As I said, we don’t know how this will go. But it’s hard not to feel a sense of foreboding — and to worry that the nation’s already badly damaged faith in the Supreme Court’s ability to stand above politics is about to take another severe hit.

Macro-economics, Investments, Law, and Power, with special emphasis on high finance and low humor.

Friday, March 30, 2012

Krugman

Thursday, March 29, 2012

I have not...

banks of member countries of BRICS are about to agree on the use of

their own currencies in commercial and credit operations within the

group., said Trade Minister of India Anand Sharma. Sharma is expected

to discuss this and other related issues on Wednesday with his

counterparts of Brazil, Russia, China and South Africa as a

preliminary to their 4th summit.

He said that initiatives of this kind will contribute to broaden trade

and investments among BRICS, which have potentials still untapped, and

facilitate our economic development as world economy remains plunged

into uncertainty.

Sharma commented that the weakened global demand of goods and

services, above all from Western markets, is affecting export

prospects and growth possibilities of member countries of the group.

Wednesday, March 28, 2012

On the heels...

SREI Infrastructure Finance, one of India’s biggest non-bank lenders, has won a court order blocking Fitch Ratings from publishing a downgrade to its credit rating, sources told IFR.

Fitch said on Tuesday it had received an order from the Calcutta High Court, dated March 20, preventing it from publishing a rating action on SREI.

Court documents showed that Fitch was ordered to state: “Fitch has received an order from the Hon’ble High Court of Calcutta dated March 20, 2012 pursuant to which Fitch India has been restrained from publishing a rating action with regard to SREI Infrastructure Limited. Fitch is therefore unable at this time to publish a current rating on the issuer.”

Neither the rating agency nor the issuer would elaborate on the matter, citing the ongoing legal proceedings. However, sources said the rating agency had earlier told SREI it planned to downgrade the firm.

The injunction is the most extreme reaction for years to an unwelcome rating move, and raises questions over the rating industry’s ability to provide free and independent advice.

Uh-huh...

From Bloomberg:

Italian Prime Minister Mario Monti said the euro area crisis is “almost over” and that his nation has helped to stop a worsening of the situation.

Europe had initially been slow to respond, Monti said in a speech in Tokyo today.

A recent...

Uh-huh...

Dat Austerity...

Britons suffered the biggest drop in disposable income in more than three decades last year in a squeeze that may continue this year as energy prices increase.

Real household disposable income fell 1.2 percent, the Office for National Statistics said today in London. That’s the biggest drop since 1977 when the then Labour government sought to cap incomes growth in an attempt to bring down inflation. The report also showed that the economy shrank 0.3 percent in the fourth quarter, more than the 0.2 percent contraction previously estimated.

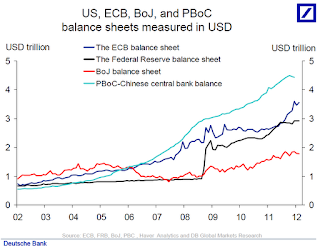

Balance Sheets

EOTrs ("End Of Timers") like to discuss the static position of Central Bank balance sheets, pointing to debt/GDP ratios as the harbinger of several "invevitable" consequences stemming from the vile and evil asset swapping activities of these blind and moronic institutions.

By Cloth or Gavel...

HAVANA, Cuba (AP) — Pope Benedict XVI wraps up his visit toCuba on Wednesday with an open-air Mass in the shrine of the Cuban revolution, hoping to revive the Catholic faith in this communist-run country. His other appointment promises a far more tantalizing climax: a meeting with Fidel Castro.

The former Cuban leader announced late Tuesday that he would happily meet with Benedict, saying he was asking for just a "few minutes of his very busy time" in Havana.

The Vatican had already said Benedict was available, so the confirmation from Castro was all that was needed to seal the appointment and end weeks of speculation as to whether Castro would repeat the meeting he held with Pope John Paul II during his historic 1998 visit.

Monday, March 26, 2012

"Information"

Sunday, March 25, 2012

This is largely...

Thus, the nation is expected to become party to endorsing the Chinese currency, the renminbi, as the currency of trade in emerging markets.

This means getting a renminbi-denominated bank account, in addition to a dollar account, could be an advantage for African businesses that seek to do business in the emerging markets.

The move is set to challenge the supremacy of the US dollar. This, experts say, is the latest salvo in the greatest worldwide currency war since the 1930s.

Thursday, March 22, 2012

Twilight of the Idols...

The Distinguished Gentlemen...

Wednesday, March 21, 2012

More revenue...

March 20 – China's state-owned enterprises reported ¥7.5 trillion in revenues and ¥211.97 billion in gross profits in the first two months of 2012, up 9.9% and down 11.5% respectively from the same period a year ago. The sluggish steel, real estate and machinery industries were cited for the decline in earnings.

About that Au Standard...

