, the central bank governor, to reassure

investors by stressing that the Irish government was already planning the tough fiscal measures that the IMF would insist upon backfired, and helped push yields on 10-year Irish bonds up 61 basis points to

8.7%.

"Putting Ireland and the IMF in the same sentence can trigger

palpitations in the credit markets," said Gavan Nolan, a credit

analyst at Markit. "Speculation that the Irish government and the IMF have already reached an agreement was doing the rounds."

Fears that Ireland could be forced into a Greek-style bailout by the

European Union or the International Monetary Fund swept through

financial markets today after the beleaguered country's borrowing

costs soared to levels seen as unsustainable by investors.

Long-term Irish interest rates surged to their highest levels since

the launch of the single currency amid growing evidence that repeated bouts of budget austerity have failed to convince international investors that the former Celtic Tiger economy can cope with the banking crisis caused by a boom-and-bust in its housing market.

Attempts by Patrick Honohan, the central bank governor, to reassure

investors by stressing that the Irish government was already planning the tough fiscal measures that the IMF would insist upon backfired, and helped push yields on 10-year Irish bonds up 61 basis points to

8.7%.

"Putting Ireland and the IMF in the same sentence can trigger

palpitations in the credit markets," said Gavan Nolan, a credit

analyst at Markit. "Speculation that the Irish government and the IMF have already reached an agreement was doing the rounds."

Paper Dragon printing paper...

the risks here were fairly straightforward. China stuck between the proverbial rock and hard place, and the is caught in intertemporal public unrest management mode.

Chinese inflation sped to a 25-month high in October and bank lending blew past expectations, highlighting the challenge faced by Beijing as it battles to keep a lid on price pressures.

The data left little doubt about why the central bank raised reserve

requirements this week and pointed to further tightening steps, from

rate rises to yuan appreciation, in coming months.

Markets have already moved to factor in tighter policy with five-year Chinese government bond yields rising sharply in expectations of a rate rise before the end of 2010.

However, while world markets swooned in October on fears that Chinese tightening would dent demand, evidence of the economy’s continued strength and a belief inflation might drive investors to hard assets provided a lift to commodity prices globally.

Chinese inflation sped to a 25-month high in October and bank lending blew past expectations, highlighting the challenge faced by Beijing as it battles to keep a lid on price pressures.

The data left little doubt about why the central bank raised reserve

requirements this week and pointed to further tightening steps, from

rate rises to yuan appreciation, in coming months.

Markets have already moved to factor in tighter policy with five-year Chinese government bond yields rising sharply in expectations of a rate rise before the end of 2010.

However, while world markets swooned in October on fears that Chinese tightening would dent demand, evidence of the economy’s continued strength and a belief inflation might drive investors to hard assets provided a lift to commodity prices globally.

Wednesday, November 10, 2010

And yet...

...given weak economies in the G20, this behavior is entirely rational from a political/order standpoint. China in particular is perfectly content to let the U.S. devalue given the dollar currency peg currently in place.

Alan Greenspan, former chairman of the U.S. Federal Reserve, said the U.S. is pursuing a policy of weakening the dollar that risks increasing trade protectionism when combined with China’s effort to suppress the renminbi.

“The suppression of the renminbi and the recent weakening of the dollar are, of necessity, producing firming exchange rates in the rest of the world,” Greenspan wrote in a column in the Financial Times today.

The ratio of global exports to gross domestic product, which recovered following the financial crisis, was again slowing in the third quarter, Greenspan said. Protectionism would accelerate that slump, he said.

Alan Greenspan, former chairman of the U.S. Federal Reserve, said the U.S. is pursuing a policy of weakening the dollar that risks increasing trade protectionism when combined with China’s effort to suppress the renminbi.

“The suppression of the renminbi and the recent weakening of the dollar are, of necessity, producing firming exchange rates in the rest of the world,” Greenspan wrote in a column in the Financial Times today.

The ratio of global exports to gross domestic product, which recovered following the financial crisis, was again slowing in the third quarter, Greenspan said. Protectionism would accelerate that slump, he said.

Saturday, November 06, 2010

Becker on U.S./U.K. policies...

...from the Becker-Posner Blog:

Of course, perhaps other factors, such as the uncertainty about the business environment that Congress and the President created through their rhetoric, and also through their actual and proposed legislation, offset powerful effects of the fiscal stimulus itself in reducing unemployment. The unpleasant fact we economists have to face is that there is not strong evidence on the actual effects of governmental spending on employment and GDP. The usual claimed effects are generally based on predictions from highly imperfect theoretical models of the economy rather than from strong direct and clear evidence on the employment consequences of different fiscal stimuli.

How many Trillions must be "spent" (QE, and QE2 do not fall within the purview of "deficit spending" in my opinion and are mere asset swaps of differing maturities) in this experiment before a decision is made as to the efficacy of the measures?

