...of interest rates in developed (G20) countries.(especially those using the dollar as defacto reserve currency) is inevitable. Emerging markets will resist doing so as attracting capital in this environment needs special inducement.

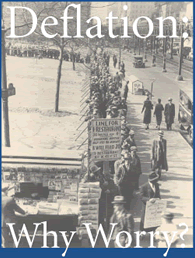

Deflation has been the trajectory for this economy for some time, and it is interesting to note that the mainstream press has just now picked up on the meme.

Oct. 6 (Bloomberg) -- As Federal Reserve Chairman Ben S. Bernanke and his global colleagues fight the worst financial crisis since the 1930s, one danger is looming larger by the day: deflation.

With asset markets tumbling, commodity prices plunging the most in 50 years and banks keeping a tighter grip on credit, the ingredients for a sustained period of falling prices are coalescing. While inflation is still a concern for many policy makers only months after oil and food prices peaked, the risk is their patchwork of rescue and stimulus packages will fail, and prices will start to fall throughout the broader economy.

``The ghost of deflation could be dragged out of the closet again in coming months,'' says Joerg Kraemer, chief economist at Commerzbank AG in London.

A global recession is already looking more likely, with the credit freeze stirring memories of Japan's decade-long struggle with deflation in the 1990s. So European Central Bank President Jean-Claude Trichet and Bank of England Governor Mervyn King may be forced to follow Bernanke, whose Fed has chopped its benchmark rate by 3.25 percentage points since August 2007 to 2 percent -- its most aggressive round of easing in two decades.

No comments:

Post a Comment