Read more: http://www.businessinsider.com/ben-bernanke-murders-the-gold-standard-2012-3#ixzz1plrQW6Vq

Neologism...

The usual suspects...

European countries and Japan from penalties for doing business with

Iran's central bank, because those countries are making significant

progress toward weaning themselves off of Iranian oil.

"I am pleased to announce that an initial group of eleven countries

has significantly reduced their volume of crude oil purchases from

Iran -- Belgium, the Czech Republic, France, Germany, Greece, Italy,

Japan, the Netherlands, Poland, Spain, and the United Kingdom. As a

result, I will report to the Congress that sanctions pursuant to

Section 1245 of the National Defense Authorization Act for 2012 (NDAA)

will not apply to the financial institutions based in these countries,

for a renewable period of 180 days," Secretary of State Hillary

Clinton said in a Tuesday statement. "The actions taken by these

countries were not easy. They had to rethink their energy needs at a

critical time for the world economy and quickly begin to find

alternatives to Iranian oil, which many had been reliant on for their

energy needs."

Tuesday, March 20, 2012

Yes, but...

"Shifting"

BHP Billiton (BHP.AX), the world's biggest miner, said it was seeing signs of "flattening" iron ore demand from China, though for now it was pushing ahead with ambitious plans to expand production.

Rival Rio Tinto (RIO.AX) said it too was sticking with plans to raise capacity from its huge mines in Western Australia's Pilbara iron ore belt, betting on a soft landing for the Chinese economy.

"The (Chinese) economy is shifting, it's changing. Steel growth rates will flatten and they have flattened," Ian Ashby, president of BHP's iron ore division, said ahead of the Global Iron Ore & Steel Forecast Conference in Perth.

Guns for bailouts...

Arms imports by Greece fell 18 percent compared to the 2002-06 period but Greece still ranked 10th internationally, falling from fourth place.

Globally the volume of international transfers of major conventional weapons was 24 percent higher in the period 2007-11 compared to 2002-06, largely due to a sharp rise in Indian arms imports, the report said.

The United States, Russia, Germany, France and Britain are the world’s top arms exporters.

Germany’s biggest market for arms exports is Greece, which imported 13 percent of weapons produced in Germany.

Greece is France’s second-biggest client, importing 10 percent of French arms exports.

Monday, March 19, 2012

Shortly...

Suffice to say that historians in future generations will look upon this time as a formative firmament for much more grandiose political tectonics. One of the more important occurrences during the last decade is that opinion and information flows are much more difficult to contain, and "control" more ephemeral.

Signs that China is getting a grip on a surge in local government debt is good news for the country’s credit standing, Moody’s Investors Service said Monday.

Moody’s said an announcement last Wednesday by Chinese Premier Wen Jiabao that local government debt rose just 300 million yuan ($47 million) on net in 2011 signaled an effective containment of the policy-induced ramp-up of local government debt in previous years.

“Containing the expansion in local government debt is credit positive for China, controlling the growth of the sovereign’s potential exposure to contingent liabilities from local governments and creditor banks,” Moody’s said in its latest weekly credit outlook.

Sunday, March 18, 2012

What???

Who would have thought this?

China’s statistics bureau said local officials forced some hotels, coal miners and aluminum makers to report false numbers, highlighting flaws in data tracking the world’s second-largest economy.

Statistics officials in Hejin city in northern Shanxi province gave companies “seriously untrue” numbers to submit for 2011, the Beijing-based National Bureau of Statistics said in a statement on its website dated March 12.

Saturday, March 17, 2012

The faith of progress...

This concept of "if only" conditions based on the goal of "justice" is simply irresponsible. That model has consistently concentrated power throughout history with disasterous results. This particular tax justice musing is nothing more than the tyranny of majority complaining about smaller countries making a niche because their services are so desperately wanted. In addition, there is no words or analysis on WHY there is such a massive incentive to park assets off-shore exists. Furthermore, the estimates included are unsupported and likely presented for shock value. It is also telling what the "missing tax receipts" would be used for.

Assets held offshore, beyond the reach of effective taxation, are equal to about a third of total global assets. Over half of all world trade passes through tax havens. Developing countries lose revenues far greater than annual aid flows. We estimate that the amount of funds held offshore by individuals is about $11.5 trillion – with a resulting annual loss of tax revenue on the income from these assets of about 250 billion dollars. This is five times what the World Bank estimated in 2002 was needed to address the UN Millenium Development Goal of halving world poverty by 2015. This much money could also pay to transform the world’s energy infrastructure to tackle climate change. In 2007 the World Bank has endorsed estimates by Global Financial Integrity (GFI) that the cross-border flow of the global proceeds from criminal activities, corruption, and tax evasion at US$1-1.6 trillion per year, half from developing and transitional economies. In 2009 GFI's updated research estimated that the annual cross-border flows from developing countries alone amounts to approximately US$850 billion - US$1.1 trillion per year.