Of course, perhaps other factors, such as the uncertainty about the business environment that Congress and the President created through their rhetoric, and also through their actual and proposed legislation, offset powerful effects of the fiscal stimulus itself in reducing unemployment. The unpleasant fact we economists have to face is that there is not strong evidence on the actual effects of governmental spending on employment and GDP. The usual claimed effects are generally based on predictions from highly imperfect theoretical models of the economy rather than from strong direct and clear evidence on the employment consequences of different fiscal stimuli.

How many Trillions must be "spent" (QE, and QE2 do not fall within the purview of "deficit spending" in my opinion and are mere asset swaps of differing maturities) in this experiment before a decision is made as to the efficacy of the measures?

P.J. O'Rourke...

...one of my favorite humorists/humanists/writers mentions some themes in an interview:

P.J.: I think it’s very, very difficult to roll this back. The only thing that will cause us to roll back the continued intrusion of the political system into our personal lives seems to occur during a financial crisis. Basically, that’s the lesson of Margaret Thatcher, it’s probably the lesson of Reagan; it’s definitely the lesson of France and Spain right now.

What happens is that as political systems expand infinitely, they run up against the laws of math. They can’t get enough money to fund all this crap. And in the process of attempting to get enough money to fund all this crap they put the brakes on society, they put the brakes on economic expansion, they put the brakes on prosperity, so you wind up with a situation like Europe, where you’ve got high nominal unemployment, but huge structural unemployment. People aren’t even looking for jobs, or they’re doing bogus job-like things. You get slow growth and bad opportunities for small businesses.

I’ve actually had people say to me, “P.J., quit being a reformist, this thing has actually got to get much worse before it’ll get better.”

P.J.: I think it’s very, very difficult to roll this back. The only thing that will cause us to roll back the continued intrusion of the political system into our personal lives seems to occur during a financial crisis. Basically, that’s the lesson of Margaret Thatcher, it’s probably the lesson of Reagan; it’s definitely the lesson of France and Spain right now.

What happens is that as political systems expand infinitely, they run up against the laws of math. They can’t get enough money to fund all this crap. And in the process of attempting to get enough money to fund all this crap they put the brakes on society, they put the brakes on economic expansion, they put the brakes on prosperity, so you wind up with a situation like Europe, where you’ve got high nominal unemployment, but huge structural unemployment. People aren’t even looking for jobs, or they’re doing bogus job-like things. You get slow growth and bad opportunities for small businesses.

I’ve actually had people say to me, “P.J., quit being a reformist, this thing has actually got to get much worse before it’ll get better.”

Supply squeeze...

...for Treasuries? Very interesting. Likely just post election pandering and positioning, but still, the debt ceiling is generally something viewed as a squisky moveable target that has not been taken seriously as a constraint.

Republicans are planning to demand major spending cuts next year before they would agree to raise the amount of federal debt that can be issued, setting up a clash between the Obama administration and a Congress stocked with lawmakers who campaigned as deficit hawks.

The U.S. can't accrue debt above a certain ceiling set by lawmakers. In the most extreme scenario, the government would default on certain debts if the cap doesn't move.

Republican lawmakers, including South Carolina Sen. Jim DeMint, and congressional aides have said major spending cuts are the primary demand they will make going into the discussions over whether to raise the limit.

It isn't clear whether the White House would agree to significant cuts so quickly, though, and Obama administration officials could try to portray the GOP as playing political games with the country's ability to borrow.

The U.S. currently has $13.7 trillion of debt outstanding, just shy of the $14.3 trillion limit Congress set in February. Barring big changes in federal spending, taxes or the economy, the government is expected to hit the ceiling by May, and administration officials have already said it will have to be raised by then.

Republicans are planning to demand major spending cuts next year before they would agree to raise the amount of federal debt that can be issued, setting up a clash between the Obama administration and a Congress stocked with lawmakers who campaigned as deficit hawks.

The U.S. can't accrue debt above a certain ceiling set by lawmakers. In the most extreme scenario, the government would default on certain debts if the cap doesn't move.

Republican lawmakers, including South Carolina Sen. Jim DeMint, and congressional aides have said major spending cuts are the primary demand they will make going into the discussions over whether to raise the limit.

It isn't clear whether the White House would agree to significant cuts so quickly, though, and Obama administration officials could try to portray the GOP as playing political games with the country's ability to borrow.

The U.S. currently has $13.7 trillion of debt outstanding, just shy of the $14.3 trillion limit Congress set in February. Barring big changes in federal spending, taxes or the economy, the government is expected to hit the ceiling by May, and administration officials have already said it will have to be raised by then.

Wednesday, November 03, 2010

The Dogs of War...

A disturbing trend I have noted here is the gall of some economic pundits and commentators in their attempts to categorize war as a "beneficial" development for a developed economy on the wane.

Ignoring the obvious normative questions involved with such utterances, to state with any sanity that the long term costs of war are less than the benefits gained requires a MUCH more nuanced, neigh Omnipotent perspective on the "totals" in the accounting ledger.