11.5 Trillion dollars? Global GDP is 60 Trillion. Does that make sense? Then we get into fantasy land. If only those assets were taxed, poverty could be eradicated.

Offshore finance is not only based in islands and small states: `offshore’ has become an insidious growth within the entire global system of finance. The largest financial centres such as London and New York, and countries like Switzerland and Singapore, offer secrecy and other special advantages to attract foreign capital flows. As corrupt dictators and other élites strip their countries’ financial assets and relocate them to these financial centres, developing countries’ economies are deprived of local investment capital and their governments are denied desperately needed tax revenues. This helps capital flow not from capital-rich countries to poor ones, as traditional economic theories might predict, but, perversely, in the other direction.

Countries that lose tax revenues become more dependent on foreign aid. Recent research has shown, for example, that sub-Saharan Africa is a net creditor to the rest of the world in the sense that external assets, measured by the stock of capital flight, exceed external liabilities, as measured by the stock of external debt. The difference is that while the assets are in private hands, the liabilities are the public debts of African governments and their people. (Read more)

Globalisation and international trade and finance have got a bad name of late. Each brings opportunities, and risks. We must now start to address seriously what may be the biggest risk of all: tax abuse, and tax havens and everything they stand for.

Capital flows to high returns and (more importantly) safety. Taxation or confiscation of assets will not help governments achieve any more or less order if the legal and cultural infrastructure is broken. To assert that "if only sub-saharan governments had more money, there would be no poverty in those countries" confuses causes and effects. It also assumes Government is this eternal construct that is morally unimpeachable when the reality is no country on this planet is more than a couple of centuries old...and all of them have sacrificed reputation in the name of expediency. The U.S. itself did this during the French Revolution when it refused to pay France on debts incurred during the American Revolution because those debts were owed to the French Crown as opposed to the nascent French Republic.

Inflation Expectations...

And now, they produce the below, a true and instant classic of its kind:

News Release: March 16, 2012

The Federal Reserve Bank of Cleveland reports that its latest estimate of 10-year expected inflation is 1.38 percent. In other words, the public currently expects the inflation rate to be less than 2 percent on average over the next decade.

The Cleveland Fed’s estimate of inflation expectations is based on a model that combines information from a number of sources to address the shortcomings of other, commonly used measures, such as the "break-even" rate derived from Treasury inflation protected securities (TIPS) or survey-based estimates. The Cleveland Fed model can produce estimates for many time horizons, and it isolates not only inflation expectations, but several other interesting variables, such as the real interest rate and the inflation risk premium. For more detail, see the links in the See Also box at right.

Estimates are updated once a month, on the release date of the CPI.The methodology used to generate the estimates was changed slightly starting June 15, 2011, and it is documented in this working paper.

Delving into the "paper" mentioned in the last sentence, we find this gem of academic obfuscation and arrogance:

Our model differs because it has four stochastic drivers

yet seven state variables. Three of the state variables in our model are

the short-term real interest rate, expected inflation, and inflation’s “central tendency,”

and they have a large influence on the cross-section of bond yields. However, they play

no direct role in determining bonds’ risk premia. Rather, bond risk premia are completely

determined by four volatility state variables whose dynamics are mixtures of normal and chi

squared innovations that derive from changes in the aforementioned three state variables

plus realized inflation. This de-coupling of the state variables that largely determine the

cross-section of yields versus the state variables that solely determine risk premia allows

for time-varying risk premia that can even change sign.

As a result, the model’s ability to fit the cross-section and time-series of nominal yields exceeds

that of traditional affine models. Because our model better matches the empirical properties of

nominal yields, one may have greater confidence that it provides the correct starting point for

decomposing nominal yields into their real yield, expected inflation, and risk premia parts.

All of this sounds very official and precise, but let us consider what they are saying with respect to this "improved" inflation forecasting technique. They take as a parameter the difference in inflation survey expectations over two time periods. This says much about the sacrosanct status "inflation expectations" has in the Fed. To assert this variable, build a mathematical model that features it, and FIT (with a conceptual crowbar) the model's prediction of expectations to "actual" expectations does not even approach a truly useful gauge of inflation. The question that should be asked is: are expectations of inflation the same thing as inflation itself? Is inflation the kind of thing that is derailed by sanguine expectations, or does it have more clandestine tactics that destroy financial order?

The fact that this paper and its result yell "ALL CLEAR TO DEPLOY MONETARY POLICY" is testimony enough as to its purpose and rigor.

Friday, March 16, 2012

Uh...where are those carriers again?

"Iran is being deleted from the world banking system Society for

Worldwide Interbank Financial Telecommunication (SWIFT) computers as

of Saturday at 1600 UTC. Once the SWIFT codes for Iranian banks are

deleted, Iranian banks will no longer be able to transfer funds to and

from other worldwide banks, turning Iranian international commerce

into a barter operation. SWIFT is taking the action at the request of

EU members to comply with international sanctions against Iran due to

its program to develop nuclear weapons. The effect will be to

drastically hinder Iran's ability to execute international business

transactions."

Thursday, March 15, 2012

How...

*BINI SMAGHI SAYS EU MUST ACT TO SHOW GREEK PSI AN EXCEPTION

Look out below...

MADRID (MarketWatch) -- Spanish house prices fell 11.2% in the fourth quarter of 2011 on an annual basis, a decrease of almost four percentage points from the previous quarter, with the index at the lowest since the first quarter of 2007, the national statistical office said Thursday. In the third quarter, house prices fell 7.4% The prices of used homes fell 13.7% in the quarter on an annual basis. House prices have been sharply declining since the fourth quarter of 2010, amid a collapse in the housing industry, which spurred a downturn in the Spanish economy.

The world...

to quote Professor Berra:

In theory there is no difference between theory and practice. In practice there is.

From the WSJ:

Twenty-first century economists, financial actors and regulators blithely talked of the "risk-free debt" of governments, and European bank regulators set a zero-capital requirement on the debt of their governments. The manifold proof of their error is that banks and other investors are now taking huge credit losses on their Greek government bonds.

The Vatican...

One of the themes of this blog is that religion will make a return to power and rule in this century.

Of course, with increased power comes increased vanity, but success must be allowed its eccentricities, no?

..Pope Benedict has taken the meaning of bespoke to a whole new level

by ordering a custom-blended eau de cologne just for him.

The fragrance, which mixes hints of lime tree, verbena and grass, was

concocted by the Italian boutique perfume maker Silvana Casoli, who

has previously created scents for customers including Madonna, Sting

and King Juan Carlos of Spain.

Tuesday, March 13, 2012

I have maintained...

It appears that the U.S. is making serious moves to effectuate this, but the risks remain that it holds on to old loyalties and out-dated notions based on wars fought in previous centuries. It will take a strong president with a clear vision to accomplish the re-prioritization...so perhaps my faith is misguided given the incumbent's "whatever makes me re-electable" stance on foreign policy.

Data risk

The problem is, of course, the incentives to change the rules of the game once it become apparent they disadvantage one of the parties. Argentina is but the latest example of the false belief that probity and mendacity stay constant no matter the external circumstances.

March 13 (Bloomberg) -- Argentina’s manipulation of

consumer-price data is turning government bonds whose interest

payments rise and fall with inflation into securities resembling

fixed-rate debt.

The statistics agency reported today that annual inflation

was 9.7 percent in February, marking the 12th-straight month

that the rate held between 9.5 percent and 9.9 percent. The 0.4

percentage-point range over the past year, which is down from an

average annual variation of 2.7 points from 2004 through 2010,

is smaller than the ranges of 1.5 points in neighboring Brazil

and 1.8 points in the U.S.

With the government reporting inflation near 10 percent,

the 12.4 percent yield on the benchmark bonds linked to consumer

prices gives the securities a rate of return of about 22

percent. The International Monetary Fund says Argentina is

underreporting the data and economists including ex-central

bankers Alfonso Prat-Gay and Martin Redrado say consumer prices

are soaring more than 20 percent a year.

“Forget making any bet on what’s going to happen with

inflation because we know it’s distorted,” Boris Segura , a

strategist at Nomura Securities International, said in a phone

interview from London. “This is basically a fixed-rate bond.”

We shall see...

Brad Delong, dismal scientist, is starting to come around.

In such a setup, the conclusion of Mankiw and Weinzerl that monetary policy has the exclusive role to play is straightforward: One stabilization policy tool--monetary policy--is non-distortionary. The other stabilization policy tool--fiscal policy--is distortionary. If monetary policy can do the job, there is then no need for fiscal policy. And if you do resort to fiscal policy, use the fiscal policy that is most effective at getting people to spend money on the things they were at the tipping point of buying anyway--use the investment tax credit rather than direct government purchases or tax cuts which might well not be spent. End of argument.

But are the assumptions correct? Can monetary policy do the job?

There is little [3] doubt that it can do the job--and that the conclusion is sound--in normal times, when the short-term safe nominal interest rate is away from its zero nominal lower bound, and when small bond sales to shrink and bond purchases to grow commercial-bank reserve deposits shake the entire intertemporal price structure. [4]

But does the same hold true in a liquidity trap, when short-term safe interest rates are at their zero nominal lower bound? At the zero nominal lower bound monetary policy as stabilization policy has two potential modes of effectiveness:

Even with short-term safe nominal bonds at par, the market flooded with excess reserves, and thus with reserve deposits perfect substitutes for short-term Treasuries, the monetary authority can take duration and default risk onto its balance sheet and thus free-up risk-bearing capacity to improve borrower access to credit.