To merely state that war is good because of GDP figures during increased manufacturing output for the engines of war is sophistry, nothing more.

So readers beware of pundits downplaying the costs of war, especially in light of the recent problems in, once again and for all eternity it seems, the mid-east.

Ignoring the obvious normative questions involved with such utterances, to state with any sanity that the long term costs of war are less than the benefits gained requires a MUCH more nuanced, neigh Omnipotent perspective on the "totals" in the accounting ledger.

To merely state that war is good because of GDP figures during increased manufacturing output for the engines of war is sophistry, nothing more.

So readers beware of pundits downplaying the costs of war, especially in light of the recent problems in, once again and for all eternity it seems, the mid-east.

Musical chairs...

...With Nippon's MOF conducting similar monetary spec-ops, who benefits and who experiences detriment?

On your marks! Set! PURCHASE!

The European Central Bank bought Irish government bonds today,

according to two traders with knowledge of the transactions.

The ECB purchased short-dated maturities, said the traders, who asked

for anonymity because the deals are confidential. A central bank

spokesman declined to comment when contacted by telephone in

Frankfurt.

On your marks! Set! PURCHASE!

The European Central Bank bought Irish government bonds today,

according to two traders with knowledge of the transactions.

The ECB purchased short-dated maturities, said the traders, who asked

for anonymity because the deals are confidential. A central bank

spokesman declined to comment when contacted by telephone in

Frankfurt.

Oh, we could purchase ONLY 500 Billion...

...But that is what they are expecting!

For a monetary operation that yields no net benefit to the real economy ( and indeed basically nets out new issuance), and was considered anathema to Fed officials a mere three years ago, this type of expectations gamesmanship seems amateurish.

Very risky times ahead.

For a monetary operation that yields no net benefit to the real economy ( and indeed basically nets out new issuance), and was considered anathema to Fed officials a mere three years ago, this type of expectations gamesmanship seems amateurish.

Very risky times ahead.

Tuesday, November 02, 2010

The paper dragon is printing paper...

...as I have stated here previously, the dangers of cost-push inflation in China is making Yuan appreciation impossible to accomplish. Control is slipping away.

Though inflation exists in China, rarely will an official warn the public to expect it to continue.

A member of the Chinese National Development and Reform Commission recently spoke anonymously to domestic media, saying that further interest rate increases will not control inflation so the public must simply be resigned to it, according to Deutsche Welle.

Subsequently, many media outlets, including China's state-run Xinhua News Agency, reported numerous responses from Internet users. The public decried the NDRC’s warning as illogical.

A continuous political signal, intent on stability and the suppression of discontent, is being sent: Endure the inflation because there is no way out.

As Markus Taube, director of East Asian Studies at the University of Duisburg-Essen, explained to Deutsche Welle, stability requires that inflation be controlled; had there been no inflation at the end of 1988, the bloodshed during 1989 might have been avoided.

Since then, the Chinese regime has been alert to the threat inflation poses to stability, and is now admitting openly that interest rates cannot stop rising prices. Some bloggers are actively suspecting a replay of the “Jin Yuanjuan” era (a currency that lasted only 10 months and depreciated more than 20,000 times its face value) during the late 1940s.

Taube says that the simplest way to relieve inflation is to allow the renminbi to appreciate, avoiding international currency speculation, encouraging investment into China, and increasing both the circulation of currency and the pressure on inflation.

But the consequence is that currency appreciation will seriously affect export costs and lead to a chain reaction from the public—something the Chinese regime would rather avoid.

Though inflation exists in China, rarely will an official warn the public to expect it to continue.

A member of the Chinese National Development and Reform Commission recently spoke anonymously to domestic media, saying that further interest rate increases will not control inflation so the public must simply be resigned to it, according to Deutsche Welle.

Subsequently, many media outlets, including China's state-run Xinhua News Agency, reported numerous responses from Internet users. The public decried the NDRC’s warning as illogical.

A continuous political signal, intent on stability and the suppression of discontent, is being sent: Endure the inflation because there is no way out.

As Markus Taube, director of East Asian Studies at the University of Duisburg-Essen, explained to Deutsche Welle, stability requires that inflation be controlled; had there been no inflation at the end of 1988, the bloodshed during 1989 might have been avoided.

Since then, the Chinese regime has been alert to the threat inflation poses to stability, and is now admitting openly that interest rates cannot stop rising prices. Some bloggers are actively suspecting a replay of the “Jin Yuanjuan” era (a currency that lasted only 10 months and depreciated more than 20,000 times its face value) during the late 1940s.

Taube says that the simplest way to relieve inflation is to allow the renminbi to appreciate, avoiding international currency speculation, encouraging investment into China, and increasing both the circulation of currency and the pressure on inflation.

But the consequence is that currency appreciation will seriously affect export costs and lead to a chain reaction from the public—something the Chinese regime would rather avoid.

Subscribe to:

Posts (Atom)