Even with short-term safe nominal bonds at par, the market flooded with excess reserves, and thus with reserve deposits perfect substitutes for short-term Treasuries right now, the monetary authority can promise it will keep interest rates lower and inflation rates higher in the future than its standard reaction function would warrant.

The Sovereign Debt Tier List

Therefore, The Recapitulator will humbly present his "Tier List" of rankings for sovereign debt, worldwide. The rankings will be organized into 4 tiers that represent relatively homogeneous groups. The bonds most likely to generate full face value (in nominal dollars, anyways) will be listed first in their respective tier.

Tier 1 These countries represent the pinnacle of the global financial system. They enjoy vast circulation, and are typically backed by fungible tax dollar guarantees from their respective governments. In addition, they offer prestige and security, and promise the holder a better alternative than any other liquid asset. These countries typically run Current Account deficits given their wealthy position in the world and the desire of the rest of the world to net save financial assets from these countries results in Capital Account surpluses. Furthermore they tend to have historcially stable governments, top level legal systems (emphasizing the rule of law, checks and balances, reliable term limits, and deference to Anglo-Saxon common law as its formative firmament), the ability to project power (both "soft" and "hard"), and a population that exhibits relative peace and normality. In short, the perfect jurisdiction to park assets anytime, but especially so in volatile periods.

Tier 2 These countries enjoy very low default probabilities, typically have floating currencies with stable populaces and very good legal systems based on anglo-saxon or Roman law derivatives. They have capable but small militarys that focus on national defense. These countries typically run Current Account surpluses given the medium-high and rising living standards, and also conversely run Capital Account deficits as the rest of the world finds other jurisdictions more attractive.

Tier 3 These countries enjoy low default probabilities, are typically mercantilistic in nature as they require foreign capital in order to invest in energy, weaponry, and foodstocks. Their legal and property rights systems are stable, but in application exhibit an arbitrariness not seen amongst higher tiers.

Tier 4 These countries have significant default probabilities. This could be for a number of reasons, but typically a lack of rule of law coupled with an unstable history with multiple government structures in a relatively short period of time. Lack of continuity and cultural links also contribute to the problems these countries face.

Hard to place in a portfolio (HTIAP): These countries are simply too unstable to place into any tier list of acceptable risks. They suffer from tyrranical government, sanctions from one or more "global authorities", and lack of connectivity to the global economy. Furthermore, they have little or no natural resources, difficult geography, and poor leadership.

So, without further delay, the list:

Tier 1: U.S.A., U.K, Canada, Japan, Switzerland, Netherlands

Tier 2: Norway, Germany, France, Brazil, India, Sweden, South Africa, Russia, Australia, New Zealand, South Korea, Belgium, Poland, Czech Republic, Finland, Denmark

Tier 3: China, Pakistan, Kenya, Uruguay, Italy, Mexico, Chile, Turkey, Argentina, Indonesia

Tier 4: Saudi Arabia, Venezuela, Singapore, Spain, Portugal, Ireland, Iceland, Columbia, Vietnam, Sub Saharan Africa***, Saudi Arabia, Qatar, UAE. Namibia, Columbia, Bolivia

HTIAP: Hungary, Albania, Romania, Nicaragua, Thailand, Sri Lanka

***Subject to change quickly given U.S. involvement

That man...

So when you look ahead to the next decade, what will the U.S. and Europe’s position be in the world economy and ultimately what do you see for China and Asia in terms of their positioning?

The International Monetary Fund’s projections for the next five years give us an answer to that question of where we’re gonna be in just a few years’ time. And the answer is that the United States will no longer be the number one economy in the world in terms of gross domestic product on a purchasing parity basis.That’s an important qualification, because it makes a big difference if you calculate GDP on that basis and take account of the fact that a haircut in China is way cheaper than a haircut in the United States. But that’s a fairly widely accepted convention to take account of differences in non-tradables. And on that basis by 2016 China will be the biggest economy in the world. And the U.S. will be number two, for the first time since the 1870s the U.S. will lose its lead position.

Back-door sterilization, Nippon style...

/START RANT...and now China has even more foreign exchange to distribute to party members "just in case" the people revolt and the leaders relocate to safer jurisdictions. /END RANT.

Sorry about that dear readers, but the twin pressures of a resurgent communist government and an unruly populace have many party members (who also happen to be major capitalists) quite nervous about retaining their new-found riches.

March 13 (Reuters) - Japan said on Tuesday it had received approval from China's government to purchase 65 billion yuan ($10.3 billion) in Chinese government debt in a move that can help Japan diversify its reserves away from the dollar and strengthen economic ties between the two Asian countries.

The timing of purchases hasn't been set yet as Japan still needs to make some administrative preparations, but Japan is likely to start with a small amount and then increase purchases, Japan's Finance Minister Jun Azumi said.

Japan will also consider the impact on financial markets when it decides the timing of its purchases, Azumi said.

Monday, March 12, 2012

The life cycle of a business model...

from "Traders Magazine"

Citing internal data, he said that HFTs' U.S. equities profits were

down in 2011 to about $1 billion, which is down big from their 2008

heyday of as much as $4.49 billion. Also, HFTs now make less per trade

than in 2008 - today they make on average between $.0005 and $.00075

per share on each trade versus $.001 and $.0015 a few years ago. In

order to keep making money, these firms need to find new ways to

trade.

"The HFTs need to trade larger volumes and at wider spreads, if

possible," Gawronski said. "After ten years, the HFT business model is

maturing."...

Costless advice...

FT) The ECB has sharpened its hardline stance on eurozone fiscal policy by urging the still-tougher policing of member states’ public finances. In a report on proposed European Union regulations to monitor budgets better and strengthen the surveillance of countries in difficulties, the ECB makes clear it sees significant scope for further improvement. Among the proposals in the report dated March 7, the ECB suggests the surveillance of countries that run into difficulties in the future should be strengthened by public warnings for the most recalcitrant. Where a country under surveillance is threatening the eurozone’s financial stability, there should be an automatic recommendation that it seeks financial assistance, the ECB says.

Right on Schedule...

As I have maintained here, much more of this to come. Promises in Brussels will yield to realities at home.

VILLEPINTE, Paris (Reuters) - President Nicolas Sarkozy, recasting

himself as France's savior from low-cost competition and high

immigration, threatened to disregard European limitations on

protectionism as he sought to give his re-election campaign a second

wind on Sunday.

Going out on a limb that risks angering France's European partners,

Sarkozy said it was time to support local companies and stop the

uncontrolled influx of immigrants and cheap imports that demonstrate

Europe's lack of protectionist controls.

Addressing some 30,000 people at a vast conference centre just outside

Paris, Sarkozy vowed to pull France out of the European Union's

open-borders Schengen zone unless there was progress over the year

ahead in fortifying Europe's borders.

He also proposed a European law similar to the "Buy American Act"

which would require governments to favor European-made products in

their purchases, and said that without advances in that area, France

would start applying the rule unilaterally.

Saturday, March 10, 2012

Cluster Bombs

With CDS, risks are clearly correlated and non-random. This makes CDS a VERY dangerous game to play to the unitiated and/or for those who are short term in their thinking.

This creates a perfect insolvency bomb for many banks.

March 10 (Bloomberg) -- Austria is facing a capital

injection of as much as 1 billion euros ($1.3 billion) into KA

Finanz AG less than two weeks after bailing out Oesterreichische

Volksbanken AG.

The International Swaps & Derivatives Association yesterday

ruled that Greece’s use of collective action clauses forcing

investors to take losses under the nation’s debt restructuring

will trigger default insurance payouts.

In a statement before ISDA’s decision, KA Finanz said it

may have risk provisions of about 1 billion euros if credit-

default swaps on Greece it has written are activated.

Friday, March 09, 2012

Anticlimactic...

LONDON, March 9, 2012 – The International Swaps and Derivatives Association, Inc. (ISDA) today announced that its EMEA Credit Derivatives Determinations Committee resolved unanimously that a Restructuring Credit Event has occurred with respect to The Hellenic Republic (Greece).

The EMEA DC resolved that a Restructuring Credit Event has occurred under Section 4.7(a) of the ISDA 2003 Credit Derivatives Definitions (as amended by the July 2009 Supplement) following the exercise by The Hellenic Republic of collective action clauses to amend the terms of Greek law governed bonds issued by The Hellenic Republic such that the right of all holders of the Affected Bonds to receive payments has been reduced.

The Committee determined that an auction will be held in respect of outstanding CDS transactions on March 19. ISDA has published a list of obligations issued or guaranteed by The Hellenic Republic, which the EMEA Determinations Committee is currently in the process of reviewing. That list can be accessed here: http://www2.isda.org/preliminary-greek-obligations/.

The unholy furcate...

This is all slightly reminiscent of the California power crisis around the turn of the century.

Thursday, March 08, 2012

All the King's monetary operations...

*REAL-ESTATE HOUSEHOLD WORTH FALLS BY MOST IN MORE THAN A YEAR

About those Fed currency swaps...

Last week, the conflict escalated to a new level. Weidmann complained in a letter to ECB President Draghi that the central bank was accepting increasingly lower-grade collateral in exchange for its cash injections. This poses a danger, he warned, as the central banks in the north of the euro zone are owed ever growing amounts of money by their counterparts in the south. If the euro zone broke apart, the Bundesbank would be left holding a good deal of its bad debt from so-called TARGET2 loans, which currently amount to some €500 billion ($660 billion), he warned.

This may sound somewhat technical to most laypeople, but among leading ECB officials the letter was seen as violating a taboo. TARGET2 refers to the central banks' internal payment system, which has accumulated massive imbalances during the course of the euro crisis. These inequalities aren't problematic as long as the monetary union remains intact. So far, the Bundesbank has always played down this risk. But Weidmann's about-face is a "disastrous signal," say ECB executives because, for the first time ever, the Bundesbank "is no longer ruling out a break-up of the euro zone."

On the surface, the wrangling revolves around loan conditions and interest rates, but in reality it has to do with the basic course of European monetary policy: the question being whether a debt crisis can be combated with even more debt, or whether it will spark the next, possibly even greater crisis.

Wednesday, March 07, 2012

Comparative and extra-sovereign law...

However, there exists a certain tilt to the current administration (and indeed of previous ones) toward centralization and unaccountable concentration of power. The POWER to employ force must be one with severely constrained manacles, lest temptation and patronage become uncontrollable.

SESSIONS: What “legal basis” are you looking for? What entity?

PANETTA: If NATO made the decision to go in, that would be one. If we developed an international coalition beyond NATO then obviously some kind of U.N. security resolution would be the basis for that.

SESSIONS: So you are saying NATO would give you a “legal basis?” And an ad hoc coalition of nations would provide a “legal basis?”

PANETTA: We would seek whatever legal basis we would need in order to make that justified. We can’t just pull them all together without getting the legal basis on which to act.

Following the wrong recipe...

Unfortunately, they are going down what appears to be the traditional Keynsian route...with the results somewhere between "useless" and "counterproductive". Sterilized QE is yet another asset swap whose only purpose will be providing the Fed POMO with something to do, and provide future members of the Eunuch class with data points from which to write vacuous post-mortems of Fed policy.

from the WSJ:

Federal Reserve officials are considering a new type of bond-buying program designed to subdue worries about future inflation if they decide to take new steps to boost the economy in the months ahead.

Under the new approach, the Fed would print new money to buy long-term mortgage or Treasury bonds but effectively tie up that money by borrowing it back for short periods at low rates. The aim of such an approach would be to relieve anxieties that money printing could fuel inflation later, a fear widely expressed by critics of the Fed's previous efforts to aid the recovery.

The risk...

...is that global bond markets are unable to price any form of sovereign debt given a putative avalanche of haircuts based on the precedent of Greece.

But current prices are not discounting this...yet. However, some countries are certainly using this option for political purposes.

Mr. Shaw also pointed out that the information minister had said Dr. Peter Phillips would have commented. Controversy erupted when u-s financial media house Bloomberg quoted Mrs. Simpson Miller as saying "if they could give a bailout like Greece, lord have mercy, you would see Jamaica grow and flourish." Bloomberg had also quoted her as saying the Jamaica debt exchange was a failure.

Some companies...

So when one of these announces the below, best to pay attention to the foreign policy and investment implications, because they represent more than economic needs and trading strategies.

GE PLANS TO RE-ENTER LIBYA, SOUTH SUDAN IN 2012

Anti-Mercantilism...

March 7 (Bloomberg) -- The U.S. Congress passed bipartisan

legislation allowing duties by the Commerce Department to offset

government subsidies in nations such as China, sending the

measure to President Barack Obama for his signature.

Chinese Commerce Minister Chen Deming said the move was not

in line with U.S. laws or World Trade Organization rules and

accused the U.S. of “pointing fingers.” He acknowledged that

some lower-level subsidies may be “problematic.”

The bill responds to a Dec. 19 decision by a U.S. appeals

court in Washington that said existing law doesn’t authorize the

agency to set tariffs on goods from countries lacking a domestic

market to establish prices. The House yesterday passed the

legislation 370-39 after the Senate backed it March 5. U.S.

Trade Representative Ron Kirk said last week that the

administration helped to craft the measure.

And then of course there is this preposterous statement by the Chinese as a rejoinder:

China’s central government has “no prohibited subsidies

provided to economic entities,” Chen said today in Beijing at a

press briefing during the annual meeting of the National

People’s Congress, according to a live English translation

broadcast on China Central Television. He said China is a big

country and there might be “problematic” subsidies at regional

levels.

Monday, March 05, 2012

That slippery slope...

"Some have called such operations 'assassinations.' They are not, and the use of that loaded term is misplaced. Assassinations are unlawful killings," Holder continued in his prepared remarks. "The U.S. government's use of lethal force in self defense against a leader of al Qaeda or an associated force who presents an imminent threat of violent attack would not be unlawful -- and therefore would not violate the Executive Order banning assassination or criminal statutes."

The IVth Crusade

Methuselah channels Urban the II.

Good luck with that...

(Reuters) - Chinese Premier Wen Jiabao cut his nation's 2012 growth target to an eight-year low of 7.5 percent and made boosting consumer demand the year's first priority as Beijing looks to wean the economy off its reliance on external demand and foreign capital.

He lowered the target from a longstanding annual goal of 8 percent, a move investors anticipated so that Beijing has some economic leeway to rebalance the economy and defuse price pressures in the run up to a leadership change later this year.

Lower growth will allow Beijing to reform key price controls without causing an inflation spike, so monetary policy can stay broadly expansionary to ensure a steady flow of credit to the small and medium-sized firms the government wants to encourage.

Risk Transfer.

Crédit Agricole, one of France's biggest banks, has used ECB loans to whittle down its financial exposure to its troubled Greek subsidiary, Emporiki. After extending more than €10 billion of loans to Emporiki, Crédit Agricole last year decided essentially to cut its losses and is instead trying to get central banks to lend money to Emporiki. Due to its foreign ownership, though, the Greek central bank has barred Emporiki from borrowing from an emergency-lending facility that other Greek banks have been tapping, according to a person familiar with the matter.

But Emporiki borrowed from the ECB. At the end of December, after the ECB's first batch of three-year loans, Emporiki had borrowed €1.8 billion from the ECB, according to Crédit Agricole. Crédit Agricole, meanwhile, reduced its loan exposure to Emporiki to €5.5 billion. It is unclear how much Emporiki borrowed from the ECB last week.

Saturday, March 03, 2012

In light of my last post...

After a lengthy investigation conducted by the NFL's security department, the league announced Friday that 22 to 27 defensive players on the New Orleans Saints maintained a "pay for performance" program that included "bounty" payments administered by then-defensive coordinator Gregg Williams during the 2009, 2010 and 2011 seasons.

This, or similar programs, are not an isolated incident. I would think they are endemic within the NFL. Just as highly competitive Fund Managers are incentivized (and encouraged, in may cases) to gain any advantage, so are NFL teams required to maintain the most competitive environments possible in order to win.

Football remains interesting to me only because of its convergence to "real" competitive systems such as military applications, and its no wonder many financial heavyweights have moved into professional sports ownership.

As for this:

The NFL said its findings were corroborated by multiple, independent sources. Asked about potential criminal charges, NFL spokesman Greg Aiello said:

“We believe that any violation of league rules should and will be handled by the commissioner.”

A very interesting comment on accountability and the place and role of sport in society.

Friday, March 02, 2012

You Can't Handle the Truth

As an asset manager, you can perform all the "best practice" due diligence in the world with respect to your fund managers, but the irresistible lure of higher returns (and higher "alpha", whatever that means these days) will always attract folks who don't ask too many hard questions...precisely because they do not want to know the answers. Its a difficult game. The asset manager wants to know how and when a fund manager makes and loses money. The Fund manager wants to keep exactly how this happens a secret, as copying investment styles is the official sport of Investment Banks.

There are many successful Funds who claim to have some "edge" when investing. They usually cloak their styles in oppressively boring platitudes designed to mask what they actually do: engage in aggressive insider trading. There are also many successful asset managers who RELY on the returns provided by these Funds engaged in this activity in order to provide the maximum benefit to, say, pensioners with definable liabilities upon retirement. The minnow in this ocean are the people who get angry at massive Wall Street and Fund bonuses while happily cashing their pension or Life Insurance annuity check that has appreciated their savings to a considerable level.

The problem for an asset manager is maintaining a "of course we did not know our thoroughly vetted and investigated Fund Managers were engaged in such activity, Mr. FBI/SEC/FINRA/FED Enforcement Officer!" fascade of plausible deniability coupled with a steady hand on the switch to remove any and all assets from a Fund Manager in the event of a Indictment/Wells Notice/Formal Investigation/etc. by said authorities. Any such notice of formal investigation applies massive pressure on individuals to cooperate and indictments are imminent. These acts will be cited when said officers ask for a raise or run for Congress. Its how the world works.

This risk is massive at the moment, with all of the above in addition to States' AG offices scanning for any reason to bring scalps to a public demanding blood and "justice". But of course, the Asset Managers will be spared. Just as when Politicians receive large campaign contributions from "interesting" people. Plausible deniability is but another gear in the world's engine.

"There are two things that you don't want to see being made: Sausage and Legislation"

You can go ahead and throw persistent Alpha in with that.

Que Mr. Nicholson.

You're not thinking big enough...

As polls universally predict victory for Vladimir Putin in Russian presidential elections Sunday, a prominent Washington Russia scholar likened the once and likely future Russian president to Italy's disgraced former prime minister Silvio Berlusconi, who was ousted from power last year during the European financial crisis.

"Putin is now moving into his 'Berlusconi phase,'" Fiona Hill, a Russia scholar at the Brookings Institution, said in an analysis prepared by the think tank and sent to journalists in advance of Sunday's polls.

"Like Putin in Russia, Berlusconi dominated Italian politics," Hill wrote. "Berlusconi's brand had been tarnished for a long time, but he was still the most popular individual politician in a fractious Italian political scene." Like Putin, Berlusconi "stifled the opposition...manipulated the media, [and] had mass protests against him. But none of the political opposition seemed to be capable of dislodging him from his perch."